This article is part of a series on COVID-19 focusing on how the outbreak is affecting industries.

Coronavirus is having an unprecedented impact on consumer markets in China and Hong Kong due to the number of individuals working from home or unable to leave their homes. This has placed a tremendous burden on the infrastructure of e-commerce retailers as consumers look to purchase necessary goods from their home and remain dependent on their country’s delivery infrastructure and supply chains.

With Euromonitor’s new global e-commerce product and price monitoring platform, Via, extracting millions of data points for standardized cross-comparison quickly reveals what product categories are selling out during key periods of the coronavirus outbreak as well as the dramatic implications these demand drivers are having on online retail pricing for select categories.

While China has been able to limit the number of products that are out of stock on e-commerce platforms, Hong Kong’s retailers have struggled to keep online shelves stocked as consumer fears spread. Meanwhile, prices for select products related to coronavirus concerns have seen dramatic increases, in some cases tripling in just a 41-day time period. Viewing daily online pricing and availability figures in these two markets provides a clear understanding of the dynamic market consumers, retailers, manufacturers and governments are dealing with due to this viral outbreak.

How coronavirus is impacting consumer goods

Governments and businesses continue to monitor the coronavirus (COVID-19) outbreak and the impact that it is having on the economy and supply chains. Travel and work limitations continue to be in place following the Chinese government’s decision to extend the Chinese New Year holiday from January 31st to February 3rd, and China is currently dealing with the largest “work from home experiment” it has ever seen. This is placing a tremendous burden on the e-commerce market as consumers are seeking to forego trips to crowded marketplaces in order to receive daily goods and services.

In Hong Kong, the government is also placing restrictions on travel and businesses are limiting commuting for employees. Despite a relatively low number of coronavirus cases, the government is worried and has encouraged businesses to implement work from home policies to avoid unnecessary travel. In both China and Hong Kong, consumers have been largely staying at home with no foreseeable future for when these policies will be lifted.

This unprecedented working situation is having a dramatic impact on the retail landscape. The Chinese government’s National Bureau of Statistics released its latest inflation figures for January and China’s consumer price inflation hit 5.4%, the highest rate since October 2011. While the government is working to prevent price gauging with fines and penalties, there is a challenge with preventing consumers hoarding given the significance of the health scare and the unknown nature of the duration of having to stay indoors. While in Hong Kong there are no official figures for inflation for January, there are several reports of high price gouging and hoarding of particular products due to coronavirus fears.

Using Via to uncover insights

There have been numerous media reports on the impact the virus is having on surgical face masks, with reports of soaring prices as supply struggles to keep up with demand. Despite the media’s focus on surgical face masks, there are numerous other consumer goods that are being severely impacted by the virus as well, and that are having vital consequences on the consumer markets in China and Hong Kong as a whole. Given the inability to travel, e-commerce provides a gateway to understanding the key market dynamics affecting consumers. With Via, daily online pricing and product information from China and Hong Kong can be observed to uncover various insights during this unprecedented period.

Using Via, we were able to quickly and easily examine nearly a million daily data observations between January 1st and February 10th, 2020 across China and Hong Kong. Moreover, the data clearly showed that the availability of selected categories and their pricing dynamics had drastically changed during this period.

For this article, a select basket of daily goods has been chosen for observation based on Euromonitor’s industry knowledge of fast-moving consumers goods in Home Care, Beauty and Personal Care, Tissue & Hygiene and Packaged Food alongside local knowledge from research analysts on the ground in China and Hong Kong reporting on local market supply chain issues. Based on that feedback, the categories of All-Purpose Cleaning Wipes, Bleach, Liquid Soap (including hand sanitizers), Toilet Paper (Recycled and/or Non-Recycled), Rice and Shelf Stable Meat have been selected for observation. While other categories have also seen dramatic price movements, these initial focus categories have been selected for the sake of simplification using feedback from Euromonitor International’s local in-country analysts.

Alongside category scope, the million daily data observations used for this analysis are pulled from 31 online retailers across China and Hong Kong and represent a significant portion of e-commerce availability. All numbers compared are in relation to the sample from these 31 online retailers.

