In the aftermath of “plant-based” becoming a household phrase, what space does a vegan positioning have and how do we expect the claim to be utilised in the future?

Vegan after the entrance of plant-based

Many meat alternative companies are directly targeting meat-eaters by promising a meat-like experience. In the words of Impossible Foods, “the Impossible Burger is made from plants for people who love meat.” By not addressing only those who already just consume non-animal products, the possible target audience multiplies many times over, with the traditional language and positioning of vegan products effectively left behind.

Mindful eating aimed at cutting down meat and dairy consumption, whether for health or environmental reasons, has gained traction since the early development of meat and dairy alternatives. In 2021, 11.1% of Europeans claimed they adhered to a flexitarian diet and 23.0% confirmed that they limited their meat intake, according to Euromonitor International’s Lifestyles Survey. This compared with 3.4% indicating they follow a vegan diet.

Merely limiting the consumption of animal-derived products is, of course, less of an adjustment than following vegan guidelines, which require the avoidance of foods that use or exploit animals. This sometimes includes less obvious restrictions, such as not consuming honey, sugars or food colourings with animal extracts, or products fortified with omega-3s. By not centring language around vegan principles, meat and dairy alternative companies have attempted to move beyond an association with these more stringent restrictions.

The vegan claim becomes one amongst many

Arguably, the language around plant-based has started to affect the use of vegan claims across all food categories, not just meat and dairy substitutes. Euromonitor International’s Product Claims and Positioning system reveals the shifting and less frequent use of “vegan” as a claim. In 2020, vegan claims declined by 2.4% on packaged food SKUs in Western Europe when accounting for the growth of the overall industry. Notable categories in which the prevalence of this claim declined were snack bars, with SKUs seeing a decline of 5.4% in penetration, while vegan claims on pasta dropped by 13.7% in the same period.

While a vegan claim was part of the product description on 49.8% of the meat substitute SKUs in Western Europe in 2020, it is far from the only communication, nor the central claim. A reason why vegan claims are not on almost half of meat substitutes is that there are more effective ways to communicate both the ingredients and the ethos of the product and brand. The increase in meat-less options on the market and the developed understanding of flexitarians’ preferences has also led to a more developed type of communication. This includes highlighting the type of vegetables used, the presence of “veggies” and “made from plants”, or more associative slogans, such as Danish Naturli’s “Eat Plants – there is no Planet B.”

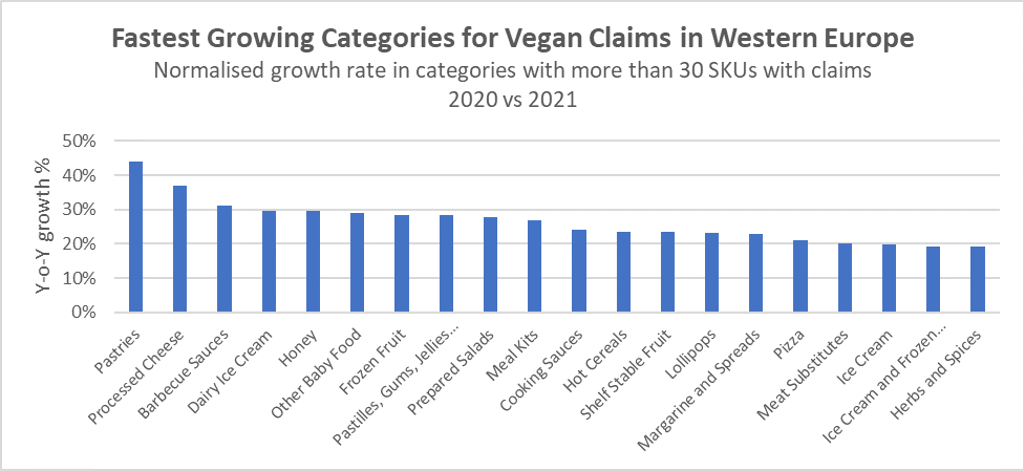

The vegan claim is growing in more processed categories

There are still some categories in which the vegan claim is growing fast and has increased its penetration, including more processed categories, such as processed cheese and pastries. These categories are also less developed in terms of non-meat and dairy alternatives, where we would expect to see development in plant-based innovation and marketing. Innovation in dairy-free cheese has been growing rapidly but remains niche in most markets. Developments in the ability to melt such cheeses have been important for pizza and cooking cheese, while artisan and aged dairy-free cheese have grown, particularly in the UK, through brands such as I AM NUT OK.

Another category in which the vegan claim has increased is pastilles, gums, jellies and chews, with vegan claims accounting for 3.1% of the overall category in 2020. In recent years many gums and chews brands switched out the gelatine and animal-derived food colourings in their products.

Neither cheese nor confectionery have been pushing a vegan positioning primarily to amplify messaging around health or nutrition. Rather, the focus is availability to a wider target audience, including vegans. However, as innovation in these less developed alternative product categories continues, we expect the vegan claim to give way to more carefully crafted messaging around sustainability, ingredients used, processing methods and other product qualities, as consumers are continuously looking for benefits in the products they consume, rather than labels as such.