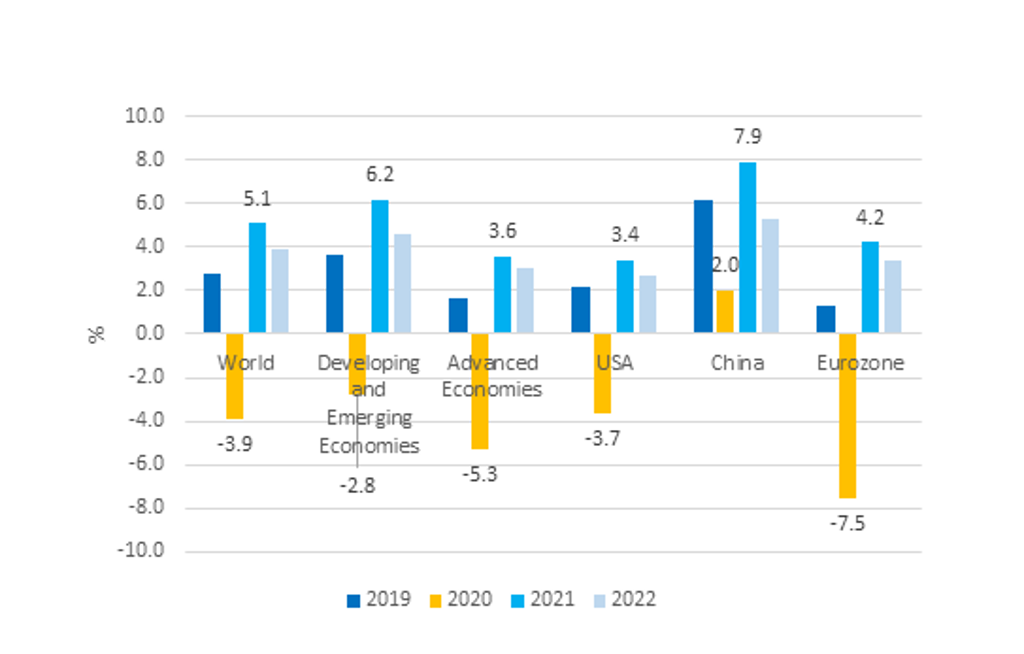

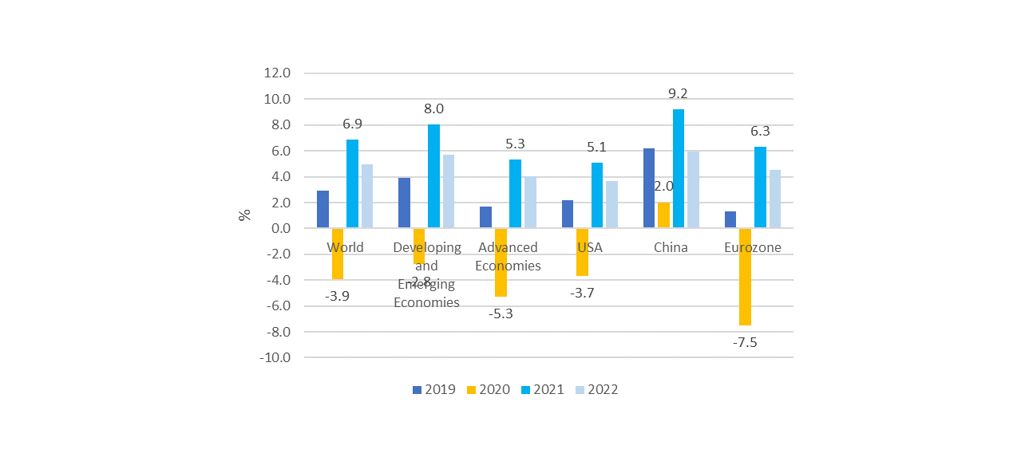

The global economic outlook has improved since October 2020 with the development of several effective vaccines raising the likelihood of a significant economic recovery in 2021 and reducing downside risks. After an estimated real global GDP decline of 3.9% in 2020, the global economy is expected to grow by 5.1% in 2021 in the baseline forecast (with a plausible range of 4.0-6.0% growth).