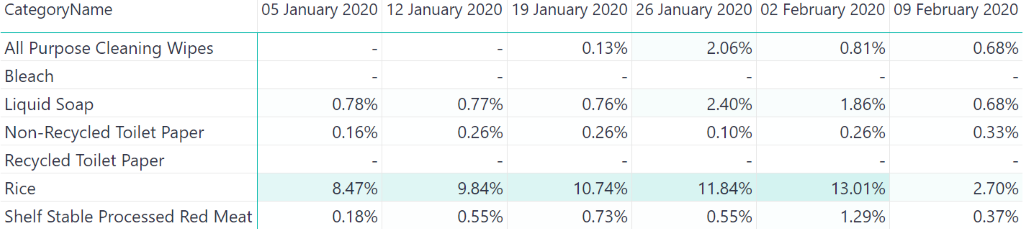

Online product shortages

With the coronavirus outbreak inciting fear of running out of supplies, consumers have flocked to online retailers to stock up while they can. Due to the unusual influx of demand for household supplies, consumers found themselves staring at “out of stock” labels in a handful of product categories. Utilizing Via’s ability to track the online presence of individual Stock Keeping Units (SKUs), the number of products sold online that are out of stock as reported by the retailer can be analyzed and cross-compared. Based on the basket of goods selected for comparison, the online availability of products in China versus Hong Kong is drastically different. With China’s vast and diversified e-commerce market, the percentage of online out of stock products peaks at 13% for rice during the week of 2 February. Meanwhile, necessary cleaning supplies and daily household items see an increase in the percentage of out of stock SKUs throughout the time period but predominantly fall back to normal levels in the last week of analysis.

China - “Out of Stock” Items as a % of Available Online SKUs

[caption id="attachment_60510" align="alignnone" width="779"]

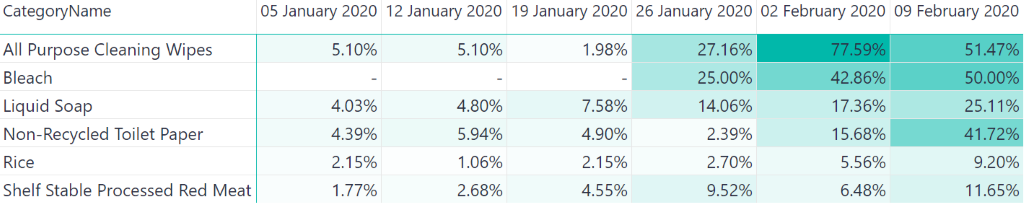

Hong Kong, however, presents a drastically different picture and the densely populated and import-dependent market has been severely impacted. As seen below, while all product categories have less than 8% out of stock items for the first three weeks of analysis, in the last half of the time period under observation out of stock items surge across all categories to over double digits with the exception of rice. All-purpose cleaning wipes is the category most impacted with nearly 80% of all SKUs reported as out of stock at one point during the week of 2 February.

Hong Kong - “Out of Stock” Items as a % of Available Online SKUs

[caption id="attachment_60511" align="alignnone" width="805"]

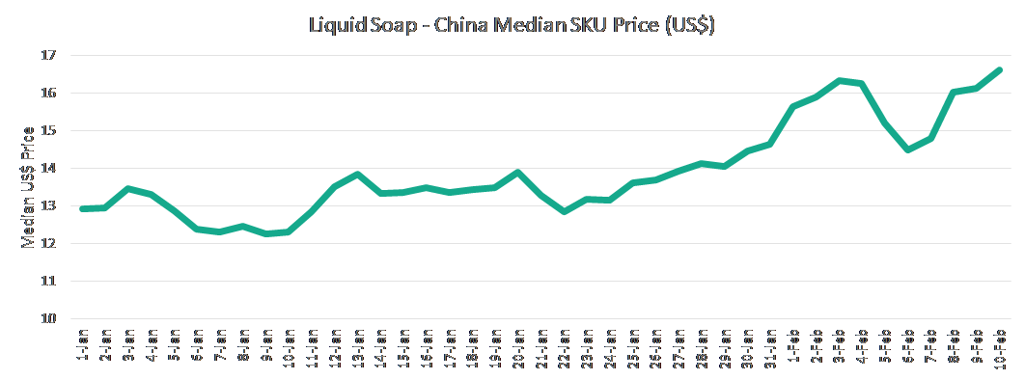

[caption id="attachment_60518" align="alignnone" width="1155"]

Overlaying the out of stock figures above on the dramatic events unfolding in China and Hong Kong below, it is clear to see the impact the news regarding coronavirus is having on the public’s rush on items that are deemed important for use or consumption during this period of staying indoors. In particular, the events of the confirmed cases outside of China on 20 January, the WHO declaring a health emergency on the 30 January and the first death outside of China on 2 February all accelerated the rush on goods in Hong Kong and left retailers and suppliers struggling to adapt.

