This article is part of a series on COVID-19 focusing on how the outbreak is affecting industries.

Chinese and multinational companies are starting to feel disruption in their supply chains as the coronavirus continues to spread; the Chinese government extended the shutdown of factories and businesses, and airlines canceled air routes in and out of the country.

Production disruptions would largely affect household goods, hi-tech goods and textile industries where China plays a core role in the global supply chain. Production disruptions in these industries would have an adverse effect on the global supply chain as companies would struggle to find alternative suppliers.

China’s production share in selected industries, 2018

| Industry | % Share of Global Production in China, 2018 | Industry’s Exports Share, % of total 2018 | Impact on Global Supply Chain |

| Household Goods | 35% | 33% | High |

| Hi-tech Goods | 46% | 27% | High |

| Textiles and Apparel | 54% | 23% | High |

| Machinery | 38% | 14% | Moderate |

| Rubber and Plastic | 38% | 8% | Moderate |

| Pharmaceuticals and Medical Goods | 29% | 8% | Moderate |

| Chemical Products | 42% | 7% | Moderate |

Source: Euromonitor International

Hi-tech goods are likely to be one of the most-affected industries as China remains the world’s largest producer and exporter. Several multinational companies have already been affected. For example, Apple shortened working hours in its stores across China and issued a warning that supply chain disruption might also affect operations in other countries. China remains the largest manufacturer of iPhones, thus factory closures could hurt Apple’s plans to increase smartphone production.

Automotive is another sector which is likely to be adversely affected. For example, Volkswagen Group, one of the largest players in China, asked 3,500 of its employees in Beijing to work from home for two weeks. BMW, Tesla and Jaguar Land Rover also announced that the virus outbreak might hinder their everyday operations in China. As an indirect effect, car companies would also suffer from reduced production output in hi-tech goods, plastics and chemical goods industries, which are among the industry’s core suppliers.

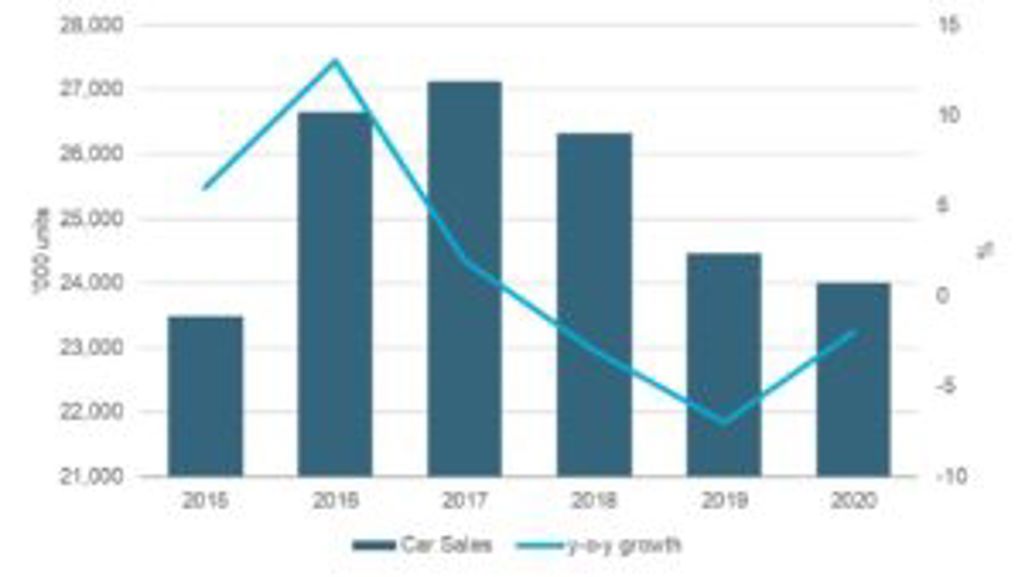

Overall, car manufacturers in China could reduce their production output by 15% during the first quarter of 2020. In response, automotive suppliers such as Bosch, Magna International and Nvidia also plan to scale down production volumes. Moreover, car sales in China are predicted to suffer as consumers feel less confident. The Chinese new car market was predicted to decline by 2% in 2020, although the losses are likely to be more extensive due to ongoing uncertainty and the dent in the profit margins of car companies.

Car Sales in China, 2015-2020 (Forecast)

Source: Euromonitor International

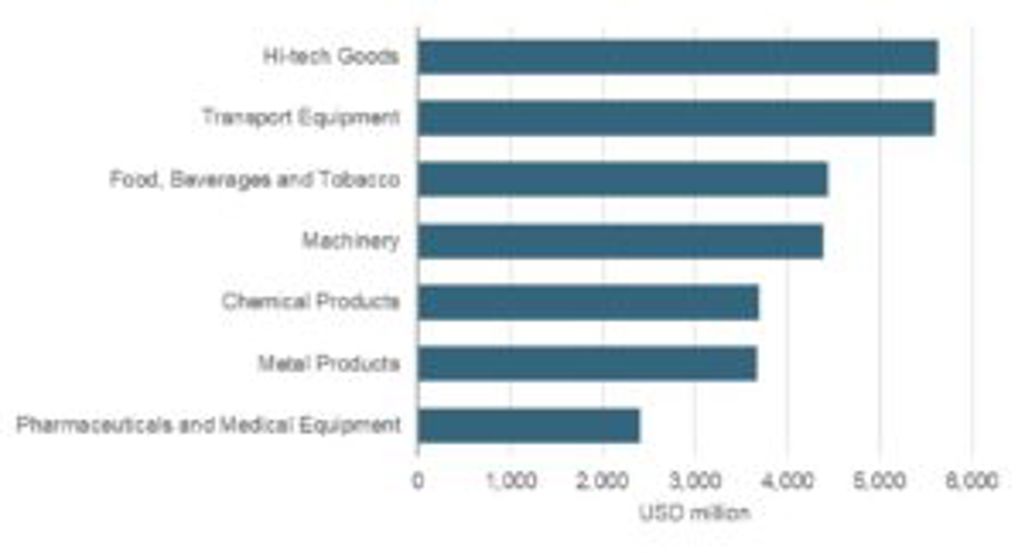

Besides manufacturers, air transport is also expected to feel the impact as large carriers, including British Airways and Lufthansa, stopped their flights to China. Cancellation of air routes to China may also have an adverse effect on global supply chains. Air transport remains among the key transportation modes for fragile, perishable or high-value goods which require quick delivery. Disruption of air travel would largely impact chemical products, pharmaceuticals, hi-tech goods and machinery industries. The final impact is currently difficult to quantify as the crisis is only beginning to unfold. However, if the air travel bans remain prolonged, businesses in both China and abroad might start feeling the shortage of goods such as pharmaceuticals, as accumulated stocks deplete.

Largest B2B Buyers of Air Transport Services in 9 Largest Economies*, 2018

Source: Euromonitor International

Overall, the coronavirus outbreak has already impacted global manufacturing and transportation industries. The impact on manufacturing industries could be compared to the outbreak of SARS virus back in 2003 when transportation, medical and hi-tech goods industries were disrupted. However, since then, the global supply chain has evolved and China’s role in global industry increased, thus the final impact on industries will depend largely on companies’ capabilities to find alternative suppliers and the success of governments across the world to contain the virus outbreak.

Note*: Demand value includes aggregated data from Brazil, China, France, Germany, India, Japan, Russia, United Kingdom and the US