For consumer appliances, inflationary pressures have been ever present since the second half of 2020. Considering 2020 now, it is difficult to remember that companies decided to vastly reduce production when they realised the full scale of the COVID-19 pandemic from Q2.

A subsequent reversal of consumer sentiment resulted in record revenue gains in the second half of 2020. This concentration of demand led to severe strains on supply chains, in addition to restricted factory capacity due to lockdowns, and supply chain bottlenecks in 2021. Add the semiconductor shortage to the mix, and the industry had a perfect storm of inflationary factors.

In 2022, new inflationary drivers are originating from pandemic-driven lockdowns in China, which could lead to severe shortages of air conditioners and small appliances. The war in Ukraine will exacerbate the semiconductor shortage, as Ukraine is a leading supplier of argon and xenon, gases used for semiconductor manufacturing.

For consumers, appliance spending in 2022 is expected to be limited to replacement rather than upgrade purchases.

Inflation in appliances might be sticky

Historical findings have shown that inflation in appliances tends to stick. Evidence in the US market shows that previous price increases during inflationary periods are not reverted completely once inflation tapers down. A minimum increase of 20-30% usually remains for major appliances. However, it must be noted that this was before the period of hyper efficient globalised supply chains, an inflation dampener.

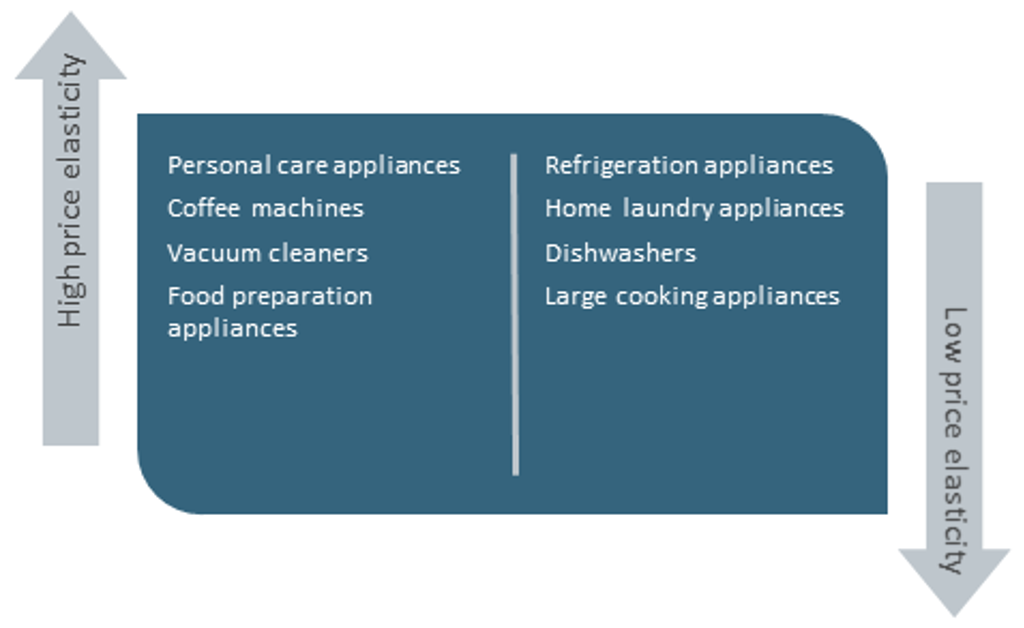

Companies with established brands can be expected to have a better pricing power in this environment. Most major appliances are bought as a distress purchase. When an appliance breaks down, consumers focus on immediate replacement and typically go for established brands. Established brands are preferred due to better brand recall, perceived quality, and wider availability. Therefore, availability and brand reputation is typically prioritised over increased prices. There’s only so many days you can do without a washing machine.

In a typical year, the major appliance replacement purchase is about 60%-70% of industry sales. This year, this rate is expected to go up due to consumer’s higher usage of appliances, which remain elevated well after consumers have emerged from lockdowns.

For small appliances, the reverse can be true for most cases. The urgency to replace a small appliance when it breaks down is much less. In an inflationary environment, this gives consumers the time to consider trading down, changing brands, or even waiting for discounts. For consumers who are price sensitive, it then makes sense to make purchase decisions based on pricing rather than availability.

How much pricing power do appliance companies have in an inflationary environment?

Elevated input costs will result in SKU rationalisation

Elevated prices of commodities will continue to drive inflation well into 2023. Another significant driver of inflation will continue to be the semiconductor shortage, which has led to companies focusing on higher margin products. This shortage has now been exacerbated by a shortage of gases used for chip manufacturing, such as argon and xenon, because of the war in Ukraine. The chip shortage is now expected to last until 2024.

