The strong recovery of the global economy, combined with measures introduced to combat the COVID-19 pandemic, continue to result in supply bottlenecks and inflationary pressures during 2021. Manufacturers across the world have faced heightened input costs – the costs of materials, labour and other overheads devoted to the production of goods. Surging prices of raw materials and transportation, and shortages of components and labour are holding back production at factories, resulting in higher production prices and slowing the pace of recovery across the US and Eurozone. The following three charts give insights on how different input prices have increased since the outbreak of the pandemic.

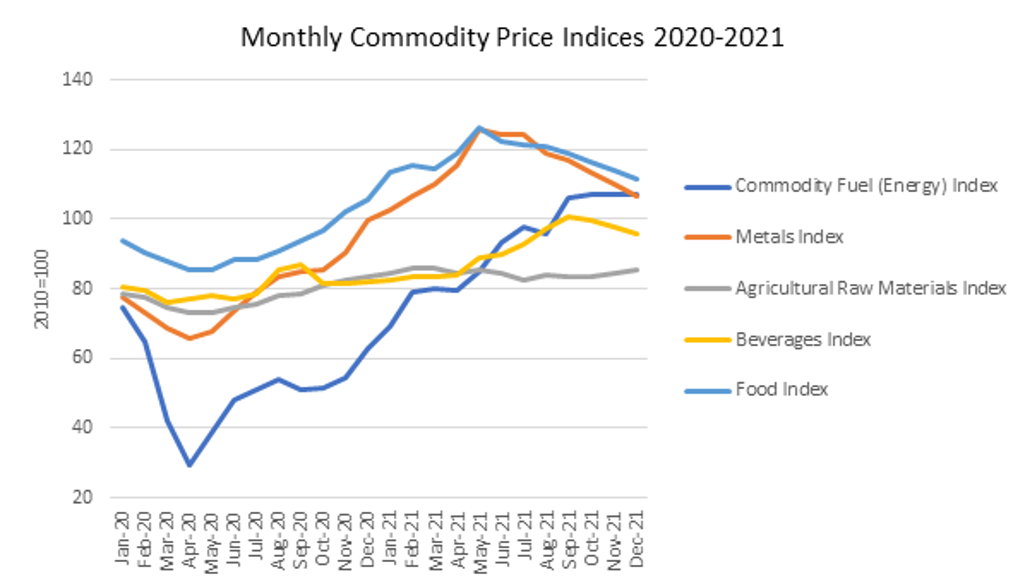

Energy and metal prices lead the hike in raw materials costs

After a short dip in early 2020, global energy prices have been surging since May 2020, triggered by a resurgence in global demand as economies emerge from COVID-induced lockdowns. During the 18 months from May 2020 to September 2021, fuel prices have tripled, making it a major contributor to cost increases for manufacturers across all industries.

Source: Euromonitor International from World Bank

Note: Data from October 2021 are forecasts.

The price of metals was the second largest contributor to overall global commodity price rises. This was mainly led by the surge in prices of key metals including copper and iron ore, as manufacturing activity recovered quickly in China and other global production hubs, while disrupted mining operations and transport congestion at ports added to higher prices. Food manufacturers also face remarkable increases in materials prices, particularly for vegetable oil and cereals in 2021, forcing some producers to pass these costs on to end consumers. While the prices of metals and food have moderated since August 2021, they are forecast to remain significantly higher than pre-pandemic levels by the end of 2021.