The recovery is expected to stretch into 2022, with real GDP growth of 3.9% (with a range of 2.8-5.2% in the baseline forecast). These expected growth rates represent moderate 0.1-0.3 percentage point downgrades since October 2020. The most significant downgrade is to the Eurozone outlook, with a reduction in 2021 real GDP growth of 0.9 percentage points to 4.2%.

Global Real GDP Growth Baseline Forecast: 2019-2022

Source: Euromonitor International Macro Model, National Statistics. Note: Global real GDP growth using PPP weights; figures for 2020 onwards are forecasts; forecasts updated on 20 January 2021.

The downgrades for 2021-2022 growth forecasts are partly due to weaker recovery momentum after a shallower economic contraction in 2020 (2020 global real GDP growth was upgraded by 0.9 percentage points relative to October 2020, due to a stronger than expected economic rebound in H2 2020). However, the downgrades also reflect a worse than expected winter pandemic wave in Q1 2021, leading to more significant social distancing restrictions and widespread lockdowns, especially in Europe.

Looking beyond the economic weakness in the beginning of this year, vaccination campaigns in most advanced economies are now expected to approach the thresholds for attaining herd immunity by the end of Q3 2021. Significant COVID-19 related social distancing restrictions and precautionary behaviours are expected to last for another 2-3 quarters in 2021. The combination of relaxation in social distancing restrictions, recovery in private sector confidence and significant cumulated household savings from 2020 is expected to sustain a strong economic rebound in H2 2021.

Vaccination campaigns in developing economies are expected to take longer, continuing into 2022-2023. As a result, these economies are likely to face ongoing local COVID-19 waves and slower recoveries in 2021-2022. The aggregate real GDP level of developing economies is expected to remain around 5% below pre-pandemic forecasts in 2022, compared to a 3.5% gap relative to pre-pandemic forecasts for advanced economies. The one notable exception among developing economies is China, where real GDP is expected to be around 1.3% below pre-pandemic forecasts in 2022 due to the country’s more effective management of the pandemic.

