Pandemic impact on plant-based products

During the pandemic many usual habits were challenged, and daily use products were reconsidered. Consumers’ expectations of gaining some health-boosting benefits from food increased, as it appeared that immunity, obesity and other underlying health factors could be key when faced with COVID-19 infection. Also, long months of mandatory home seclusion and down-time led many to rethink their calorie intake, digestion and weight gain implications for general wellbeing. In 2021, Euromonitor International’s Voice of the Consumer survey indicated that “Makes me feel healthier” was the predominant motivation for 49.5% of consumers to choose a flexitarian/mostly plant-based diet. The overall consumer base which tries to follow such a diet has already reached 16% globally. This growing consumer segment has clearly induced demand and therefore led market players to expand such offers. For example, in February 2021 McDonald’s and Yum Restaurants announced partnerships with Beyond Meat, which became their supplier of plant-based burgers and could potentially have a broader role in the future.

Besides health-related motivations, the lockdown and prolonged home seclusion brought about cooking fatigue and a craving for novelty. In times of isolation, consumers had time to master cooking skills and thus plant-based alternatives finally appealed as innovative products to alternate food experiences. E-commerce growth also helped, as the increasing popularity of retailing apps provided convenient access to a broader variety of novelty products. The shift to online has in addition allowed some large market players to redirect their strategies, and instead of focusing only on foodservice they are reaching out directly to consumers. In June 2020 Impossible launched “Impossible At Your Door”, offering delivery of its main products, as well as trendy merchandise. Such developments have strengthened the relationship with the target audience and aim to motivate consumers to sustain their chosen lifestyle.

Lengthy ingredients lists cast doubts on health benefits

However, the strong and successful development of plant-based products has also provoked some criticism. The processing required to turn nuts into a cheese block or beans into a meat-like burger patty is burdensome for the image of plant-based products. Meat producers and other key market players have increasingly labelled alternatives as “ultra-processed”. This has become the key argument when challenging the health benefits of plant-based products and thus partially negates a core reason for the consumption of such alternatives. Based on Euromonitor International’s 2021 survey, about 37% of consumers choose plant-based alternatives to meat so they feel healthier – this is the top motivation. Meanwhile, environmental issues seem to have a lesser impact, concerning 21% of global consumers, and animal welfare promotion is a key argument for 19% of respondents choosing plant-based meat alternatives. Therefore, attempts to bring the processing and long ingredients lists of these products to consumers’ attention pushed some manufacturers of meat alternatives to reshape their recipes. For instance, in 2020 Lightlife started cleaning up its labels under its “Clean Break” campaign. However, after doing that, it started pointing to its rivals’ products, accusing them of “hyper-processed ingredients, GMOs, unnecessary additives and fillers, and fake blood”. Although the company has committed to revamp its own entire product portfolio, and continued doing so even in 2021, its attempt to shame competitors has cast suspicions and doubts on the entire sector.

What’s in store for a plant-based future?

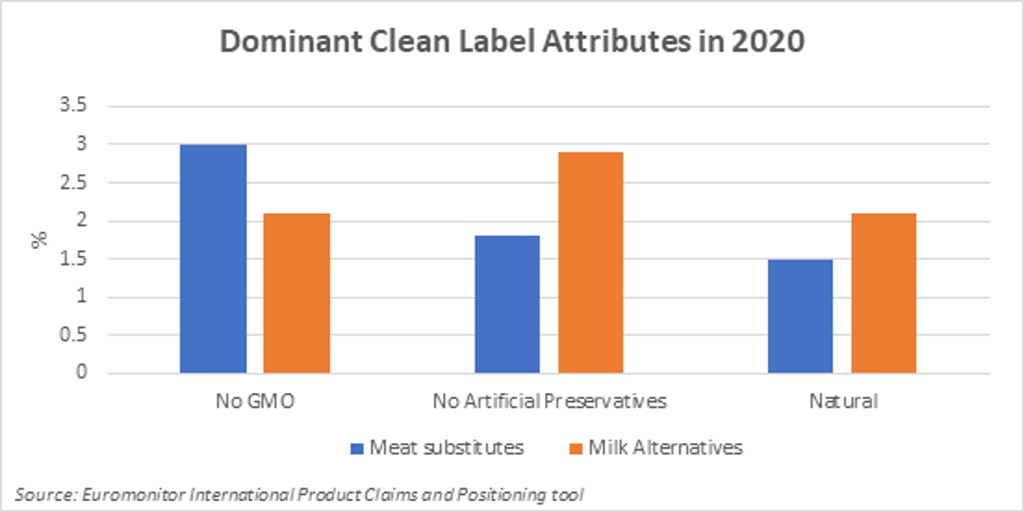

After a period of market disruption, plant-based foods have come out as a winner of increased consumer attention. In 2020, global sales of meat substitutes grew by 9.1% in constant terms, reaching USD20.7 billion. Plant protein gained a wider opportunity to establish its position as a healthy, sustainable and slaughter-free option, and also as a novelty that introduces new tastes. However, moving forward will require further innovation. The health and wellness focus will continue to call for clarity and scrutiny of ingredients in products that mimic well-known, traditional meals. The relevance of clean label will be on the rise, especially on e-commerce platforms, where consumers usually tolerate higher price tags and search for products that meet their needs. Although there is no one agreed definition for clean label, Euromonitor International’s Claims and Positioning tool indicates that for meat substitutes and milk alternatives, dominant claims indicating clean products include: “No GMO”, “No Artificial Preservatives” and “Natural”.