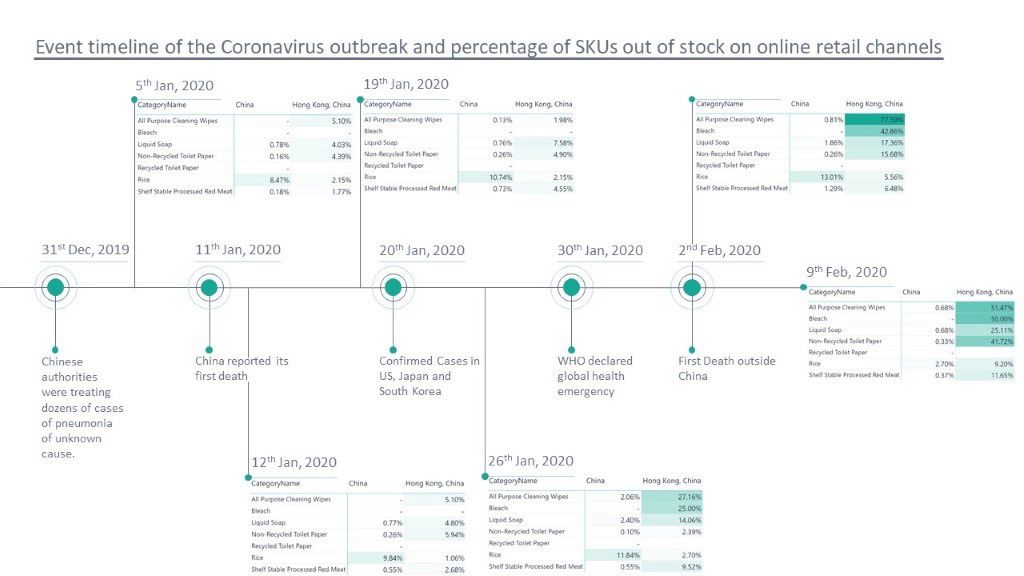

Chinese market pricing dynamic

The surge in demand for these products and the limited availability of categories explained above have all had a drastic impact on the pricing of the select basket of goods under comparison. All products under observation in Via’s coverage since the beginning of the year have seen online retail price increases as consumers, retailers and manufacturers struggle to adapt to this changing landscape. Liquid soap best represents the pricing movement seen across our selected products from the beginning of the coronavirus outbreak.

Analyzing over 64,000 liquid soap SKUs across 21 e-commerce retailers for the 41-day time period in China, there is a strong upward price movement. Starting with a median price of US$12.94 on 1 January, the category’s median price per SKU fluctuates but remains between a US$12 and US$14 window until 28 January. However, as news of coronavirus continues to worsen consumers stock-up on items which in turn leads to price increases. On 23 January, the city of Wuhan and its 11 million citizens were officially put on lockdown by the Chinese authorities and the severity of the situation increased. In the chart below, around this time there is a dramatic rise in prices, breaking the $14 price ceiling on 28 January and continuing to a high of US$16.33 on 3 February. There is a pricing correction downward until the 6 February but then the category continues its steady median SKU price increase as consumers continue to demand the product due to health concerns and safety recommendations of increased hand washing.

