The alcoholic drinks industry is going to have to adapt, as Qatar – a small conservative Islamic Arab emirate – will become the epicentre of the global sports community, as it is set to host the 2022 FIFA World Cup in Doha. This brings challenges for drinkers keen to imbibe, as at present access to alcoholic beverages is restricted to non-Muslims, whether tourists or local expatriates, according to local law.

Regarding the off-trade, Qatari law stipulates that only liquor license holders that meet a certain income threshold are permitted to purchase alcoholic drinks, and even so, identification upon purchasing is required, as selling to Qatari Muslims is forbidden. Qatar Distribution Company (QDC), a subsidiary of Qatar Airways, owned by the Qatari government, is the only permitted importer and seller of alcoholic drinks. Regarding the on-trade, beverages are only consumed in a select few bars and some restaurants within hotels.

However, alcohol consumption is anticipated to grow as inbound tourist arrivals to Qatar will inevitably be accompanied by an increase in both off-trade and on-trade retail sales, as many flock to the Gulf emirate. Sales via e-commerce will be facilitated, as QDC has successfully launched its own website to ease purchasing. Looking at a slightly more liberal drinks market in the Middle East, such as the United Arab Emirates, per capita consumption is nearly 50% higher than that of Qatar. This is unlike more conservative GCC markets such as Kuwait and Saudi Arabia, where no legal alcohol consumption occurs outside of diplomatic compounds.

Inbound arrivals for FIFA World Cup 2022 act as a catalyst for alcoholic drinks growth in Qatar

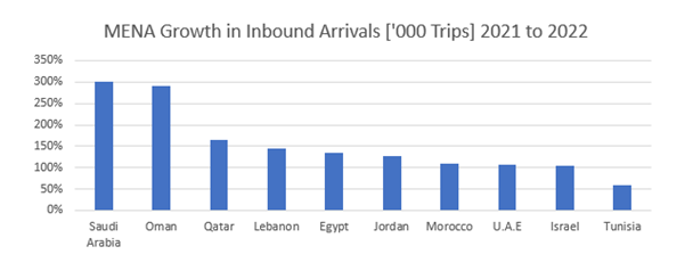

Across the region, Qatar is expected to rank third highest for percentage growth in inbound arrivals in 2022. The emirate is expected to see an estimated influx of 1.4 million people. These arrivals will not only boost both regional and country consumption of alcoholic drinks in the retail segment, but will also positively impact the consumer foodservice industry, with estimated 4.7% growth between 2021 and 2022, as consumers dine in chained restaurants, hotels, and other foodservice establishments. Qatar will consequently lead total volume growth in million litres regionally, with the strongest growth seen from its largest category, beer, which dominates with 75% of retail volumes. At present, the consumption of alcoholic drinks on-trade is limited, with the options available for consumers heavily restricted to sports bars and restaurants within 4- and 5-star hotels, airport lounges, as well as the emirate’s airline, Qatar Airways.

How will the Qatar World Cup affect alcoholic drinks globally?

The uniqueness of the 2022 FIFA World Cup means that it is the first to ever take place in the Middle East – with previous competitions held in Europe or Latin America. The spectacle might not radically change the alcoholic drinks landscape in Qatar, but it does have the potential to boost sales of alcoholic drinks globally at a time of severe macroeconomic headwinds.

The event will also coincide with advertising opportunities for Budweiser, The Coca-Cola Company and McDonalds, which are the main food and beverage partners of the World Cup. MENA has hosted sporting events in the past, with others upcoming, such as the World Heavyweight Boxing in Jeddah, Saudi Arabia, and the F1 Grand Prix in Abu Dhabi, UAE. The region is hence increasing its role as a host of global sport. Ultimately, what matters most for Qatar is to leave consumers reminiscing – as sport brings with it the creation of memories (as well as drinking opportunities). Hayya Hayya (Better Together), the official FIFA Qatar soundtrack, signifies the desire to cater for consumers arriving from all corners of the world – where the majority will expect alcohol – while also upholding sacred laws. Only Qatar itself will know how best to strike this balance.

For further insight to the Alcoholic Drinks industry, click here.