Downside risks have declined but remain high

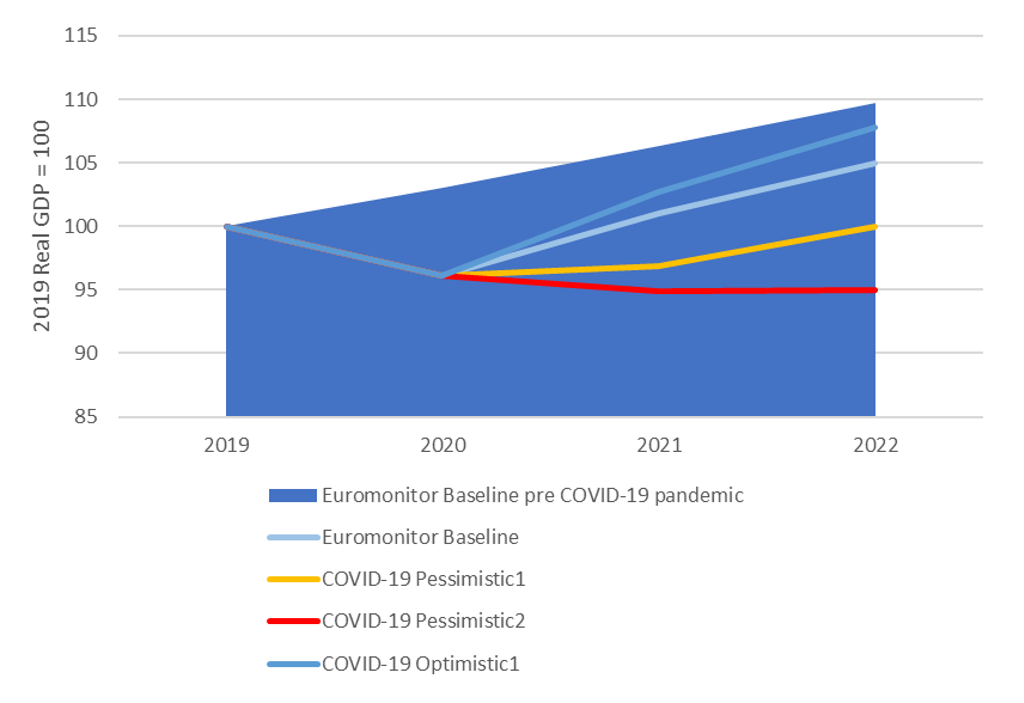

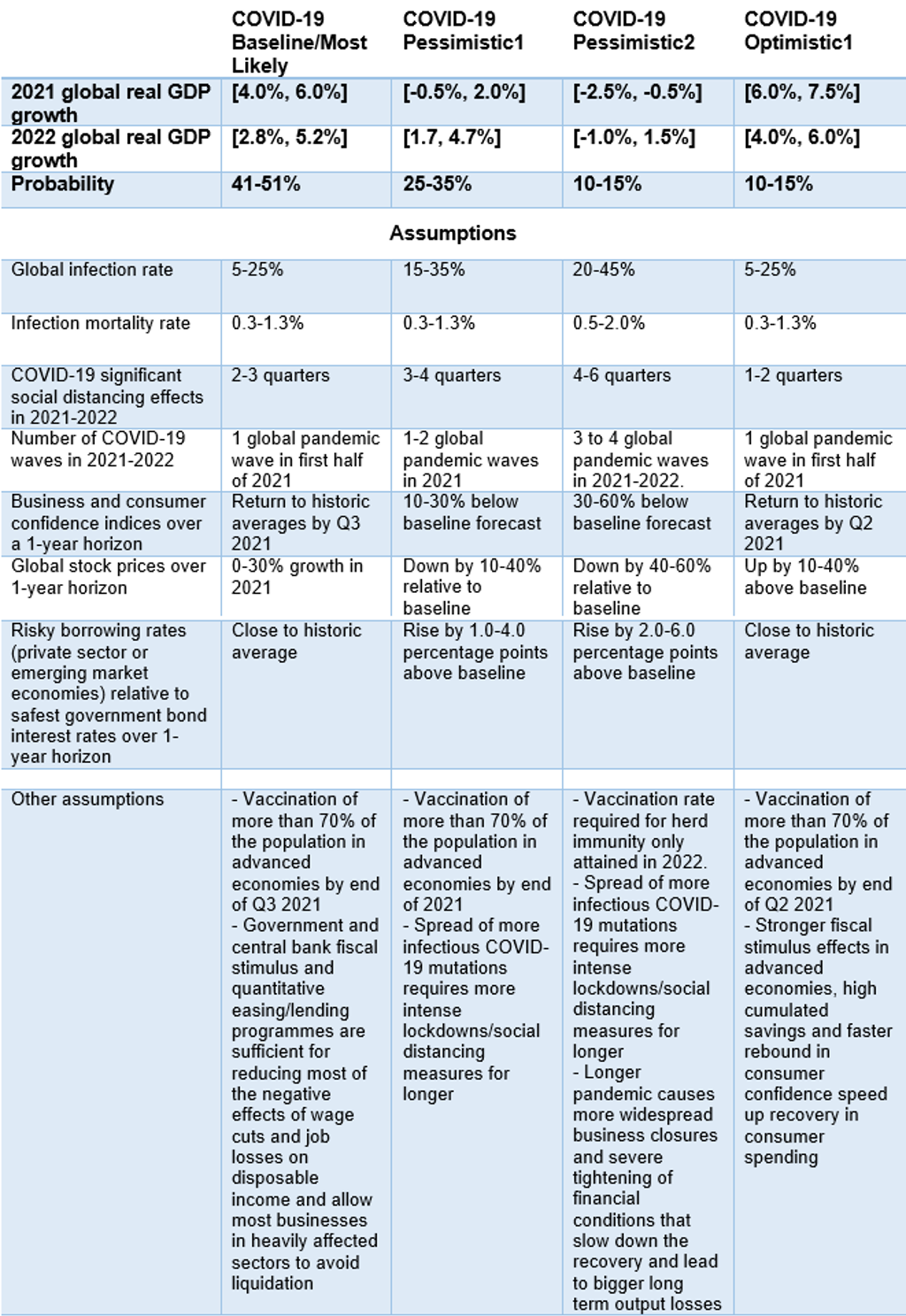

Despite significant uncertainty about the economic impact of ongoing pandemic waves in Q1 2021, downside risks to the economic recovery in 2021-2022 have declined substantially with the development of effective COVID-19 vaccines and the start of vaccination campaigns at the end of 2020. The probabilities of our Pessimistic COVID-19 scenarios have declined to around 42% as of January 2021, from around 52% in the October 2020 outlook. The probability of the Pessimistic2 scenario, in which widespread vaccination campaigns are delayed into 2022, has been cut to around 12% (compared to around 20% probability on the Pessimistic2 and Pessimistic3 scenarios in the October 2020 forecast). This leaves around 58% probability for the baseline forecast or a more optimistic faster recovery scenario.

