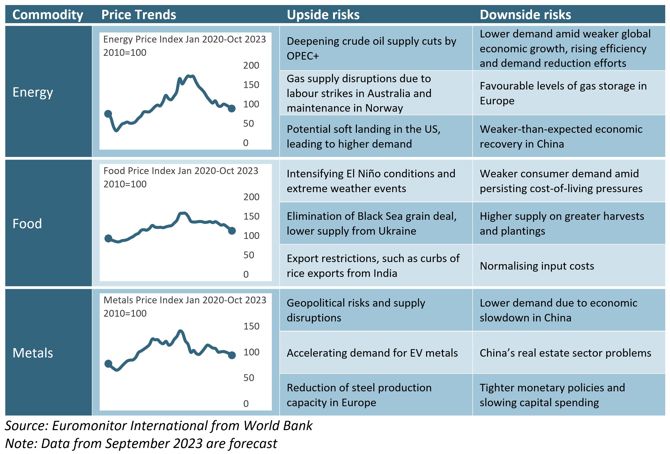

Albeit staying historically high, prices of many commodities are set to normalise below last year’s levels, weighed by weaker global demand. Despite recent improvements in global economic outlook, it remains fragile as high borrowing costs, persisting inflation, geopolitical woes and disappointing China’s recovery weigh on the outlook and dent demand for energy, metals and food. Yet, tightening global supply adds pressure to energy and food commodities markets.

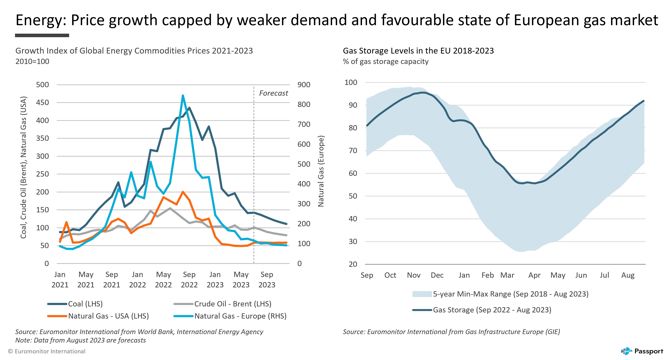

Weaker demand caps energy prices, yet tighter market may add upward pressure

Energy prices are forecast to average below last year’s levels, helped by weaker global demand. Despite recent improvements in global projections driven by unexpected resilience in the US and several other economies, global economic risks remain tilted to the downside. Persisting inflationary pressures and the lagging effects of monetary tightening are expected to curb spending and investment growth, while China’s post-pandemic recovery has been failing to gain significant momentum, adding to energy demand weakness.

During the first half of 2023, average global energy prices plunged by 25% year-over-year

Source: Euromonitor International

Widespread energy conservation efforts, as well as the intensifying shift to renewable energy and energy efficiency are also set to translate into lower energy demand and help in mitigating energy market pressures, especially across developed economies.

Moreover, the European Union had successfully replenished its gas reserves meeting the November target of 90% by August, reaching a record high for this time of year and thereby mitigating potential risks of gas supply disruptions in the region ahead of the upcoming winter season.

There are, however, several upside risks to energy price forecasts on the supply side. For example, oil supply cuts among members of the Organisation of the Petroleum Exporting Countries and its allies (OPEC+), including Saudi Arabia and Russia, have already resulted in a global oil supply squeeze and triggered a spike in oil prices in July 2023. Moreover, the global natural gas market has recently come under pressure, as the ongoing labour dispute and potential strikes at Australia’s major liquefied natural gas complexes and maintenance works in Norwegian gas infrastructure will likely curtail global output and exports.