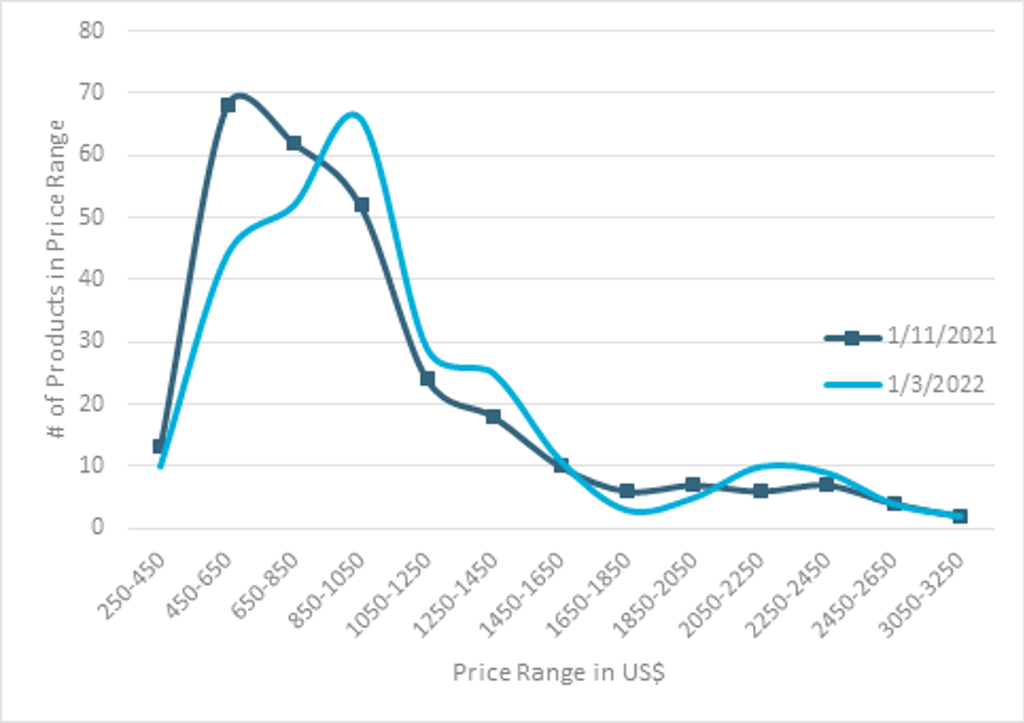

With a shortage of chips and high input costs, companies are prioritising high priced products. To better illustrate this point, Euromonitor International conducted a price check on a basket of dishwashers from major brands on 2 dates, November 2021, and March 2022. While it is not surprising to see that average prices have shifted from USD985 to USD1,072 and median prices from USD849 to USD944, it is noteworthy that the price range has shrunk from USD296-USD3,099 to USD359-USD3,099, meaning lower-end product prices have increased, whereas high priced items have largely remained the same.

Price comparison for dishwashers from major US retailers

Source: Euromonitor International

E-commerce companies may help reduce inflation

Globally, e-commerce companies have played an inflation negating role on many industries. Consumers, armed with the ability to compare prices across retailers, have tended to buy the cheapest available option, putting pressure on retailers to reduce prices. Retailers are struggling to profit accordingly.

In 2021, Chinese e-commerce giants JD and Tmall saw appliances as one of their next big growth drivers. In 2020, online sales of appliances, both major and small, exceeded those in retail stores.

In partnership with major appliance brands, both companies conducted campaigns with promises of RMB10 billion (USD1.5 billion) in rebates. E-commerce platforms are working closely with appliance companies to make the purchase of small and major appliances online frictionless.

They are currently focusing on sales of major appliances with free delivery, no-questions-asked returns, and flexible consumer credit. Companies such as Alibaba, JD and Pinduoduo are also partnering with retail chains to expand their offering.

What to expect for the rest of the year?

COVID-19 lockdowns in China will be a key contributory factor to appliance inflation in 2022. China accounts for 60-70% of global production capacity, with ACs (50%), refrigerators (35%) and small appliances (30%) the top three categories. Additionally, copper prices will remain elevated, as new-energy industries compete for the same commodity.

High oil prices will also make it expensive to ship products that are manufactured in China to the rest of the world. The semiconductor shortage is expected to continue, as Ukraine previously supplied more than half of the world’s neon gas, which is crucial for semiconductor production.

The selection of cheaper entry level appliances is expected to be limited, as inflation results in companies focusing on high-margin high priced items. Consumers will be forced to buy more expensive models even as inflation makes these models even more expensive.

Prices are likely to remain high in 2022, despite a demand slowdown as major production centres, such as Turkey (lira devaluation impact) and China (COVID-19 lockdowns), face uncertain macroeconomic conditions.

For consumers, appliances spending in 2022 is expected to be limited to replacement rather than upgrade purchases as most continue to struggle with the rise in living expenses.