[caption id="attachment_60513" align="alignnone" width="813"]

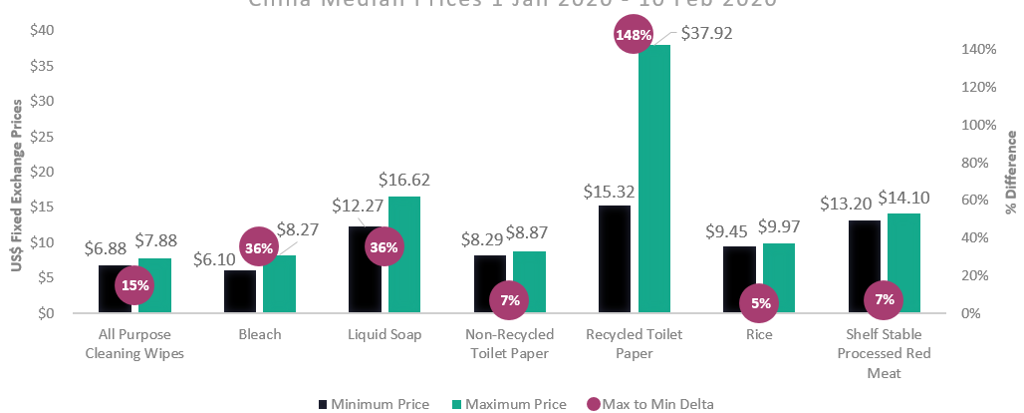

While all products under observation show similar online price increases between 1 January and 10 February 2020, viewing the categories all together clearly highlights there is a great difference between categories that show a significant change in their maximum and minimum median price over the selected time period. In turn, this showcases the government’s challenge in reining in prices for select categories. In the chart below, there was a 36% median price difference between liquid soap’s maximum and minimum price. The category that showed the largest fluctuation during the time period was recycled toilet paper, with its median maximum price 148% larger than its minimum median price during the 41-day time period. Given that the recycled toilet paper market in China is significantly smaller in volume than more common non-recycled toilet paper, this is likely a result of affluent consumers willing to pay for the daily luxury and suppliers/retailers struggling to stock the product. “Regular” toilet paper, however, only sees a 7% difference indicating the government and the business infrastructure’s effective ability to keep prices for daily essential items relatively stable.

The same can be shown for rice and shelf-stable meat with respective differentials of just 5% and 7%. The 5% differential for rice closely mirrors the government’s official January inflation figure of 5.4%. Meanwhile, bleach and all-purpose cleaning wipes show drastic price differentials similar to liquid soap with a maximum to minimum median price differences of 15% and 36%, respectively. Given the importance of these products in their ability to reduce infection, the government, leading suppliers and e-commerce retailers will need to carefully monitor median prices and look for ways to reduce demand and increase supplies to bring down such large price fluctuations.

[caption id="attachment_60514" align="alignnone" width="883"]

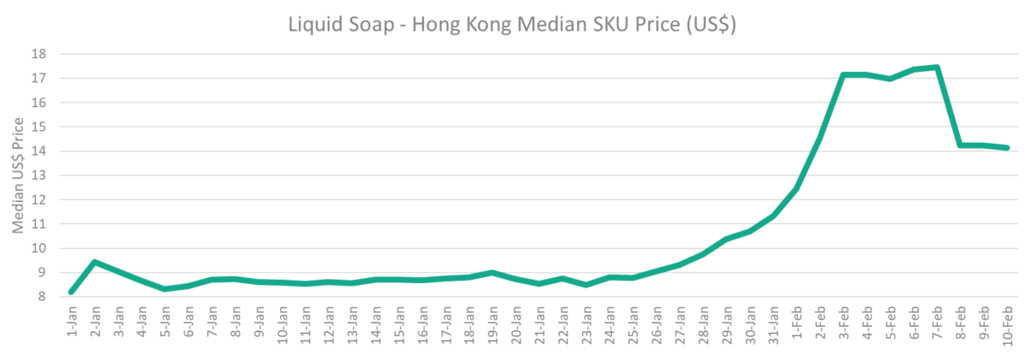

In Hong Kong, many of the same observations and trends are true but at a much more profound and accelerated impact due to the challenges of product availability as discussed previously. In the case of liquid soap in Hong Kong, between the period of 1 January and 28 January, the median price per SKU falls between a US$8 and US$10 window. As the region struggled to contain the outbreak and more infections continued to rise, the need for liquid soap intensified and, as seen below, the median category price exponentially accelerates from 23 January at US$8.49 to 3 February at US$17.14. Following this strong median price increase, the median price plateaus for 5 days before decreasing to around US$14.

