The luxury goods industry was among the worst hit by the COVID-19 pandemic. Whilst the global economy shrank by over 3% in 2020, sales across luxury were hit hard with overall value dropping by 14%. However, almost three years on, and the outlook is more optimistic with Euromonitor International’s latest Luxury Goods data revealing that the industry is set to register real value growth of just under 6% on 2021, to reach USD1.2 trillion in sales by the end of 2022. The global outlook overall also remains positive, with Euromonitor International’s latest forecast data suggesting that luxury goods will exceed pre-pandemic levels by 2023.

This is hugely impressive against a backdrop of ongoing political, economic instability and the continuing effects of the pandemic. However, just as recovery is taking place faster than expected, the industry is now facing further turbulence around the uncertainty in Ukraine, and galloping inflation rates, leading to rising production costs and further supply chain woes, not to mention weakened consumer spending as the cost-of-living crisis takes shape.

Improving supply chain resilience top priority for luxury players

The pandemic revealed the vulnerability and limits of the globalised supply chain in luxury goods. Disruption caused by the pandemic and shifts in consumer behaviour have forced players to rethink almost every aspect of logistics and route to market. Amongst others, major disruption was caused by factory closures, raw material and shipping costs, over-concentrated supply chains, a lack of strong digital presence and problems reaching the home-bound consumer.

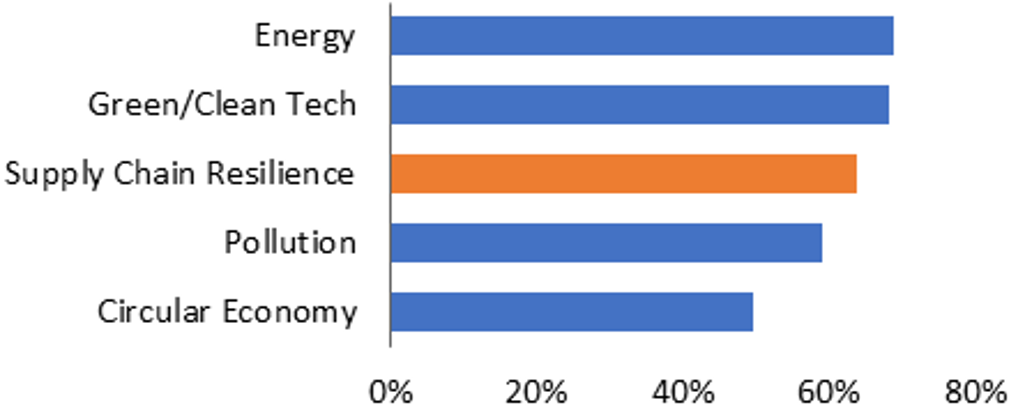

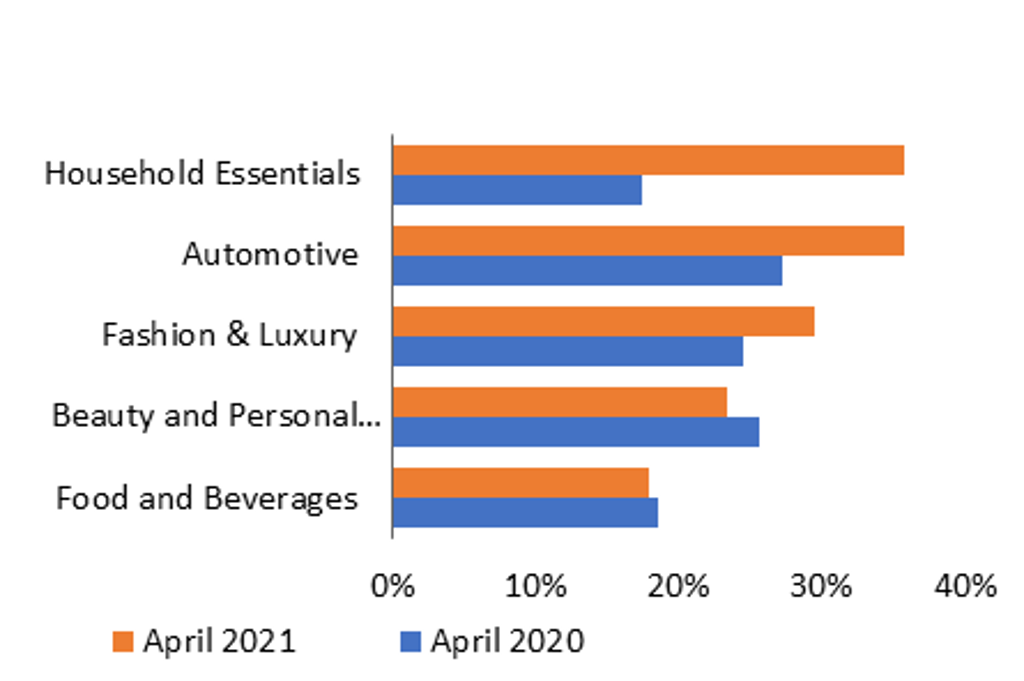

Over 40% of companies in Euromonitor International’s Voice of the Industry Survey (fielded in February 2022) agreed that investment in automation and new supply chain technologies was paramount to prevent future risks. In the same survey, over two thirds of respondents in Fashion and Luxury plan to increase investments in supply chain and one third plan to work on localised production. To put this in a global context, China currently accounts for almost half of the world’s production of textile and leather goods, but this is set to decline to one third by 2030. Moving forward, supply chains in luxury goods are set to be shorter, greener, more diversified and digitalised.

