The Coronavirus (COVID-19) pandemic has brought the largest peacetime economic recession since the 1930s. We forecast that the global economy will contract in the range of -5.5 and -3.5% in 2020. To support economies through this downfall and aid future recovery, governments have had to implement record-breaking fiscal policies. However, this support will skyrocket public debt.

Advanced economies have the highest debt levels in 75 years and emerging economies do not have as many monetary policy tools as advanced economies to deal with the potential debt crisis, which creates vulnerabilities for future recovery. Tackling global public debt levels is likely to be one of the key economic policy concerns for years to come.

Global debt levels rise while potential downside risks loom

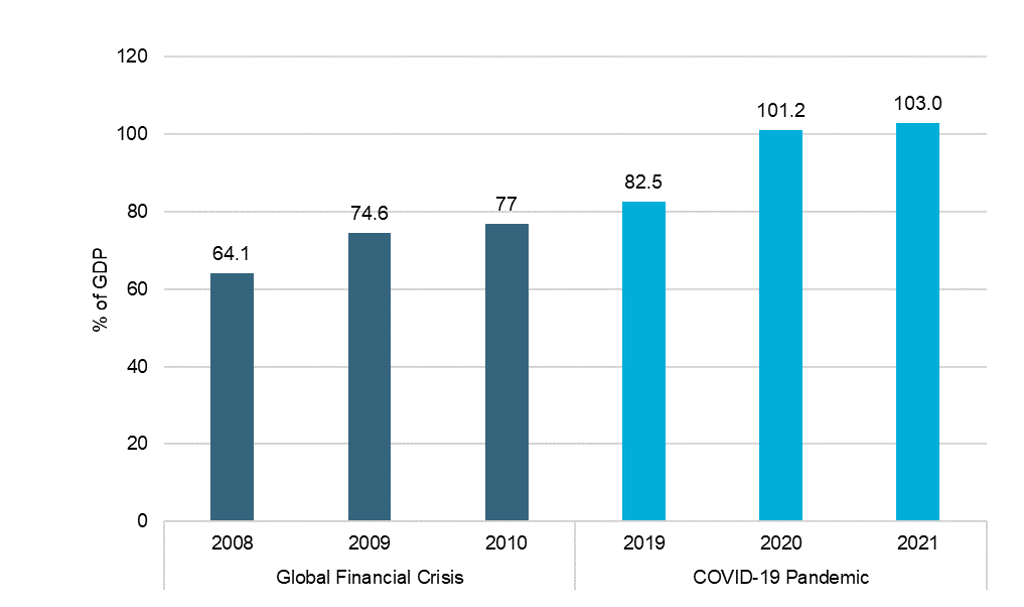

The International Monetary Fund (IMF) estimates that as of July 2020, globally fiscal stimulus measures amounted to USD11 trillion. This corresponds to 12.6% of global GDP in 2019. In 2020 and 2021, during the COVID-19 economic recession, public debt as a percentage of GDP is expected to grow by 20.5 percentage points while during the Global Financial Crisis (2008-2009) it grew by 12.9 percentage points from 2008 to 2010.

Global Public Debt as a Percentage of GDP 2008-2010/2019-2021

Source: Euromonitor International from International Monetary Fund (IMF). Note: Data for 2020 and 2021 are forecasts.

The current economic outlook has potential downside risks: a global second wave of COVID-19 and a potential financial crisis. Moreover, most economic forecasters’ models expect economic rebounds in 2021 and implicitly assume that a vaccine from COVID-19 will be made available. Setbacks in COVID-19 vaccine development could further prolong the economic downturn.

In case of these risks materialising, governments around the world would have to raise spending on unemployment insurance and income support transfers and increase fiscal stimulus to aid their economies. This would further exacerbate government deficits which would lead to even higher increases in public debt.