Global Real GDP Index, Baseline and Alternative Scenarios: 2019-2022

Source: Euromonitor International Macro Model, National Statistics. Note: Global real GDP growth using PPP weights; figures for 2020 onwards are forecasts; forecasts updated on 20 January 2021.

Negative risk factors include the spread of recent, significantly more infectious virus mutations that require stricter social distancing measures to control, worse than expected declines in economic activity from the strong pandemic winter waves now affecting many economies, slower vaccine distribution due to logistics problems, and insufficient vaccine take-up by the population. New virus mutations may also require additional research to develop new vaccine variants, delaying vaccination campaigns.

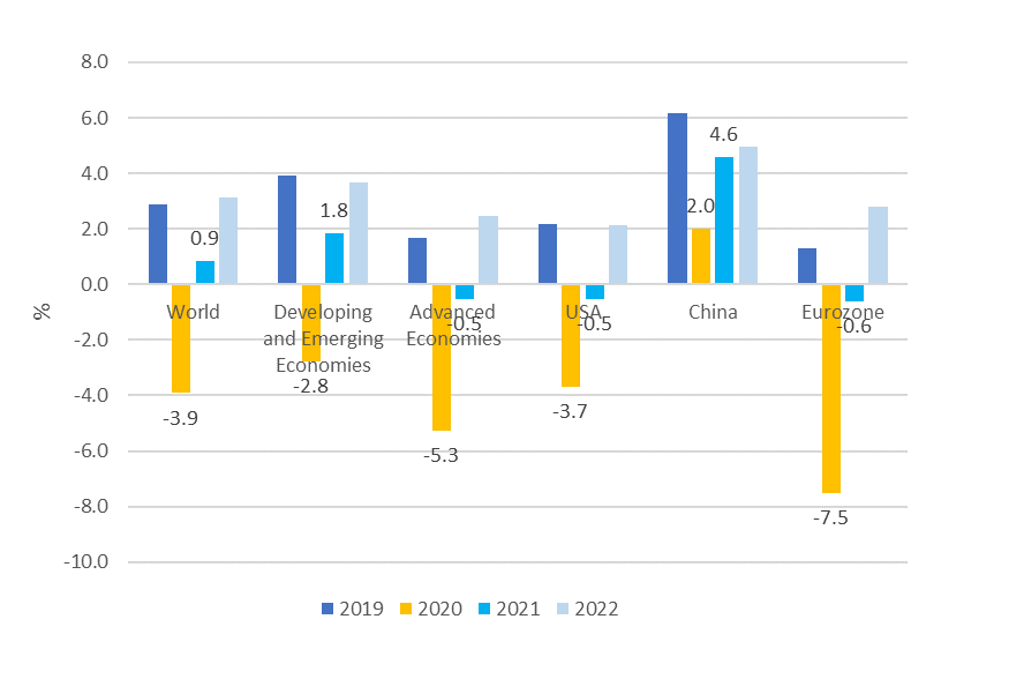

The main downside risk is the COVID-19 Pessimistic1 scenario, assigned a 25-35% probability in 2021. In this scenario there are 1-2 global pandemic waves in 2021. Vaccination rates sufficient for herd immunity are only attained in advanced economies by the end of 2021, possibly stretching into early 2022. As a result, significant COVID-19 related social distancing restrictions and precautionary behaviour last for another 3-4 quarters in 2021. Global real GDP growth in this scenario ranges from -0.5% to 2.0% in 2021, rising to 1.7-4.7% in 2022.