[caption id="attachment_60515" align="alignnone" width="883"]

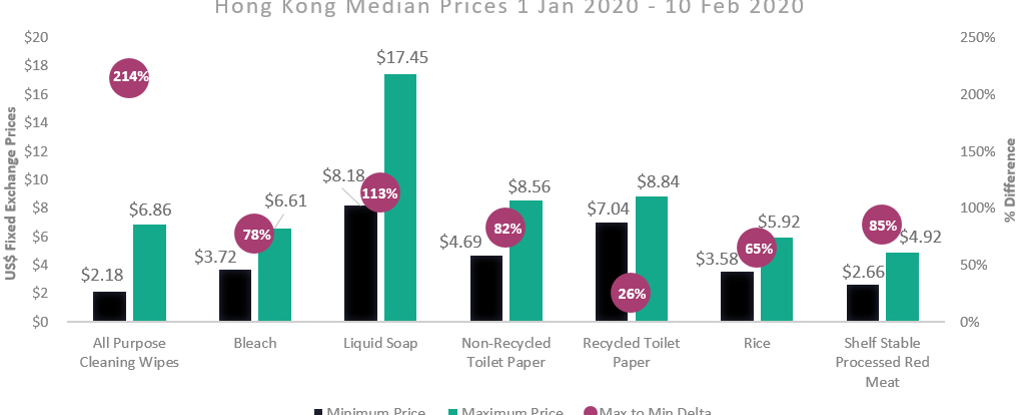

Examining the overall differences between the maximum median price to the minimum median price during this time period indicates much stronger price fluctuations in Hong Kong compared to China. Whereas the difference between the maximum median price and the minimum median price of liquid soap in China was 36%, in Hong Kong during the same time period it was 113%. All the categories under observation show double-digit price differences during this 41-day time period. All-purpose cleaning wipes saw the largest pricing differential of 214%. More alarming is the price differential for essential everyday goods of toilet paper, rice and shelf-stable red meat.

[caption id="attachment_60516" align="alignnone" width="640"]

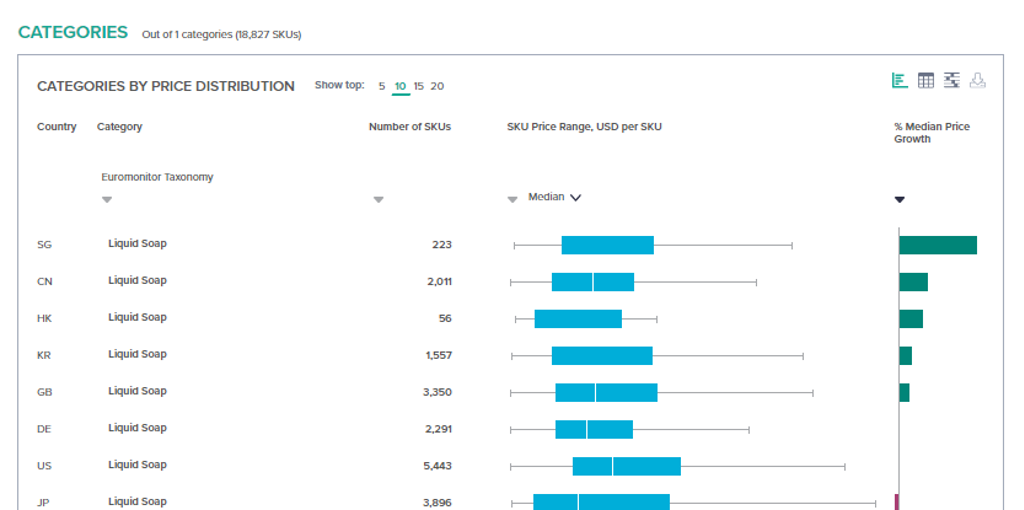

A window to uncovering global e-commerce insights

As China, Hong Kong and the world struggle to adapt to the ever-changing business and retail environment brought on by the coronavirus outbreak, understanding online product availability and price dynamics for everyday products uncover key insights in the market and how countries are dealing with the crisis. While this article focuses on just two countries and a narrow basket of products, Euromonitor’s Via provides access to 11 fast-moving consumer goods industries, more than 1,500 e-commerce retailers and 40 countries, with like-for-like standardized comparisons in an interactive dashboard as shown below.

[caption id="attachment_60517" align="alignnone" width="640"]

To see Via in action and learn how it can help refine your pricing, promotion and innovation strategy, request a demo.