Global supply chains continue to face additional pressures in 2024 due to the security crisis in the Red Sea. To avoid militant attacks, global shipping companies and their clients avoid trade routes via the Suez Canal and instead are rerouting vessels round the Cape of Good Hope. This impacts approximately 11% of the global trade and poses the largest threat to Asia-Europe shipping routes.

Trade disruptions are likely to continue throughout 2024, in turn adding to the additional supply chain challenges and higher inflationary pressures.

European industry would be the most heavily affected by trade disruptions

According to the IMF Port Watch data, daily transit calls through the Suez Canal dropped by 28% in the first week of January 2024 in comparison to the same period in 2023, due to security risks. This impacts a broad range of Asian, Middle Eastern and European countries that rely on this trade route, yet European countries are likely to feel the heaviest impact. The Suez Canal is an important trade hub for commodities, energy and various componentry shipping from Asia and the Middle East to Europe.

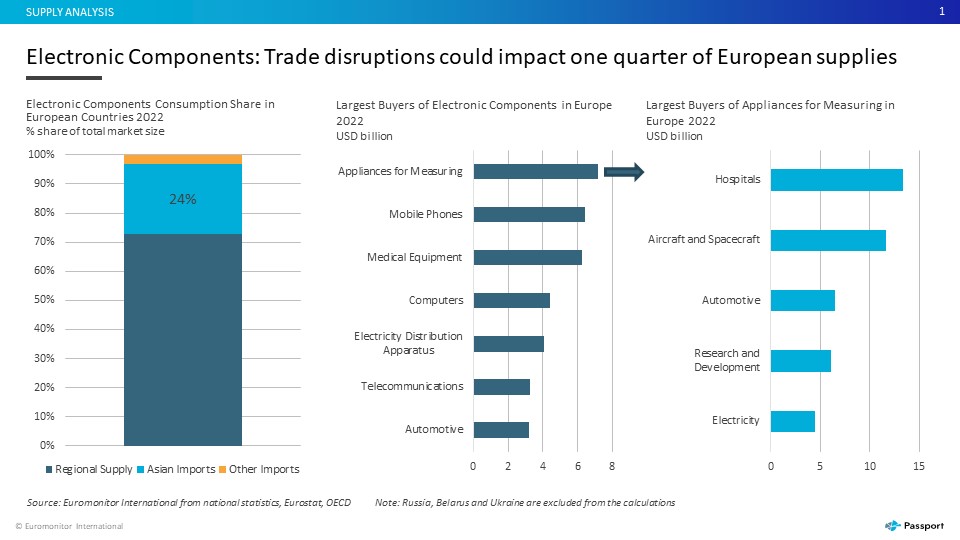

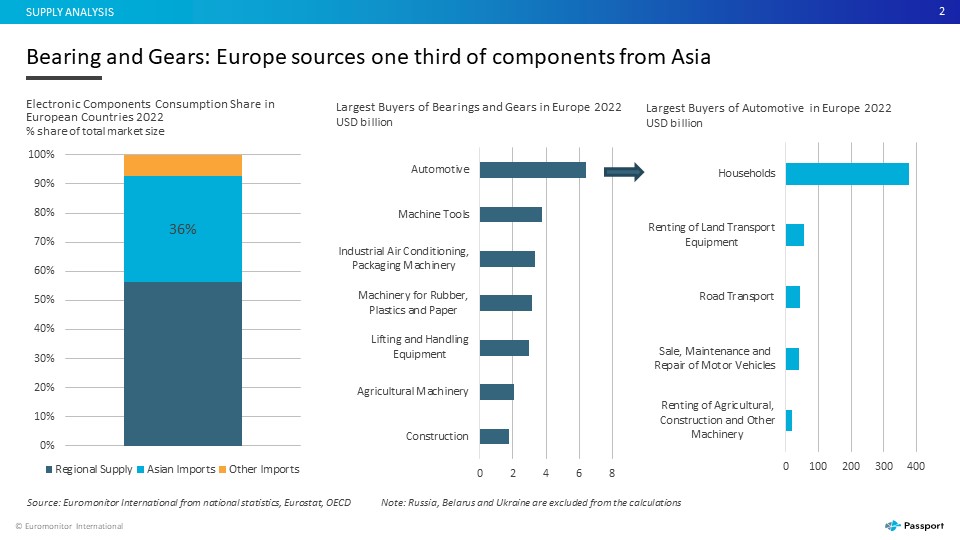

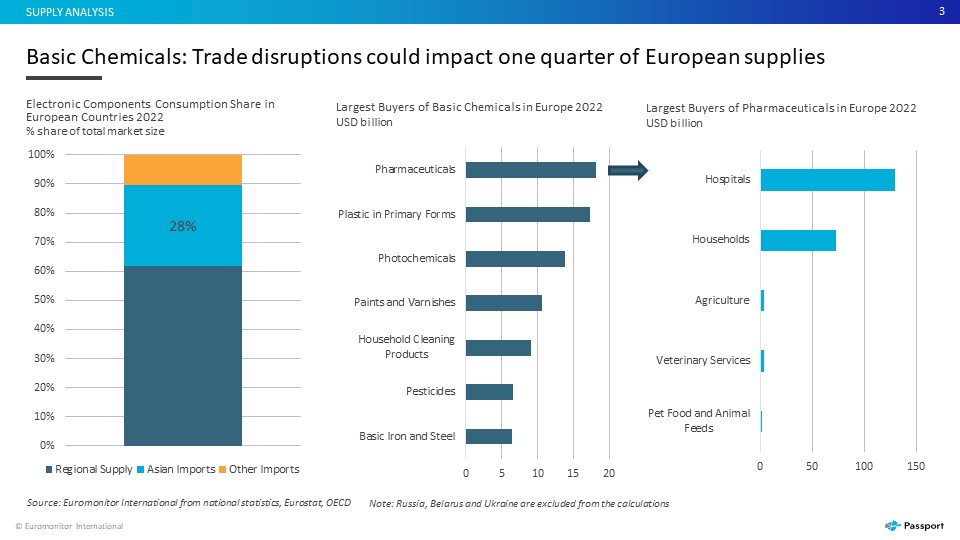

Electronics, chemicals, automotive, machinery and other engineering industries in Europe are the most vulnerable to trade disruptions as they rely heavily on imported components from Asia in their production network. Prolonged trade disruptions and shipment delays could force the companies to halt or downsize production. For example, Tesla already announced it will halt production in its Berlin plant for two weeks as a result of delayed shipments.

Production disruptions would also impact upstream industries in the production network and could cause temporary deficits of components or manufactured goods. In turn, this would add to the higher inflationary pressures across Europe. Companies are also likely to face greater pressure on their profit margins as slower economic and consumer income growth make it more difficult to fully pass on cost increases to the end consumer.

Large-scale trade disruptions are unlikely, yet companies will face higher logistics costs

Despite the heightened security risks, large-scale trade disruptions, as witnessed during the pandemic, are unlikely. The situation is different as global production capacity remains sufficient and shipping companies as well as buyers have greater flexibility in adjusting their trade routes and production.

However, shipping disruptions will result in higher logistics costs for companies. For example, the trade diversion through the Cape of Good Hope adds approximately 10 further days to the trip to the European ports and costs around USD900,000 on extra fuel costs. Increased travel time and higher insurance costs for shipping companies also directly impact shipping rates. For example, freight prices for a 40ft equivalent container on Asia-Europe routes have more than doubled to USD4,000.