Global Real GDP Growth COVID-19 Pessimistic1 Scenario: 2019-2022

Source: Euromonitor International Macro Model, National Statistics. Note: Global real GDP growth using PPP weights; figures for 2020 onwards are forecasts; forecasts updated on 20 January 2021.

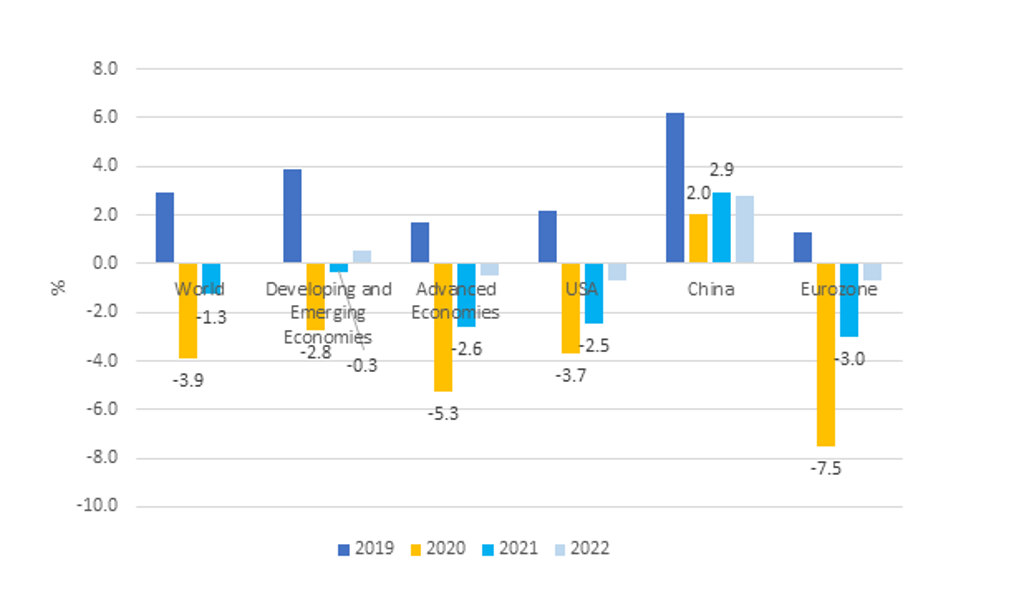

Risks of longer delays in widespread vaccination are captured by the COVID-19 Pessimistic2 scenario, assigned a 10-15% probability in 2021. In this scenario logistical complications, significant population resistance to vaccination and lower effectiveness of the initial vaccines against new virus mutations delay sufficient vaccination rates for herd immunity in advanced economies into 2022, with longer delays in developing economies.

The spread of more infectious virus mutations leads to more intense and longer-lasting lockdowns and social distancing measures, while the delay in vaccinations leads to more pandemic waves in 2021-2022. The longer pandemic causes severe financial distress and more widespread business closures, further delaying economic recovery. Global real GDP declines by 0.5-2.5% in 2021, with real GDP growth ranging from -1.0% to 1.5% in 2022.

Global Real GDP Growth COVID-19 Pessimistic2 Scenario: 2019-2022

Source: Euromonitor International Macro Model, National Statistics. Note: Global real GDP growth using PPP weights; figures for 2020 onwards are forecasts; forecasts updated on 20 January 2021.

Faster than expected vaccination campaigns could lead to a more optimistic scenario

On the upside, in the new COVID-19 Optimistic1 scenario, vaccination rates sufficient for herd immunity are attained in advanced economies by the end of Q2 2021. As a result of faster vaccination campaigns, significant social distancing effects last for only another 1-2 quarters in 2021. Stronger fiscal stimulus effects in advanced economies, high cumulated savings and the faster rebound in consumer confidence speed up the recovery in consumer spending. Global real GDP growth rates increase to 6.0-7.5% in 2021 and 4.0-6.0% in 2022. This optimistic scenario is assigned a 10.0-15.0% probability in 2021.

Global Real GDP Growth COVID-19 Optimistic1 Scenario: 2019-2022

Source: Euromonitor International Macro Model, National Statistics. Note: Global real GDP growth using PPP weights; figures for 2020 onwards are forecasts; forecasts updated on 20 January 2021.

COVID-19 Global Scenario Probabilities and Assumptions