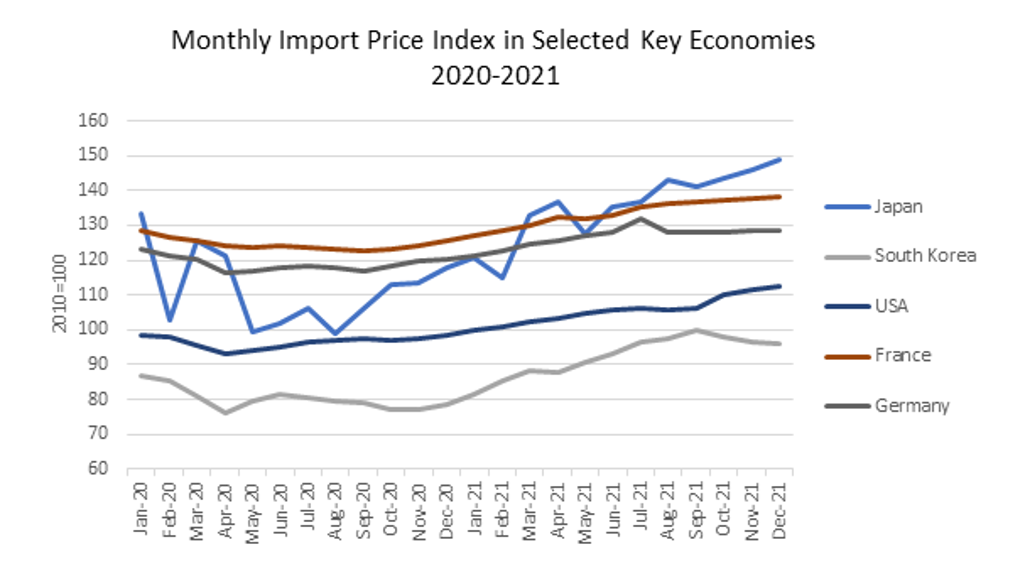

Rising import prices add pressure

The import price index (which shows the change in value of one unit of actual imported merchandise) is another indicator that reflects the development of input costs in manufacturing, as many manufacturers rely on the import of raw materials and component goods (such as semiconductors) for domestic production. Since 2021, the import price index has increased across major advanced economies. The US import price index, for instance, increased by 14% over the last 18 months. The rise in import prices has been driven by the higher prices of raw materials, capital and consumer goods, but soaring freight costs have also played a role. Global shipping costs have increased since the end of 2020 globally on the back of surging consumer demand for goods, while the logistics industry faces various capacity constraints due to labour shortages, port congestion and closures.

Source: Euromonitor International from Eurostat/national statistics

Note: Data from October 2021 are forecasts.

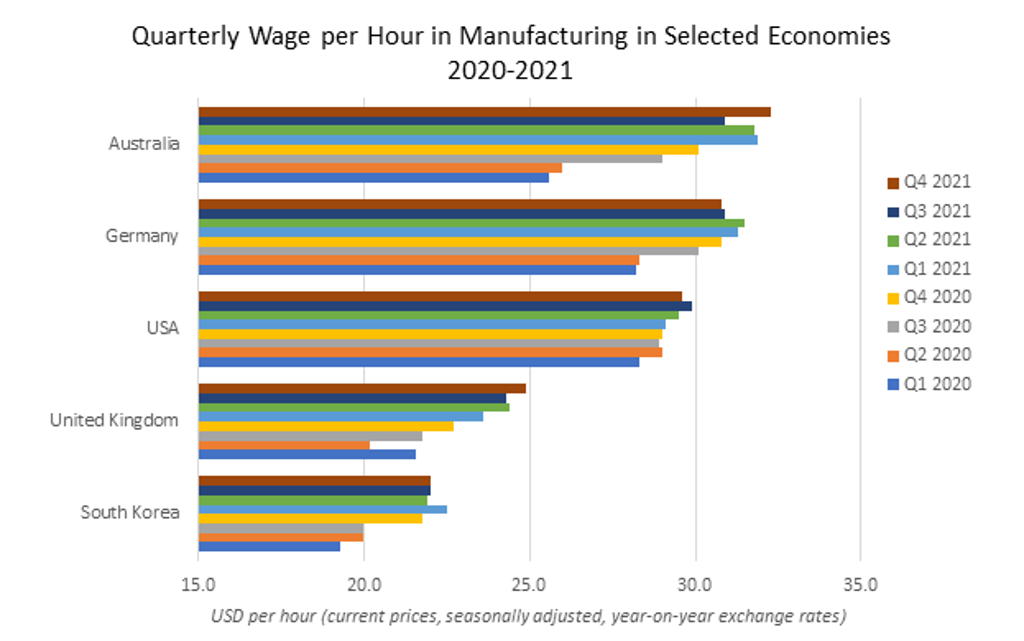

Labour shortages and inflation trigger wage rises

The labour market has witnessed an accelerated shift since the pandemic, with labour shortages now a major issue faced by many producers globally. Lockdowns and border closures have led to an overall decline in labour participation, while many other people voluntarily quit roles just as demand for workers rose as economies reopened. As a result, wages in the manufacturing sector have risen in many economies, pushing up input costs further for producers. In the United Kingdom, the hourly wage in manufacturing in Q2 2021 increased by 20.7% over the same period the previous year, as the labour market was hit hard by both Brexit and the pandemic. In Germany, the manufacturing wage has increased since late 2020, while German workers continue to request higher pay as the country’s inflation rose to a record level in 2021. In addition to pandemic-induced impacts, demographic factors including population ageing and shrinking labour forces will continue to put upwards pressure on wages in many countries in the long term.

Note: Data from Q3 2021 are forecasts.

Enhancing supply chain efficiency and resilience remain top of the business agenda

High input costs have led to producer price inflation across economies during 2021. The manufacturing producer price index in the US rose to 127 in September 2021 (2010=100), compared with 110 the year before. Although the global economic recovery is likely to already have peaked in 2021, most analysts forecast that several supply constraints (e.g., labour shortages and logistics problems), as well as energy price pressure, could last into 2022, keeping input costs high at least in the near term.

As demand continues to outstrip supply capacity, manufacturers are having a hard time regaining growth momentum and maintaining profit margins. While some companies have used their pricing power to pass costs through to the customer, it is becoming increasingly important for businesses nowadays to explore ways to reduce inefficiencies and build resilience across the supply chain.

To learn more about Euromonitor’s economic data and insights, request a Passport demo today.