Major League Soccer and Liga MX: A Partnership for Growth

Recently Major League Soccer (MLS) and Liga MX hosted their first joint All-Star game. The neck and neck game ended with the MLS All-stars winning in a penalty shoot-out. This game was another step in the progressing partnership between the two leagues. Both have already joined forces for The Leagues Cup (which will be debuting an expanded format in 2023), and the Campeones Cup. The joint events generally draw strong crowds and TV viewership indicative of a mutually beneficial partnership. These expanded joint ventures have sparked industry rumours of an even tighter partnership between the two leagues, with some discussing the possibility of a future merger.

Euromonitor’s League Index helps to understand the strengths that both leagues bring to this partnership. According to The League Index, which ranks 65 leagues globally according to their commercial attractiveness, the MLS stands fifth in football/soccer globally while Liga MX ranks 10th.

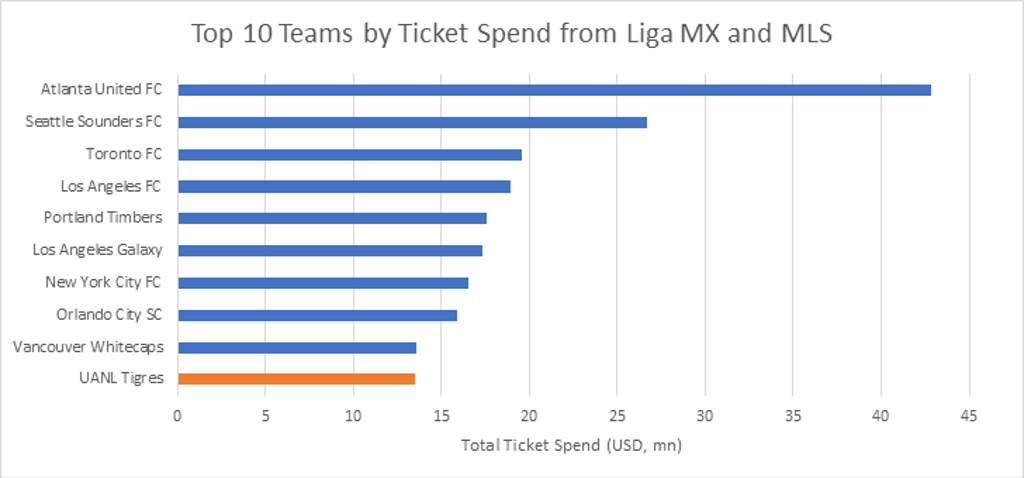

The MLS has been successful in harnessing its young fanbase and adopting customs unique to the sport rather than replicating the customs of the Major Leagues. While Liga MX draws more fans on average, MLS expansion could quickly change this, with the league recording growing attendances annually, in contrast to the declining attendances in Liga MX. The MLS continues to expand its footprint across US cities with recent franchises including Inter Miami CF, Nashville SC and Austin FC while Charlotte FC and St. Louis City SC will be joining in 2022 and 2023, respectively. MLS gets an additional boost from the economic strength of its home market, determining high purchasing power of its sports fans, as the disposable income per capita in the US in 2020 was USD48,108 compared to USD6,285 in Mexico. Regarding the ticket spend, nine out of top 10 teams come from the MLS with Atlanta United FC leading the list.

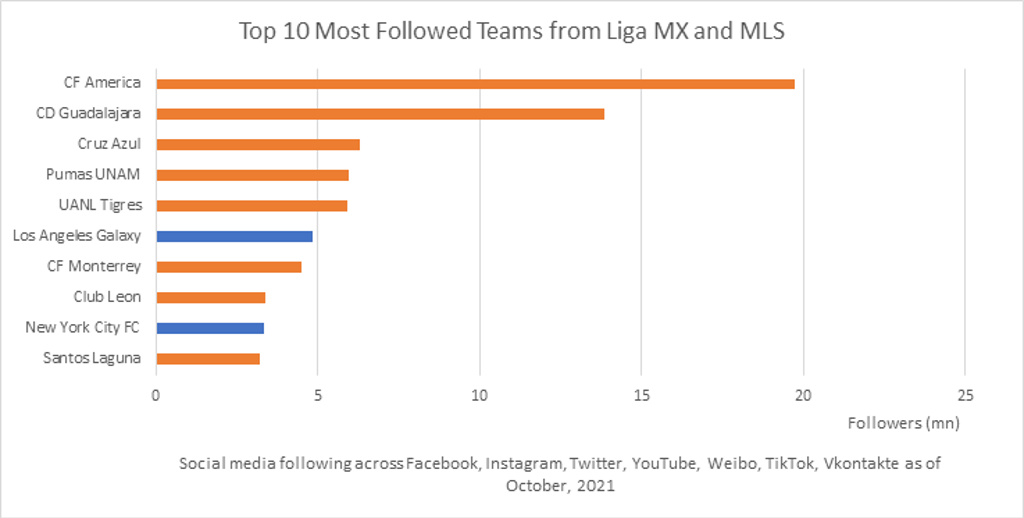

Nevertheless, Liga MX has the distinct advantage of heritage that comes with the league operating for 78 years and being deeply rooted in the sports and entertainment space within Mexico. Some member clubs of the league have been around for well over 100 years having built multigenerational fan networks, something that is somewhat lacking in the only 27-year-old MLS. Liga MX benefits from being the largest sports league in the country, while the MLS has to compete for fans and viewership with other top four major leagues in its home market. The team loyalty built within Liga MX is not only strong within its home market, but also draws from the large Mexican American population within the US for its fixtures hosted in the US. The disparity in engagement with Liga MX and the MLS is clearly seen in the difference in social media footprint with eight out of top ten most followed teams within both leagues coming from Liga MX.

Distinctive advantages of MLS and Liga MX present opportunities for both leagues to grow, creating a solid foundation from which to explore other partnership opportunities in the future. While MLS has been expanding its domestic footprint through new franchises, higher visibility with Liga MX fans will be an important step in its future growth in the region. At the same time, for Liga MX, a partnership allows for deeper integration within the US market. While an actual merger remains speculative, it is very likely the two leagues will continue to work closely together, particularly in the anticipation of the 2026 World Cup that US, Mexico and Canada will host together.