Despite historic and forecast global declines, the tobacco industry in the Middle East and North Africa (MENA) is anticipated to continue growing. This is partly as tobacco companies continue to diversify and invest in alternatives, although the majority of volume growth over the forecast period will be driven by traditional cigarettes. Over the forecast period, the region is anticipated to maintain growth owing to cultural norms, an increase in female smokers in selected markets, and increased demand for tobacco alternatives across e-vapour products and heated tobacco. Currently consumers are trading down in cigarettes, with some opting for economy and mid-priced brands, and price bands shifting across countries.

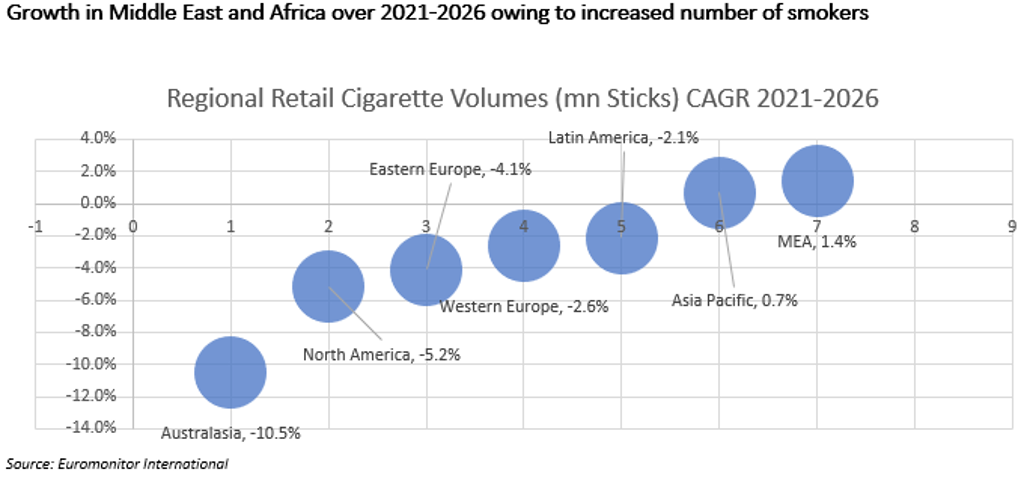

While cigarette retail volumes have been on the decline in all regions apart from Asia Pacific, the Middle East and Africa is anticipated to show a 1.4% CAGR for 2021-2026. Despite challenges in the supply chain, and price sensitivity amongst consumers during the pandemic, owing to a decrease in disposable incomes, the MEA region continues to grow, as cultural habits remain strong, such as high smoking prevalence.

Looking specifically at the MENA region, Euromonitor International’s socioeconomic data show smoking prevalence in terms of the total number of male smokers is highest in Egypt, Algeria and Morocco. As for female smokers, the highest figures per ‘000 persons are seen in Egypt, Morocco and Tunisia. The number of female smokers continues to grow due to more social openness and a breakdown of cultural taboos. The availability of cigarettes, along with a deep-rooted cultural acceptance of smoking in the region, helps facilitate and fuel rising consumption. This pastime has long been enjoyed within the context of social gatherings amongst family and friends, where food is also often involved in consumer foodservice settings in restaurants and coffee shops. Growth is expected to be maintained by traditional cigarettes, particularly economy and mid-priced brands, as consumers trade down to lower-priced products.