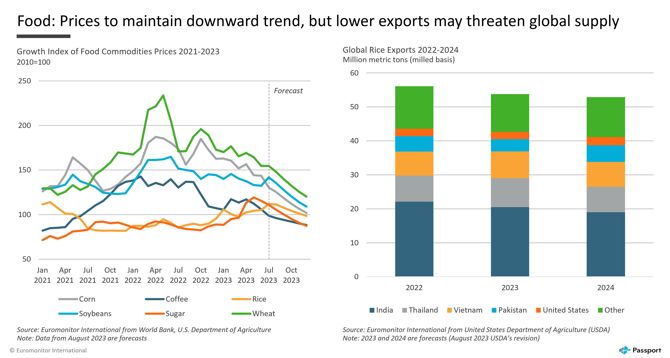

Export curbs and adverse weather among key risks for food prices

Average prices of food commodities are forecast to normalise during 2023, supported by moderate consumption and the anticipated strong grain harvest globally. According to the International Grains Council’s August forecasts, global grain production is projected to be the second largest on record. However, the outlook remains volatile and is mixed across different food commodities, with notable upward risks stemming from global supply uncertainty.

In July 2023, Russia suspended the Black Sea grain deal, which allowed Ukraine to export grain by sea. Termination of the deal and damaged seaport infrastructure is set to put strain on grain and oilseed exports from the region, which could trigger a price rally in grains and oils.

Moreover, projections of rice prices are tilted to the upside following trade curbs introduced by India, which accounts for nearly 40% of global exports. In August 2023, India has imposed a 20% export duty on non-Basmati parboiled rice, following a ban on non-Basmati white rice exports in July, in efforts to control domestic food inflation. As a result, global supply of rice is projected to slide by over 4% year-over-year in 2023, according to the US Department of Agriculture.

The development of El Niño weather conditions could also lead to disruptions in precipitation, triggering droughts or floods, and curbing global agrifood production. As of July, there was a 90% probability of at least moderately strong El Niño pattern persisting in the second half of 2023, according to the World Meteorological Organisation.

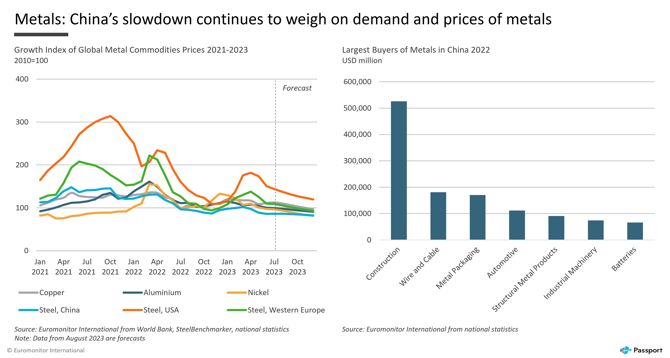

China’s slowdown continues to weigh on demand for metals

Prices of key industrial metals are forecast to remain on the downward trend in Q3 2023. Tighter monetary policies in the largest economies, slower global economic growth and slowing China’s post-pandemic recovery are weighing on the demand and prices of metals.

Problems in the China’s construction sector in particular are hurting demand for key metals like steel, aluminium and copper.

According to national statistics, property investment in China fell by 8.5% over January-July 2023, while new construction starts plunged by almost 25%

Demand for metals in China’s construction industry is predicted to remain supressed in 2023 and potentially in 2024 as ongoing liquidity problems of the real estate developers and weak demand for new property will continue to hurt construction of new projects.

Underperforming manufacturing sector in China is also adding to weaker demand for metals. The official Manufacturing Purchasing Managers’ Index has stayed below the 50-point threshold since April 2023, indicating that manufacturing sector will continue to show subdued performance in 2023 amid faltering domestic and foreign demand. In fact, China’s exports contracted by 14.5% in July 2023, reflecting weak export demand and rising geopolitical tensions. Slower growth in industries that are the key consumers of metals will continue to cap metal prices throughout 2023.

Among the bright spots, demand for lithium, nickel and other metals used in electric vehicles (EV’s) production is predicted to remain strong. In 2023, global sales of EV’s are forecast to grow by 22% to almost 10 million units. However, despite the demand growth prices of lithium are forecast to remain stable throughout 2023 as EV manufacturers have refilled their inventories of lithium and supply-demand temporarily reached an equilibrium.

Learn more about developments in global commodities markets in our report, Global Trends in Commodities Market. And read our recent article on Rising Energy Pressures to learn how they affect economies, businesses and consumers, and where opportunities lie in times of intensifying environmental awareness and regulations, and growing energy security concerns.