Finovate is a conference series presenting the innovators and ideas at the forefront of banking and financial technology (fintech). Its Europe 2022 edition showcased the rapid development of fintech-driven payment innovations since the outbreak of COVID-19 through a variety of demos, panels and presentations, including by Euromonitor International. Following the pandemic-induced digital push amid increasing financial pressures such as inflation in the region, these emerging online payment and banking methods have shown rising potential. As consumers and merchants increasingly embrace financial technology, thereby driving “Buy Now Pay Later” (BNPL), digital currency and digital challenger banks in particular, the competitive landscape in consumer finance is becoming increasingly dynamic.

Buy Now Pay Later surges into the mainstream

The rise of BNPL has been emblematic of the growing influence of fintech in consumer finance. With online shopping skyrocketing as a result of the pandemic, expectations have quickly grown regarding convenient and seamless customer journeys online, including payments. While the option to pay for purchases in instalments previously existed, it is the embedded lending service provided by fintechs like Klarna that have significantly reduced pain points for consumers seeking credit. By integrating their technology-driven lending products directly into online shops, requiring only limited customer information, these players have made lending broadly accessible and popular amid rising online spending, especially by millennials and Generation Z.

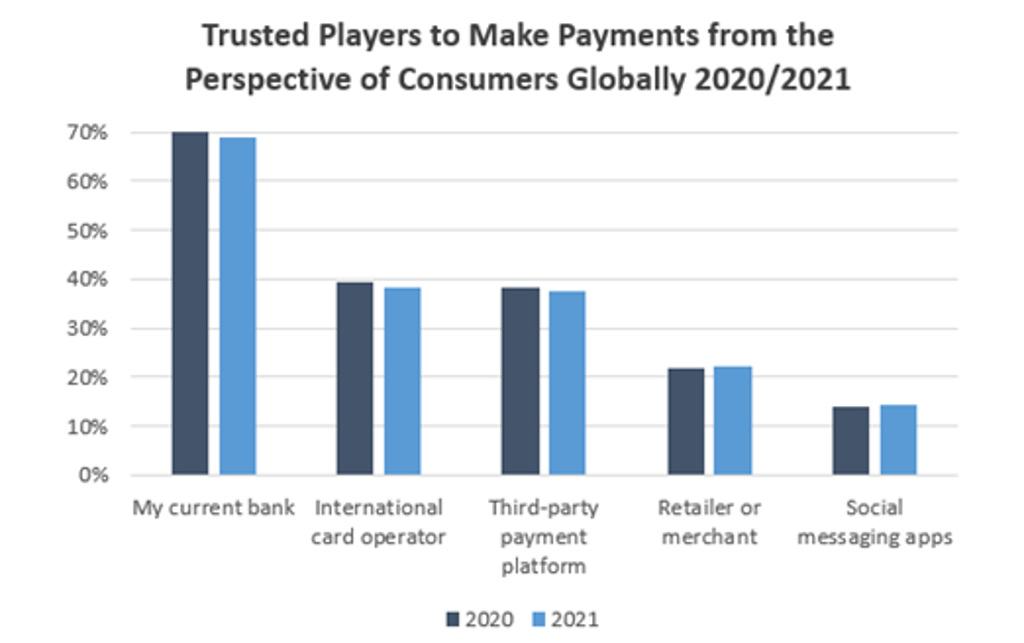

By surging into the mainstream within just two years, BNPL has revealed its disruptive potential vis-à-vis traditional payment players. At the same time, its rapid growth has given rise to numerous new players, fuelling questions about the medium- to long-term success factors and potential consolidation within the highly dynamic BNPL landscape. Here, trust from both consumers and retailers has been highlighted as a key differentiator going forward. Retailers aim to align their brands with trusted services, particularly amid a fluid regulatory environment, while consumer trust drives their payment choices, especially in view of payment options steadily increasing.