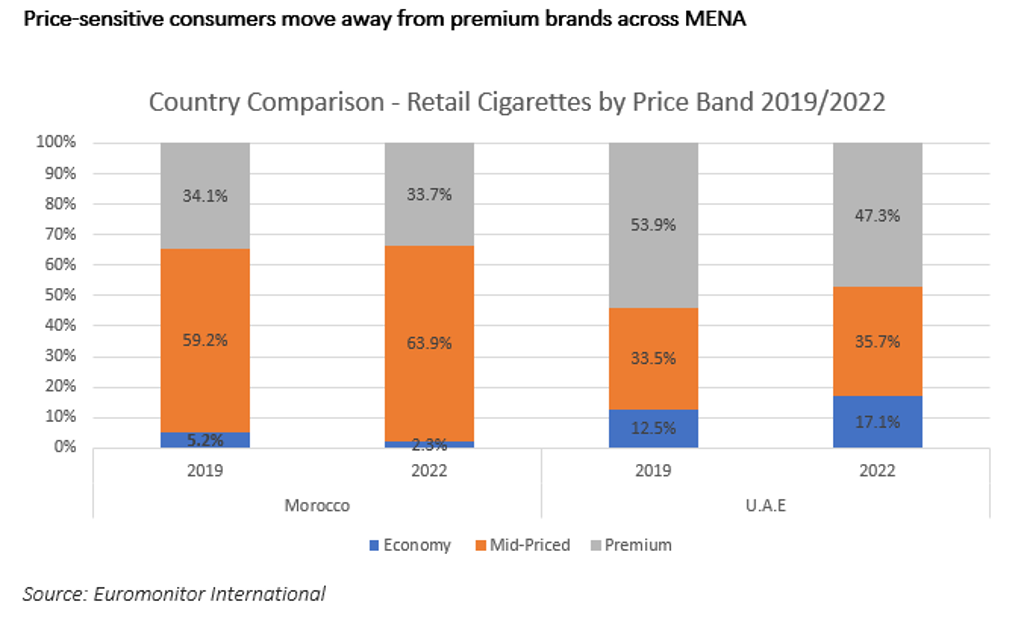

Price sensitivity became more pronounced during the pandemic, with lockdowns and supply chain issues, and decreases in disposable income allocated to non-essential goods such as cigarettes, making consumers more conscious of their spending. In response during this period, as seen in Morocco and the UAE, many companies saw stronger demand for mid-priced brands (both countries), as well as economy brands (the UAE). Players thus strengthened products in these price bands in order to retain consumers and maintain their shares. More price-sensitive consumers continue to substitute between price bands, as many cigarette brands have increased in price.

New products have also been spurring growth. Phillip Morris International (PMI) has added its IQOS and HEETS products to its portfolio across Egypt, Israel, Morocco, Tunisia and Saudi Arabia, while more recently the Glo brand from British American Tobacco has also been gaining from sales in Egypt. During the pandemic PMI opened its first retail outlet within the Gulf, as the ban on heated tobacco products was lifted in April 2019. The trend of consumers gradually moving away from traditional cigarettes is becoming more widespread as e-vapour products and heated tobacco become more widely available, even though some smokers remain particularly faithful to traditional cigarettes due to their practicality and relatively lower prices.

What is next for tobacco companies as they look to the future?

The MENA region continues to show potential, which is evident as tobacco players continue to invest in and diversify towards alternatives such as e-vapour products and heated tobacco. In selected developed markets, strong CAGRs are expected in alternative tobacco products, with e-vapour products showing the strongest potential in value terms in Algeria and Saudi Arabia, while in Tunisia, Saudi Arabia and Morocco, heated tobacco is positioned for strong value growth over the forecast period.

Given the anticipated growth, to increase their revenues and profits global owners within the region will need to continue their focus on strengthening both economy and mid-priced brands, as consumers reduce their consumption of premium brands. They will also need to continue investing more in alternative tobacco products such as e-vapour products and heated tobacco. The growth of heated tobacco within MENA will help to accelerate the shift away from premium cigarettes, as higher-income consumers are typically early adopters. Tobacco smokers have not just exhibited downtrading, but also out-switching – both intra- and inter-industry substitution, which has squeezed premium cigarettes. Those companies able to exploit these opportunities are best-positioned to maintain value sales in the region over the forecast period, while others in traditional cigarettes internationally are likely to experience continued declines.

For further insight, in-depth analyses and comprehensive data on the tobacco industry across 100 research countries, click here.