The worsened economic outlook and energy price shocks are forecast to weigh on the global manufacturing sector in 2023, with industries with high energy intensity and highly reliant on investment demand being the most vulnerable. However, despite the clouded outlook, global supply chain problems are forecast to ease in 2023 and provide relief to the global manufacturing sector. Ongoing production reshoring efforts and tight labour markets are also forecast to support faster investment growth in digital and production automation tools.

Manufacturing industries forecast to show uneven growth in 2023

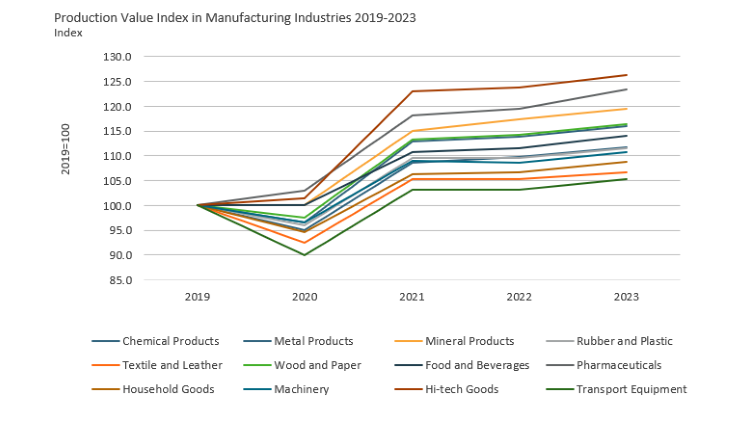

The global manufacturing sector is forecast to experience turbulences in 2023, as the worsened economic outlook, rising geopolitical risks and volatility in the energy and commodities markets will put pressure on manufacturers’ performances. Growth across industries is forecast to be uneven in 2023, with industries with high energy intensity or highly reliant on investment demand taking the heaviest hit. Globally, the chemical products, rubber and plastic, and machinery industries are forecast to show slower production value growth in 2023, as weaker B2B demand and rising energy costs are expected to impact production. Slower sales of new cars due to the worsened economic climate in 2023 are also forecast to drag down the performance of the global transport equipment industry. However, the recovering airlines industry and rising defence spending will support the faster growth of the aerospace sector in 2023.

On the contrary, higher value-added and less cyclical industries are forecast to sustain growth momentum in 2023. The hi-tech goods industry is predicted to show the strongest performance amongst all manufacturing sectors in 2023, as the shift towards green energy and investment in digital tools will continue to support demand for hi-tech goods. B2C-centric manufacturing industries, such as pharmaceuticals or food and beverages, are also forecast to show relatively strong production value growth in 2023, in large part benefiting from stable demand from consumers.

Global supply chain pressures to ease in 2023 despite the existing risks

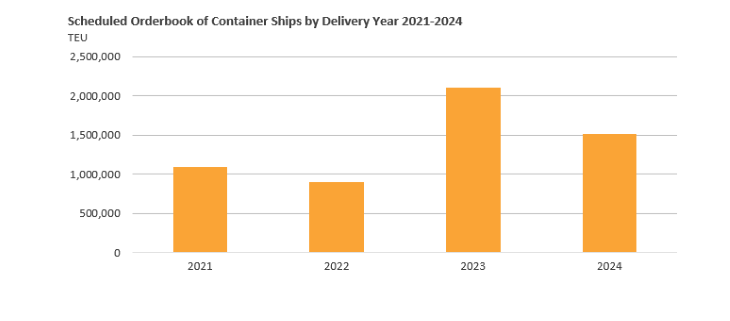

After two years of turmoil caused by the global pandemic, supply chain pressures are forecast to finally ease in 2023. Improved production capacity, restored inventory levels, increased transportation capacity, and generally weaker demand growth due to slower economic performance in 2023 are all predicted to help rebalance demand and supply and ease supply chain problems. For example, the Logistics Managers Index, which tracks transportation, warehousing capacity and inventories, continued to improve in Q3 2022, indicating easing pressures across global supply chains.

Additional shipping capacity is also expected to help reduce transportation costs in 2023 and ease supply chain problems. According to BIMCO, an association of ship owners and shipping agents, around 2.1 million TEUs will be added to the global shipping capacity in 2023, in comparison to around 1.0 million TEUs added in both 2021 and 2022. In turn, increased shipping capacity will help to cap the prices of water transport services and ease global trade.

A number of risks, including China’s zero-COVID policy, rising energy prices, and increased geopolitical risks, continue to cloud the swift recovery of global supply chains. Nevertheless, global supply and transportation networks are still expected to maintain an improving trajectory in 2023, despite the existing risks.

Production reshoring and tight labour markets to drive investment in digital tools

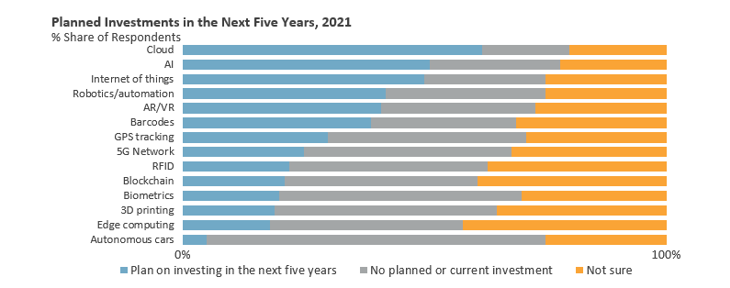

Despite the worsened economic outlook, companies are forecast to continue to accelerate their investments in digital tools in 2023. According to Euromonitor International’s Voice of the Industry: Digital survey, around 62% of companies globally plan to increase their investment in cloud computing over the next five years, while around 50% of companies plan to invest in Artificial Intelligence, Internet of Things and production automation tools.

Accelerated production reshoring is one of the trends driving faster investment in digital tools in the manufacturing sector. Manufacturing companies accelerated their production localisation and reshoring efforts after the outbreak of COVID-19, with rising geopolitical tensions emerging as an additional catalyst for production reshoring in 2023. For example, according to the Reshoring Initiative, a production reshoring advocacy group, 1,800 companies in the US alone are planning to reshore production. In turn, the rising need to improve the visibility and transparency of supply chains, as well as the need to compensate for higher production costs in developed economies, are supporting investments in production automation and digital tools.

Tight labour markets is another factor that is expected to support investment growth in production automation tools in 2023. The recovery of industries that were heavily hurt by the COVID-19 pandemic, and structural labour market problems are creating challenges for companies as they are struggling to find workers. To partly solve the problem and compensate for rapid wage growth, companies are forecast to accelerate their investment in production automation tools in 2023. Because of the issue of ageing populations, investment in production automation is also likely to become a long-term trend. For example, in 2030 more than 40% of the population in Europe is forecast to be aged 50+ years, in turn shrinking the labour pool and adding to the existing labour market problems. Production automation in many cases could be the only viable option for companies to ensure productivity growth.

More information on the key economic trends in 2023 is available in our on-demand webinar, Global Economy 2023: What are the Key Recession Risks?