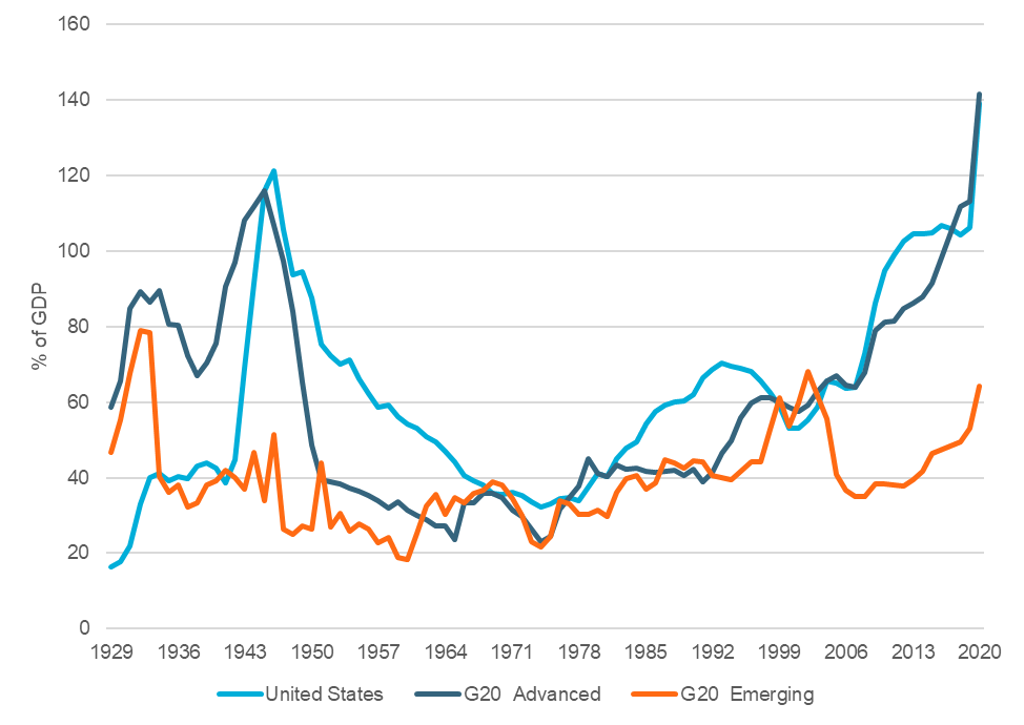

G20 public debt to surpass WWII levels

Advanced economies in G20 will record up to 141% of GDP public debt in 2020 - above the 116% seen at the end of WWII. Governments after WWII were able to reverse the rise in debt burdens. However, the economic situation looked quite different then. In the US, high inflation rates and capital controls were some of the factors that helped the country control its debt. During the Global Financial Crisis of 2008-2009 governments used quantitative easing, austerity measures and cuts in public spending.

Now, due to low real interest rates, high public debt is not as threatening in developed countries, compared to the developing world. However, debt level is at a record high and due to ageing populations and rising savings rates, advanced economies are struggling to increase inflation which could alleviate their debt burden.

Public Debt as a Percentage of GDP: 1929-2020

Source: Euromonitor International from International Monetary Fund (IMF). Note: G20 Advanced includes advanced economies from G20. G20 Emerging includes emerging economies from G20. Data for 2020 are forecasts.

Emerging markets are in a fragile position to deal with skyrocketing debt

Advanced economies largely borrow in local currencies and use quantitative easing programmes to support low, or even negative, interest rates which limit the adverse impact of high public debt on economic growth. However, emerging economies do not have these tools placing them in a poorer position to address the looming debt crisis. Emerging economies from G20 will record debt levels of around 64.1% in 2020 - comparable to 66.9% seen in 2003 - which is the largest since 1935. In 2021, G20 emerging economies’ debt as a percentage of GDP is likely to surpass the 2003 level.

Countries in Latin America are especially vulnerable - they entered the COVID-19 recession without fully recovering from the 2014 recession caused by a slump in commodity prices. Their debt levels were already high and now the region is one of the epicentres of the COVID-19 pandemic worldwide. The region’s public debt is expected to rise from 68.0% of GDP in 2019 to 78.9% in 2020.

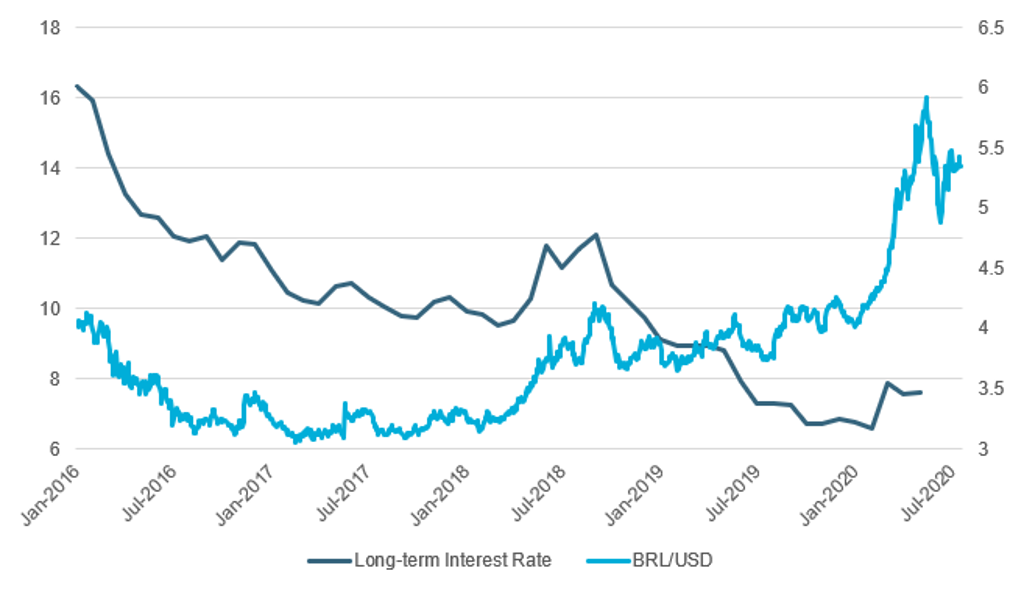

Argentina, which saw its economy contract in real terms since 2018 - even before the COVID-19 pandemic - already defaulted on its bond payments in May 2020. Furthermore, Brazil will see its public debt surpass the country’s 2020 output as the debt to GDP ratio is expected to rise by around 13 percentage points in 2020. While long-term interest rates for Brazil are less affected by the COVID-19 pandemic and continue their downward trend, the Brazilian real has already sold off by more than 30% since the beginning of 2020.

Brazilian Long-term Interest Rates vs Brazilian Real - US Dollar Exchange Rate: January 2016- July 2020

Source: Euromonitor International from national statistics/OECD, Board of Governors of the Federal Reserve System (US)