Source: Euromonitor International’s Voice of the Consumer: Digital Survey

Cryptocurrency emerges as a viable alternative

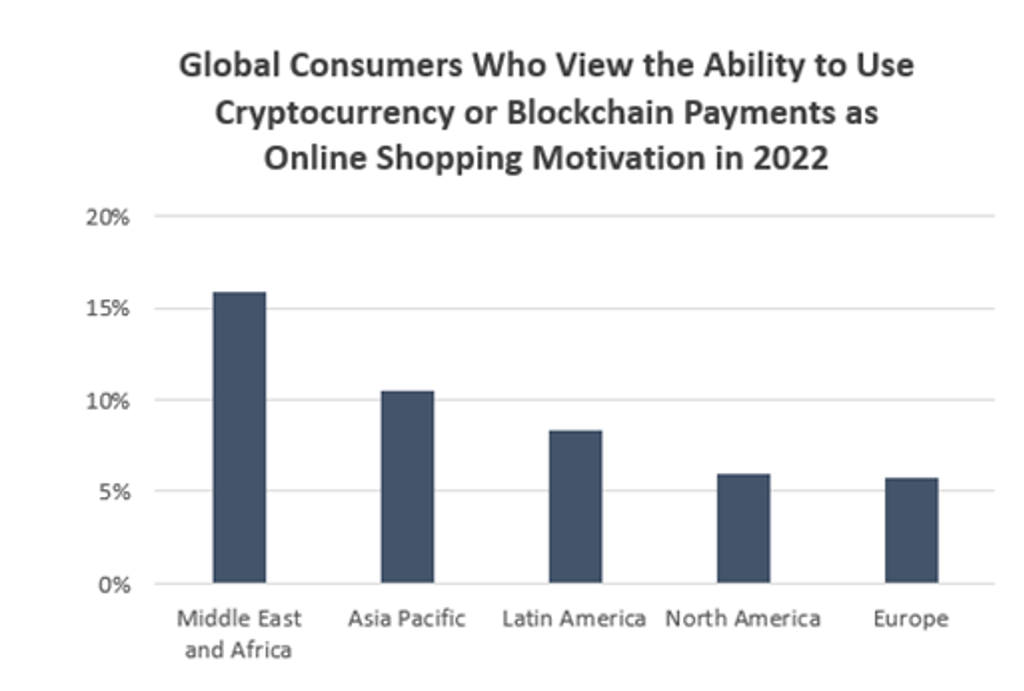

Why companies should embrace crypto was a key theme that highlighted how cryptocurrency is increasingly established next to government-issued currency, or fiat currency, such as the US dollar. Most financial institutions globally from banks to payment players are expected to use cryptocurrency within the next five years. While this underlines the medium-term prospects of crypto on a broader scale, there is a growing number of players in 2022 that provide opportunities to covert fiat currency to crypto and vice versa.

Payment processing company Worldpay, for instance, aims to allow merchants to accept cryptocurrency as payment directly from consumers, online or in person, and to enable merchants to convert it to fiat immediately. Hence, instead of paying by cash or card, consumers can use a crypto wallet. Since this payment process poses a direct threat to the major card networks, Visa and Mastercard are now pursuing their own crypto strategies. On balance, this illustrates the prospects of cryptocurrency going forward. While its usage remains limited overall, it is likely to become a viable alternative to entrenched payment methods.

Digital challenger banks gain in scale and specialisation

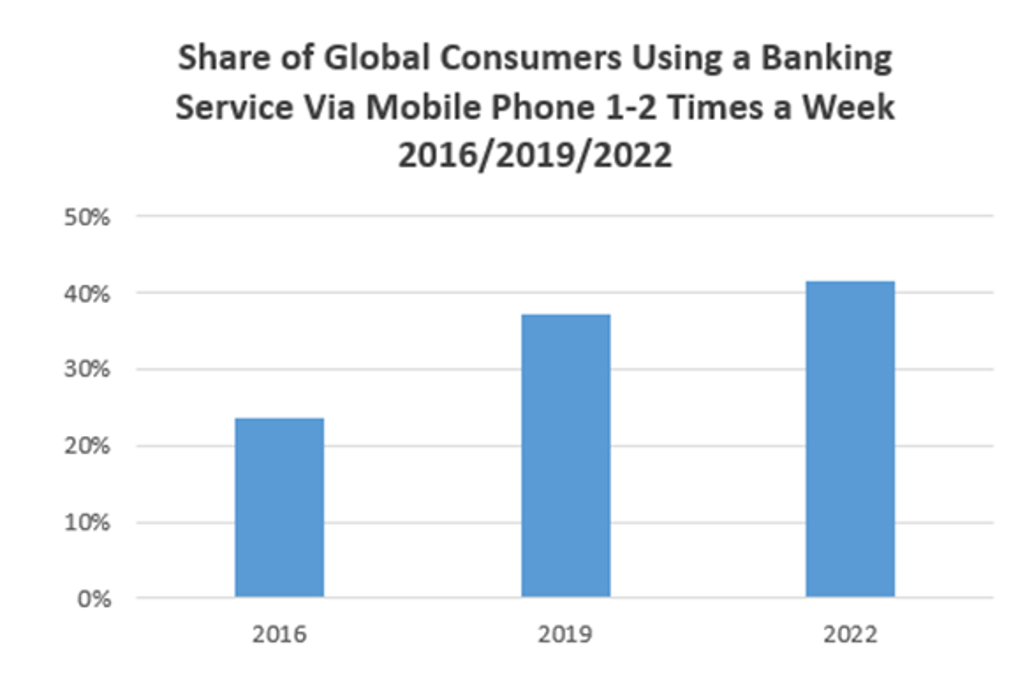

Digital challenger banks like Monzo have seen rising growth rates in all respects in recent years, not least as a result of the pandemic. Although growing rapidly, these players are still building trust with customers who typically only use mobile banking applications as their secondary bank account, particularly in developed countries. Yet, this process is increasingly threatened by large-scale cyberattacks, particularly following the Russian invasion of Ukraine, thus making data security a key priority among digital challenger banks in 2022.

A further challenge is their limited profitability, particularly as incumbents are launching successful digital-only banking apps themselves. Hence, with their digital-first approach no longer a key differentiator, challenger banks increasingly seek to specialise. By delivering a highly personalised banking experience to a specific customer segment, such as Tomorrow’s focus on climate-conscious consumers, digital challenger banks are more likely to become profitable. With various challenger banks developing distinct business models and services, including from basic mobile banking services on a global scale to country-specific financial super-apps, there will be sufficient room for each player to grow, thus making rapid consolidation of the market less likely.

Finovate Europe 2022 showcased how the digital shift globally, accelerated by the pandemic, has provided additional momentum for financial technology. In fact, BNPL, cryptocurrency and digital challenger banks have moved from niche to mainstream at a significantly faster pace than expected by industry experts. These developments also highlight the growing emergence of consumer finance independent of traditional financial institutions and government-issued money. This profound change could significantly impact how consumers prefer to trade value going forward, potentially resulting in fundamental shifts within the banking and payment landscape in the years ahead.