Commodity prices are projected to continue moderating on the back of softer global demand and adequate supplies. Amid the global economic slowdown, weaker private consumption, business spending and capital investment are expected to weigh on commodity demand and curb price growth. However, the outlook remains highly uncertain due to elevated geopolitical risks, which could lead to supply disruptions and intensify price volatility, especially in energy markets.

Energy market outlook clouded by volatile geopolitical situation

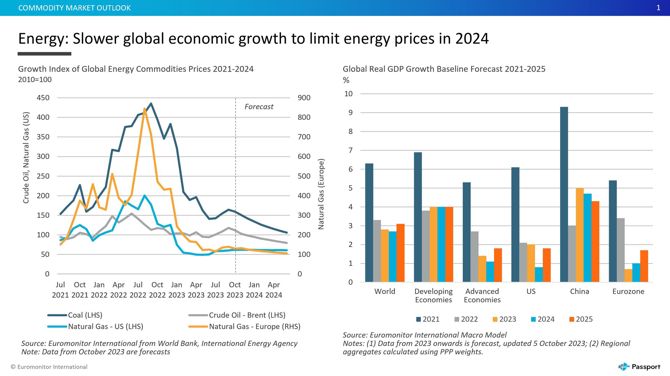

Global energy prices are projected to trend downwards into 2024, on the back of slowing global energy demand. According to Euromonitor International baseline forecasts, real global economic growth is projected to slow to 2.7% in 2024, as the delayed effect of tight financial conditions weighs on global economic activity, especially across advanced economies. An ongoing real estate crunch and moderate economic growth in China are also set to curb energy demand, which will counter the expected resurgence in oil consumption from the country’s reviving travel sector.

The energy market outlook, however, has been subject to heightened uncertainty. Since September 2023, crude oil prices have witnessed several upticks due to a series of oil output cuts by the OPEC+ and rising supply concerns associated with the Israel-Hamas war. While oil prices have retreated from the peaks reached in September and October, intensifying geopolitical risks, including a potential escalation of the war, could increase volatility in global energy supply and prices.

Higher-than-average storage levels of natural gas in the EU, at above 97% as of late November, are expected to reduce the risks of shortages and cap European natural gas prices.

European natural gas price declined by 68% in the first 10 months of 2023 year-on-year

Source: Euromonitor International from World Bank

Efficiency gains, demand cuts and accelerated green energy rollout have also helped to reduce Europe’s dependence on gas. Moreover, weather forecasts for the upcoming winter season predict warmer-than-average conditions in Europe, according to the Copernicus Climate Change Service.

Nevertheless, the possibility of extreme weather conditions, such as cold snaps or heatwaves later in the year, could elevate the demand for heating and cooling, thereby leading to an increase in gas prices. Unexpected production and trade disruptions could also place upward pressure on natural gas prices compounding recent challenges in global gas markets, such as the Baltic Connector gas pipeline damage, the closure of the Tamar gas field in Israel, and the shutdown of the Groningen gas field in the Netherlands.

Agrifood market outlook improves on favourable supply projections

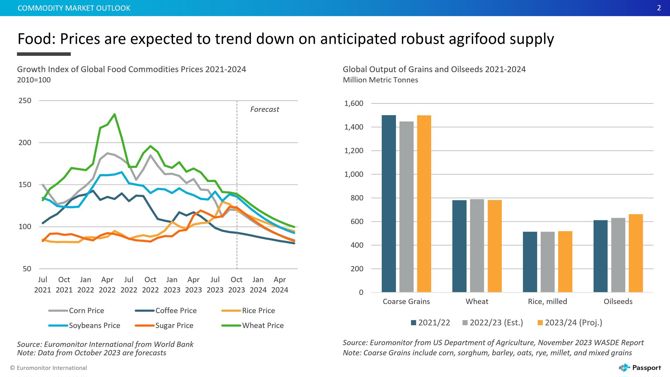

Average prices of food commodities are projected to continue moderating into 2024, helped by an improved outlook for grain supply, particularly soybean and corn. According to Brazil’s National Supply Company (CONAB), the soybean planting area in Brazil is expected to rise by 2.5% in 2023/2024, resulting in a record soybean harvest. Meanwhile, ample corn supply is expected to be driven by larger output in the US on better-than-expected yields.

On the other hand, the development of El Niño weather pattern, which can cause extreme weather events ranging from drought to flooding, is a major factor that may negatively affect agrifood output and uplift prices. For example, unusually dry weather in India and Thailand has recently damaged sugar harvests, leading to global shortages and driving sugar prices to a 12-year high. Meanwhile, Australia witnessed its driest October in over 20 years, leading to diminished crop yields in one of the world’s major wheat-exporting nations.

In addition, energy supply disruptions and price volatility could drive up farming production costs, including transport and fertilisers, leading to higher food prices and increasing the risks of global food insecurity.

Metal prices to remain stable in 2024 but long-term supply imbalances grow

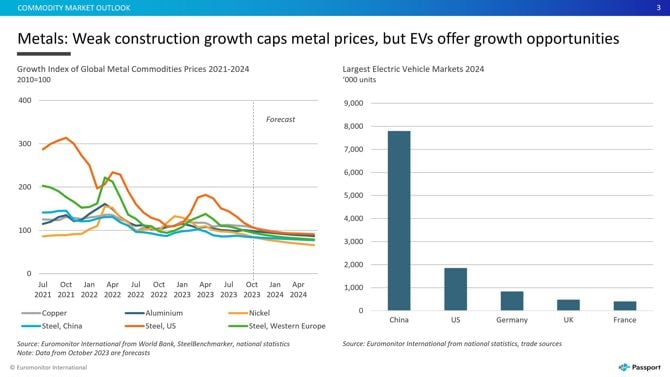

Prices of key industrial metals are forecast to remain stable in Q4 2023 and 2024.

Slower economic growth in China and ongoing real estate market problems to a large extent cap price growth of industrial metals

Source: Euromonitor International

According to national statistics, real estate prices in China continued to decline in September 2023 and more than 50% of the real estate projects are expected to face delays. Demand for housing in the eurozone is also predicted to shrink in 2024 as a result of higher interest rates, further limiting global demand for metals.

On the bright side, electric vehicles will continue to support demand for industrial metals in 2024. Global registrations of battery electric vehicles are forecast to grow by 35% to 13.5 million units in 2024, in turn lifting demand for copper, lithium, nickel, cobalt and other metals used in battery production.

Despite the anticipated metals price equilibrium in 2024, long-term supply risks continue to grow as lower metal prices and higher capital costs hinder investments in capacity expansion. For example, mining company Freeport-McMoRan stated that high capital costs prevent development of new copper mines. Metals used in green energy transition, such as copper, face the highest long-term supply risks and a supply gap could start to widen as early as 2025. Insufficient supply and price hikes would particularly hurt battery, electricity and renewable energy industries.

Learn more about developments in global commodities markets in our report, Global Trends in Commodities Market. And read our recent Global Economic Outlook: Q4 2023 to assess how the diverse global economic development may affect the commodities market dynamics across different economies.