Snacks sits on the cusp of transition. 2021 saw a more than encouraging sales performance, with constant retail growth accelerating by 0.8 percentage points to reach USD620 billion. This was fuelled by the return of social snacking and impulse purchases after COVID-19 vaccines were rolled out. 2022 will challenge real value and volume growth again, with Ukraine’s invasion causing a historically high inflation surge, pushing up production costs and applying more pressure to faltering supply chains. Yet, amidst more frugal lifestyles, snacks should weather these more volatile conditions without drama. Five key trends are to shape global snacks to 2027.

New consumption occasions for hybrid lifestyles

The lifting of most COVID-19 measures in 2021, thanks to rising vaccination rates, has created a new set of hybrid lifestyles; where the home remains a stronger hub than pre-pandemic, but people are also back to living, socialising and eating outside the home. Eating snacks at home remains the strongest snacking habit mentioned by survey respondents in 2022. And, as office workers around the world have only partially returned to the office, this response rate is still higher than pre-pandemic.

Snackification is also still strong, as more consumers have moved away from set mealtimes throughout the day. Breakfast represents a promising avenue for snacks players, as the hybrid worker desires convenience and time-saving. Weekday lunchtimes are also potential functional snacking occasions. An example of an industry response is the launch of RXBAR A.M. protein/energy bar in the US in 2022, which is positioned as a hassle-free, healthy, yet also indulgent breakfast solution.

Elevated experience through permissible indulgence

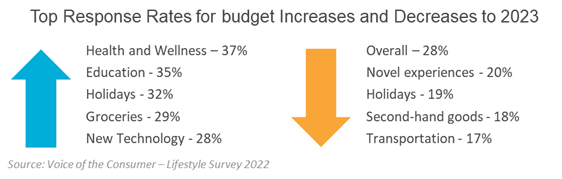

As the economic context forces many to rethink their spending habits, snacks, which remain a relatively low type of discretionary expense, can still feel like a treat. Although split on whether to increase or decrease their holiday budget, survey respondents do want to spend less overall, but more on groceries and health and wellness.

In this context, permissible indulgence through smaller treat sizes, higher-profile ingredients and sensorial novelty remain effective strategies.

Plant-based craze: Dairy alternatives populate sweet treats

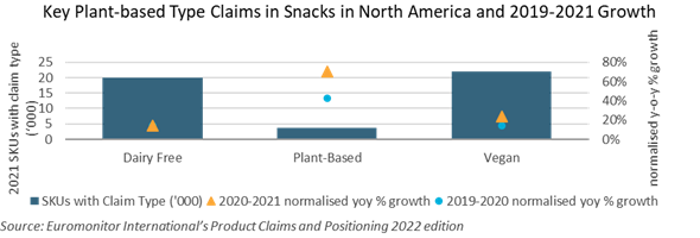

The permeation of plant-based alternatives into snacks accelerated in 2021. More and more consumers perceive these as a healthier choice, although environmental concerns will also increasingly be a sales driver. In 2021, ice cream saw plant-based claims proliferate geographically outside mature markets. Etiqueta Verde competes with Not IceCream in Argentina, Yamo offers a yam-based alternative familiar to consumers in Brazil, while Kaju Vegan targets those with lactose intolerance in Egypt.

In mature markets, plant-based also gained ground quickly in chocolate confectionery. Mars and Lindt, for instance, launched dairy-free variants in the UK and Canada, respectively. However, the trend is not growing seamlessly everywhere, with more scepticism in Europe about the health credentials of plant-based snacks. Future offerings will need to be compelling both in their taste profile and from an ingredients point of view, to avoid the feeling of sacrificing indulgence.

Energy- and brain-boosting as new frontiers in health benefits

In many markets, snacks are blurring the lines with (and even cannibalising) the vitamins and dietary supplements category, by bringing to the market products with attractive functional benefits for the body and, increasingly, the mind. Energy- and brain-boosting, notably as potential competition to coffee and energy drinks, show long-term potential.

In Colombia, where access to vitamins and dietary supplements is limited due to high prices and a low presence in traditional retail, Viva Vita gummies with vitamins were launched for various age groups, both in plastic jars for home consumption and pouches for on-the-go.

Sustainable snack propositions: From claims to solutions

In 2022, sustainability remains less front-of-mind and largely a brand differentiator. Yet alongside company pledges, increased consumer awareness of its various facets, and even a greater need to diversify ingredients amidst ramping inflation, sustainability is set to become an essential component of the product proposition by 2027.

Whilst chocolate confectionery is most exposed to a potential backlash in terms of social responsibility around cocoa supply, all snacks players will need to address mounting sustainability issues, such as poverty, food and packaging waste, climate change and renewal of resources. Certifications such organic and fair trade lead the way in snacks, but packaging is amongst the biggest avenues for innovation. The natural character of ingredients and their sourcing is amongst the most viable, long-term routes to more sustainable snacks.

Future outlook for snacks

The economic outlook for the coming years continues to look tough, and perceived value will be a key consideration when consumers are looking at what to spend their money on. Whether suggesting a breakfast solution, a luxurious product with a new texture and flavour profile, a vegan alternative to chocolate biscuits, chocolate that helps focus, or a more locally sourced product, the perceived value for money will need to be unequivocal.

If you want to read more about snacks, click here.