The latest edition of our Global Economic Forecast report has launched for Q1 2019, looking at the quarterly macro changes for the world’s key economies and what these mean to our view of the likely, optimistic and pessimistic scenarios for the global economy.

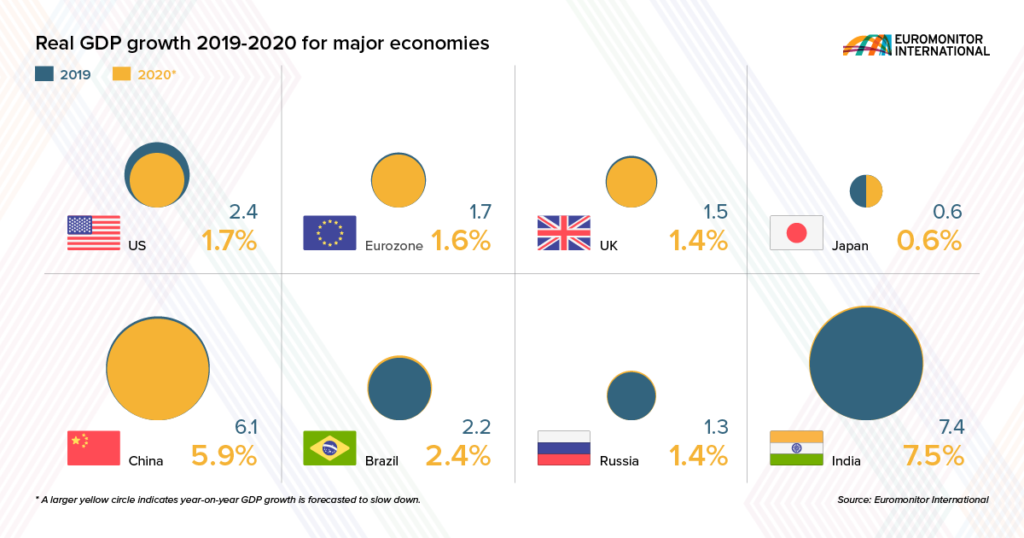

Annual global economic growth is forecast to decelerate to 3.5% in 2019 and 2020, down from 3.7% in 2018. This deterioration in our global outlook has primarily been a result of downgrades to the advanced economies, including the US and the Eurozone, but also to some emerging economies such as Mexico and Russia.

The real GDP in advanced economies is estimated to grow by 2.0% in 2019 and 1.7% in 2020, a decline from 2.3% growth in 2018. Emerging economies are anticipated to see a steadier real GDP growth of 4.6% in 2019 and 4.7% in 2020, which is similar to a pace of 4.6% in 2018.

Risks remain high

The world trade growth is likely to weaken in 2019 as a result of a pullback in globalisation and increasing political risks. The recent decline in financial asset prices also suggests a risk of recession in 2019.

Major global risks are stemming from remaining trade war uncertainty, tightening financial conditions and risks of a worse-than-expected Chinese economic slowdown. The Eurozone outlook is also clouded by a possibility of a no-deal Brexit and Italian fiscal policy. Lower oil prices and the emergence of populist leaders in Latin America could further weigh on the outlook of emerging economies.

Overall global risk outlook has worsened since August. Escalating trade barriers, higher political risks, and worsening financial market conditions could further reduce growth across advanced and emerging economies alike.

| SCENARIO | GLOBAL RISK INDEX |

| Global Downturn | 63 ↓ |

| Emerging Markets Slowdown | 39 ↓ |

| Global Crisis | 34 ↑ |

| Eurozone Recession | 20 |

| China Hard Landing | 20 ↓ |

| US-China All-Out Trade War | 16 |

| Disorderly No-Deal Brexit | 15 |

| Eurozone Crisis | 11 |

| Trump Adverse Policies | 10 |

| Korean Conflict | 9 |

| Global Trade War | 9 ↓ |

| No-Deal Brexit | 7 ↓ |

Note: Global Risk Index ranks scenarios by the expected GDP impact, calculated as the impact of the scenario multiplied by its probability.

Risk ranking changes include revisions in scenario dynamics.

Biggest forecast changes for Eurozone, Mexico, Russia and the US

Eurozone

More negative news at the end of 2018 has led to further downgrades in the Eurozone outlook. Private sector sentiment has declined to the lowest level in two years, and GDP growth in Q4 2018 was just 1.2% year on year. Much of the recent disappointing growth is due to temporary factors such as the Gilets Jaunes protests in France and some sectoral industry shocks in Germany. However overall, the Eurozone economy appears to be slowing down close to its long-term trend growth in 2019–2020, with rising downside risks.

Mexico

We have downgraded Mexican GDP growth forecasts by 0.3–0.4 percentage points in 2019–2020. This reflects worse than expected growth at the end of 2018, rising business uncertainty about the policies of the more populist Lopez-Obrador government, and a worsening global trade environment. Higher risks of currency devaluation, inflation and a tighter monetary policy have also worsened the outlook.

Russia

We have downgraded Russian GDP growth forecasts by another 0.1–0.2 percentage points in 2019–2020 due the worsening oil price outlook. The price per barrel of Brent oil has declined from USD80–85 in September–October 2018 to USD60–65 in January, and it is expected to remain in that range in 2019–2020. The worsening outlook for oil prices has further dampened Russia’s already mediocre growth prospects, with average annual GDP growth in 2019–2023 forecast at around 1.4%.

US

We have reduced the GDP growth forecast for 2020 by 0.3 percentage points to reflect worsening trade and political uncertainty together with estimating a more transitory impact of the 2018 business tax cuts on investment. While financial markets have likely overreacted negatively in recent months, recession risks have increased for 2019–2020.

Euromonitor International’s new macroeconomic outlook, Global Economic Forecasts: Q1 2019 provides the latest Euromonitor International macroeconomic forecasts, assessment of the global economy, discussion of recent events and a deeper analysis of key economies. Download Global Economic Forecasts: Q1 2019 to stay ahead of risks and opportunities as they emerge on a macroeconomic basis.