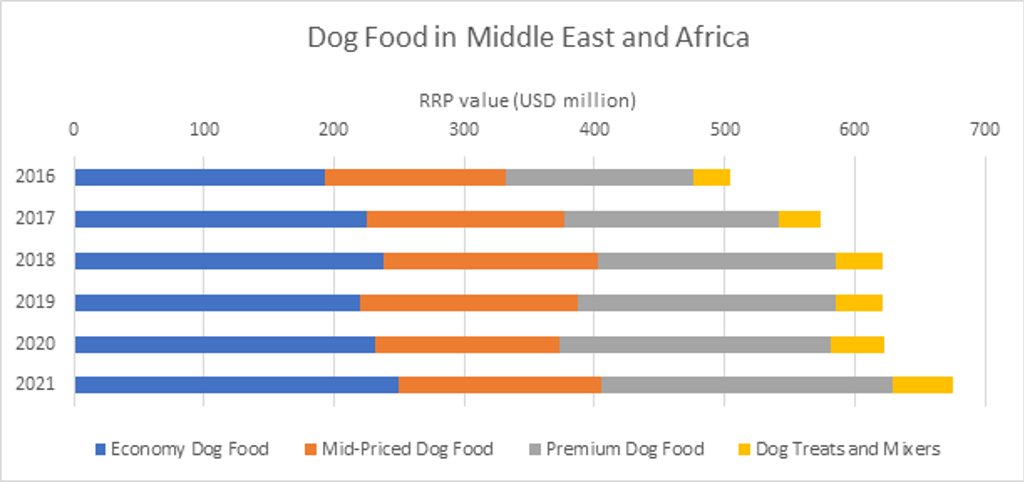

Emerging Market for Dog Food in Middle East and Africa

Despite being the smallest market, Middle East and Africa posted strong growth over recent years, given the religious and cultural background of the region. Many countries in the region are dominated by the Islamic religion, which strongly prohibits dog ownership under Islamic law. The market is therefore largely untapped due to the historic restrictions, but increasing acceptance and adoption of dogs as pets is expected to significantly expand the size of the dog population over the forecast period. The COVID-19 pandemic boosted dog adoption as consumers looked for companionship when movement and social gatherings were prohibited. The increase in the dog population is therefore expected to drive up volume and value sales of dog food in the region.

Changing attitudes towards dog ownership a boost for dog food

Dog ownership in the Middle East was historically very low, not only because of cultural restrictions, but also due to the hot climate and small living spaces making it challenging to own a dog. Social media has been playing a pivotal role in the rising adoption rates in the Middle East as influencers posted about themselves adopting a dog during the pandemic and their followers then followed suit. The dog population in Middle East recorded 5% year-on-year growth in 2020 and 2021, with large breed (20 to 50lbs or 9 to 23kg) dogs dominating the pet population. In South Africa, dogs had primarily been kept for safety reasons, but, in recent years, the perception of dogs has been changing from guard dog to “heart dog”. Large breed dogs dominate the dog population in South Africa, for example, but small (up to 20lbs or 9kg) and medium-sized (20 to 50lbs or 9 to 23kg) breed dogs have been seeing stronger growth in 2020 and 2021. These figures indicate that owners in South Africa are choosing smaller pets, as they need less space and can easily live in apartments. Globally, we are seeing Millennials and Generation Z consumers emerging as the most prevalent pet owners. Regionally, this trend is also emerging, as the change in pet ownership reshapes the market.

Humanisation and premiumisation widespread as education and awareness increase

Prominent global trends like humanisation and premiumisation are more prevalent thanks to increasing consumer education and awareness. Despite difficult financial conditions brought on by the COVID-19 pandemic, dog owners continue to humanise their dogs. While South African pet owners were trading down to economy brands due to financial constraints, they were supplementing the dry food with wet dog food, mixing the two together to make it “tastier” for their dog, which is typical humanisation behaviour. This new trend boosted growth for economy dry and wet dog food in South Africa. Dog treats are growing in popularity across the region as owners want to spoil their animals and offer them more than just dog food. Long working hours mean that when owners arrive home, they want to compensate for their long absence by giving their dogs extra special treatment. Increasing humanisation means that owners want to reward their dogs by giving them treats like they would to children.

Premiumisation continues to gain momentum across the region. As education improves, consumers who can afford it buy more premium dog food to ensure the health and wellness of their dog. Furthermore, consumers believe that by feeding their dogs more premium food they will live longer, therefore dog diets have been geared towards longevity and health to ensure their pet is around for a long time. Pet shops in the United Arab Emirates have capitalised on the popularity of ethical and health and wellness dog food products. Pet’s Delight, for example, has opened a new store with an in-house pet nutritionist.

Pandemic significantly boosts e-commerce

The distribution of dog food in the region is dominated by supermarkets and, to a lesser extent, pet shops. However, e-commerce grew in importance as a distribution channel for dog food during 2020, and this trend is expected to continue accelerating during 2021 and beyond. Consumers are becoming more comfortable shopping online, and investment in this channel by the likes of internet retailer Jumia and grocery retailer Carrefour is deepening. Brands are also investing in e-commerce by creating their own online platforms, like Bob Martin in South Africa and Royal Canin in the United Arab Emirates. Specialised online platforms are becoming increasingly popular and attracting dog owners with continuous offers on dry dog food brands. As consumers resume their busy lifestyles post-COVID-19, automation of pet food will become more important. The nature of dog food makes it ideal for automation through subscription models via e-commerce platforms. Delivery of dog food to the consumer’s doorstep every month is very convenient for time-poor consumers. Furthermore, automated/subscription models are secured business for retailers, which could allow them to offer discounts to cash-strapped consumers. Amazon’s Subscribe & Save programme has been a pioneer in this area in Western markets like the US, which offer consumers a 15% discount for automated deliveries.

As an emerging market, dog food in the Middle East and Africa holds great potential as changing attitudes towards dog ownership boost the demand for dog food in the region. Humanisation and premiumisation trends are expected to intensify, which will create more opportunities for brands to meet consumer demands. By leveraging the growing demand for convenience, e-commerce platforms could offer automation of dog food orders and secure monthly revenue, which is a win-win for all.