Shipping disruptions are also likely to cause delays further down the transportation network. Changes and disruptions to shipping schedules will cause challenges in ports and put greater pressure on cargo handling and road transport sectors to efficiently handle the goods and avoid major delays. For buyers of logistics services, it will likely result in higher prices, as logistics providers will face higher labour, fuel and fleet management costs. Higher transportation costs would mainly impact European retail, automotive and construction industries as they rely heavily on efficient transportation networks.

Risk for further economic slowdown in Egypt and neighbouring economies

Lower shipping volumes through the Suez Canal, could deepen economic problems in Egypt. The Suez Canal is one of the largest sources of foreign currency revenue for Egypt, contributing USD9.4 billion in the fiscal year 2022-2023; equivalent to 2.3% of GDP in 2023.

The scale of impact on Egypt’s economy will depend on how long the security crisis lasts, as the country has resources to withstand a short-term drop in shipping fees. However, prolonged disruptions would cause more serious problems as Egypt would face dwindling foreign exchange reserves, slowing growth and rising inflation. Euromonitor International’s Macro Model shows that under a growth slowdown scenario, which assumes declining consumer and business confidence and deteriorating financial market conditions, Egypt’s GDP growth would be 1.9% in 2024, almost two percentage points lower than the Q1 2024 baseline forecast.

Deteriorating government revenue in Egypt and worsening financial conditions could also have negative spill over effects for other emerging countries in the region, such as Ethiopia or Sudan. Insecurity and worsened financial conditions would damage the confidence of foreign investors, in turn making it more difficult for emerging countries to finance their debt.

Supply chain diversification efforts to accelerate

Amid ongoing geopolitical tensions and trade disruptions, companies will seek to invest in supply chain diversification and production reshoring to create regional production hubs. This would help to better shield from unexpected risks and transportation cost fluctuations. However, any significant improvements will take time to materialise as both countries and companies need to develop relevant infrastructure and build production capacity necessary for production reshoring.

Further information on geopolitical risks is available in our New Economic Reality: Geopolitical Risks and Globalisation Reset strategy briefing.