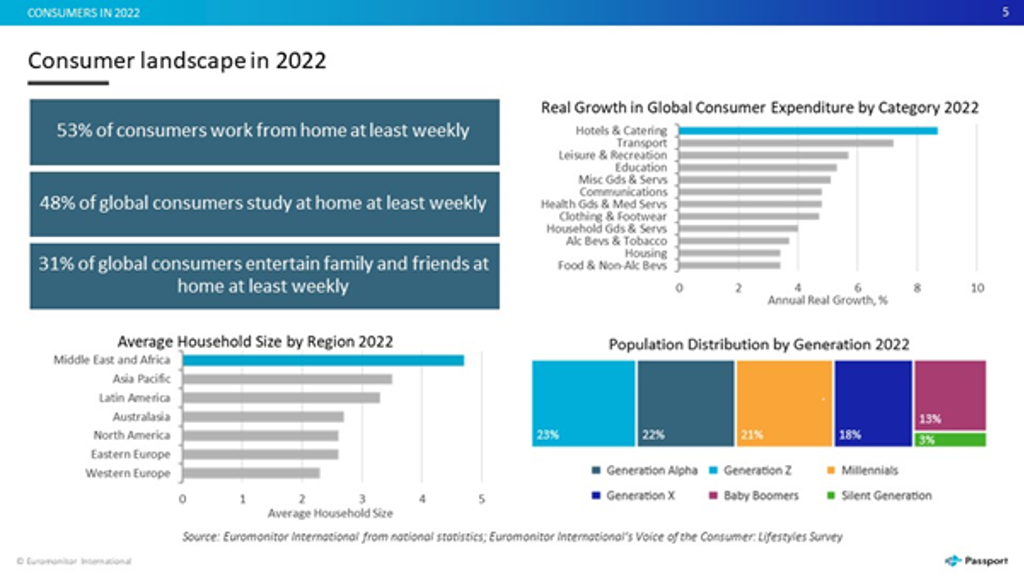

The consumer landscape of 2022 will be characterised by a strong rebound in consumer expenditure on hotels and catering, transport, and leisure and recreation, as pent-up demand is released. Global consumer expenditure is set to grow by 4.5% year-on-year in real terms in 2022. Western Europe is expected to lead with the fastest growth in consumer spending, reflecting a recovery in the region’s consumer activity.

Euromonitor International’s report Consumers in 2022 highlights some of the most important trends from the perspectives of population, households, income and expenditure, and lifestyles for the year ahead.

Western Europe to lead with the strongest consumer expenditure growth

In 2022, consumer expenditure in Western Europe is predicted to grow by 5.5% year-on-year in real terms, accelerating from estimated 3.3% real growth in 2021. Western Europe is expected to be the region with the fastest growing consumer expenditure in 2022.

As a region with low levels of income inequality, the middle class is set to remain the most numerous and important consumer base. However, when targeting Western Europe’s middle class, businesses need to keep in mind the shift towards cautious and conscious consumption as a result of middle-income consumers’ efforts to stretch their limited resources, growing awareness of environmental issues, and changing values.

The older consumer group, with rising numbers and relatively strong financial health, is another important consumer segment. In 2022, Western Europeans aged 65+ are expected to enjoy an average gross income of USD47,866 – an increase of 5.5% in real terms over the previous year.