5-Year Planned Corporate Investment Initiatives 2022

Source: Euromonitor International

Industry Plans to Invest More in Localised Production

Source: Euromonitor International

The need to unlock the full potential of omnichannel strategies is accelerating

While the pandemic has permanently shifted how, when and where we work, it has also shifted how, when and where we shop. There was already a huge shift to digital before the pandemic emerged. However, the need to unlock the full potential of an omnichannel strategy has simply been accelerated. According to Euromonitor International’s latest data, online sales of personal luxury accounted for just 11% of all sales in 2019, but as consumers habits are changing, this is set to increase to a massive 20% by the end of 2022.

Looking beyond e-commerce, technology is reshaping the world on almost every level. More consumers are joining The Metaverse Movement, online gaming is up and lives will shift more between the physical and the virtual world. Luxury businesses must understand their role in how to increase brand recognition and revenue in the Metaverse. Indeed, the next fashion retail revolution is set to go from D2C (Direct to Consumer) to D2A.

Luxury hospitality and retail returns to focus on the wealthy tourist again

After a long hiatus, attitudes towards travel are expected to normalise in the medium term and luxury hospitality and retail will once again turn to focus on the international wealthy tourist.

Indeed, experiential luxury (which includes luxury hotels and luxury foodservice) is the fastest growing category across luxury goods in 2022. This category is expected to benefit from the lifting of travel restrictions, pent-up consumer demand and the anticipated return of affluent tourists. This marks a major turning point in terms of living with the virus and it would appear that society is gradually moving towards an endemic phase. However, the mass tourism model that saw record sales in 2019 was heavily exposed during the pandemic. In a post-pandemic world, increasing numbers of consumers are demanding value and purpose-driven offerings, and they are taking fewer holidays, but spending more time and more money. Decarbonisation across luxury travel and hospitality will be critical to protecting the ecosystems and communities that depend so heavily on luxury tourism.

Nevertheless, the recovery here remains uneven and almost three years on, the effects of the pandemic remain visible. Tourist spending on personal luxury is still down across all markets and according to Euromonitor International’s latest travel date, global inbound spending overall is still sitting at just 45% of pre-pandemic levels. The outlook has been further overshadowed by the war in Ukraine.

Importance of holistic health fuels demand for luxury wellness propositions

Against a backdrop of the pandemic, a focus on health and wellbeing is now embedded in every single aspect of consumer lifestyles. Rising awareness of the importance of holistic health is fuelling demand for luxury wellness propositions with many luxury companies already benefiting from the more health-centred consumer.

According to Euromonitor International’s latest Consumer Lifestyles Survey (2022), 37% of global respondents expect to increase spending on health and wellness in the next year and 63% of global respondents exercise at least once a week. A shift in socioeconomic, behavioural and consumption patterns will encourage more luxury brands to focus on consumers’ physical, emotional, mental and spiritual wellbeing.

Luxury goods must join drive towards ethical and social responsibility or be left behind

Environmental, social, and corporate governance (ESG) has entered the corporate lexicon and investors in luxury goods companies are holding CEOs accountable for ESG targets. The impact of the pandemic has led many brands to resist returning to the volume-driven model and companies are looking at ways of operating in a more sustainable way, but there is still substantial work to be done.

Increasing numbers of consumers today are buying from companies that share their ESG targets and are not shy of holding companies accountable for ESG missteps. However, although the pressure on companies to act is present, less than one fifth of industry experts in Euromonitor International’s Voice of the Industry survey (2022) report they have a net zero strategy in place.

Diversity, equity and Inclusivity (DEI) are also now at the top of the agenda. Young consumers in particular are challenging business norms across luxury goods and above all they are demanding equal opportunity, diversity and social inclusion. There is a clear refocus across luxury goods to address how the shift to DEI aligns with ESG. Today, it is no longer about exclusivity (not limited to its buyers) but also the mindfulness of supply chains, and how brands are marketed to ensure representation in content delivery and imagery, but as competitors become more purpose driven, luxury brands need to get on board or get left behind. The black pound, pink pound and purple pound are more important than ever to ensure inclusivity in luxury goods to attract these consumers.

For further insight, see our report, World Market for Luxury Goods.