Birth rates fall amidst growing health threats and economic uncertainty

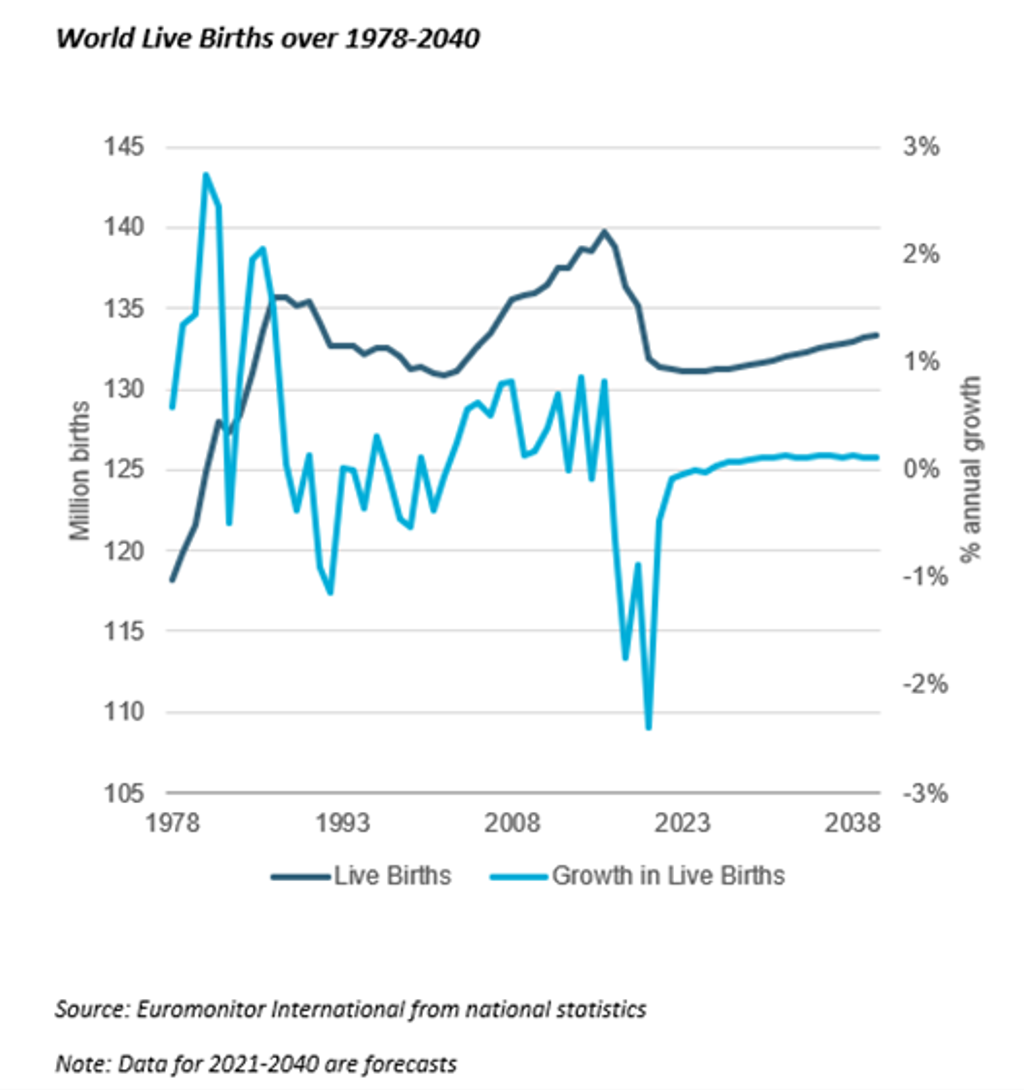

Pandemic-related restrictions on social mobility were expected to lead to higher birth rates over 2020-2022. However, the combined effects of growing financial insecurity, rising unemployment and restricted healthcare services made couples rethink or postpone having babies, and world birth rates experienced the steepest fall since the 1970s.

Stagnant birth rates instantly result in consumers demanding fewer baby- and family-related goods and services; however, the instant effect is usually then prolonged, as once accustomed to the idea, consumers choose to stick to a child-free lifestyle long-term. This means lower tax collections, workforce shortages and greater competition for consumers in the future.

The pandemic exacerbated what has been a long-term structural trend in birth rates. Over 2000-2020, the global birth rate decreased by 21%, led by Latin America and Asia Pacific, and although birth rates are expected to stabilise in Eastern Europe, the remaining regions will see fewer babies born over 2020-2040. Therefore, consumers are also expected to demand fewer family-orientated goods in the long term.

What do consumers want in 2022?

The economic shock of the pandemic has resulted in panic-saving and savvy shopping, but while consumers are looking at ways to reduce their spending and buying more lower-priced items, their focus is on value for money and getting more from their investments. This is accelerating the shift to buying fewer items, but buying better.

In addition, consumers are shifting to alternative means of accessing products and services, saving money or spreading the cost, renting and repairing items, and buying pre-owned.

Emotions are increasingly influencing consumers’ choices, and purchasing decisions are increasingly based on how well a product or service aligns with buyers’ personal values and priorities. Many are willing to pay a premium to achieve this, especially in relation to health and safety, convenience and environmental and social concerns.

Consumers are looking for innovative solutions that help them be the best they can be and make the world a better place, and they want to actively engage with brands to make this happen. Companies that provide a sense of community, inspire, and offer real value at a time when consumers have become more cautious and discerning about their purchases, will appeal.

Purchase our full report, Consumers in 2022, for more analysis.