Spread of Delta COVID-19 variant and supply constraints limit economic recovery

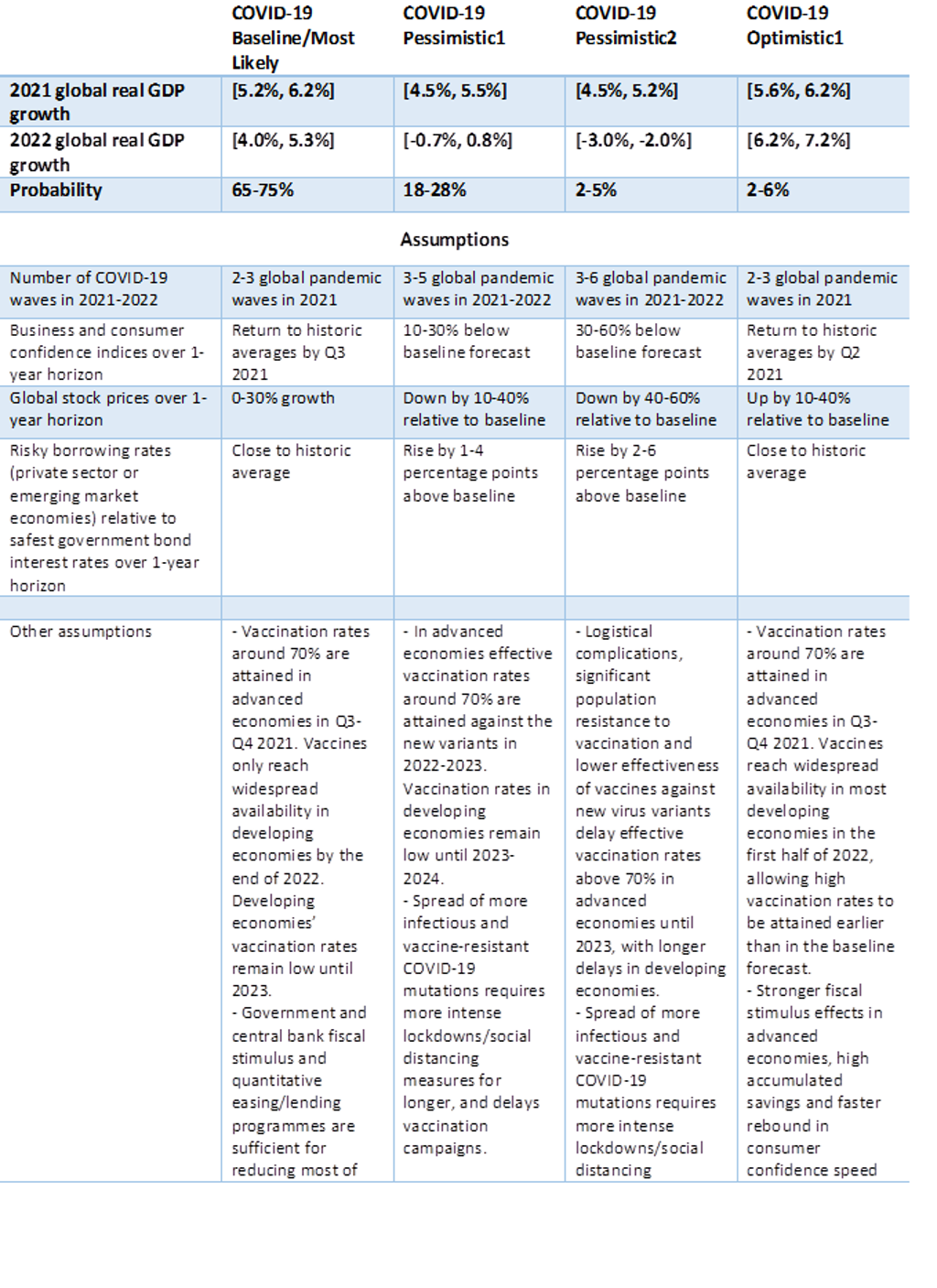

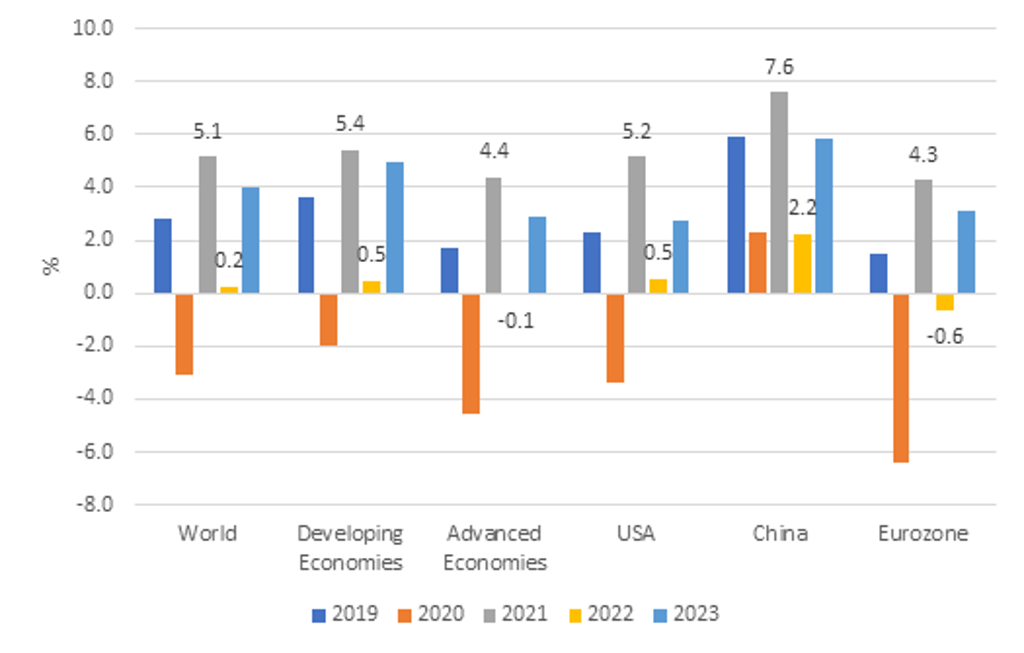

The global economic outlook for 2021 has worsened moderately since mid-2021, offset by slightly more optimistic recovery forecasts for 2022. Global real GDP is now forecast to increase by 5.7% in 2021 (a 0.2 percentage point downgrade since July 2021), and by 4.8% in 2022 (a 0.2 percentage point improvement relative to the July 2021 forecast).

Since July, real GDP growth forecasts for 2021 have been significantly downgraded for the US, Canada, China, India, and other Asia Pacific economies, such as Indonesia and Australia. By contrast, 2021 forecasts have improved substantially for the Eurozone, Eastern Europe and Latin America. The growth in global economic activity in Q2 was stronger than expected. However, the spread of the much more infectious Delta COVID-19 variant and worsening supply constraints have tempered global economic recovery and put greater pressure on vaccination campaigns to control the pandemic.

Real GDP Growth Baseline Forecasts: 2019-2023

While infection rates from the current wave of COVID-19 have gone down in many countries, they risk rising again during Q4 2021 in the northern hemisphere as the weather gets colder and people spend more time indoors. The current vaccines are estimated to be 60-88% effective at preventing symptomatic infection with the Delta COVID-19 variant and 71-96% effective at preventing hospitalisation due to this variant, depending on the vaccine used. However, the Delta variant has a 2.5-3.0 times higher transmission rate than the initial variants, requiring vaccination rates of 90-100% to attain herd immunity. As of October 2021, vaccination rates in major advanced economies range around 55-75%, and progress in vaccination campaigns has slowed down in many countries. As a result, in many countries the Delta variant is likely to require a short-term return to some social distancing restrictions even for vaccinated individuals, and more aggressive discrimination between restrictions for unvaccinated and vaccinated individuals. While the economic effects of recent lockdowns have been more moderate, they remain a significant drag on recovery.

Governments have also instituted stronger vaccine mandates, for instance requiring vaccines for workers in certain sectors. In combination with greater public concern about the risks of COVID-19 infection, these measures should provide a further boost to vaccination campaigns. However, significant anti-vaccine sentiment or vaccine scepticism is likely to limit vaccination rates in most countries to 70-80%. Attaining a 70-80% population vaccination rate, in combination with vaccination rates of around 90% among more vulnerable groups, such as the elderly, is expected to allow advanced economies to control COVID-19 with only mild restrictions by the spring of 2022.

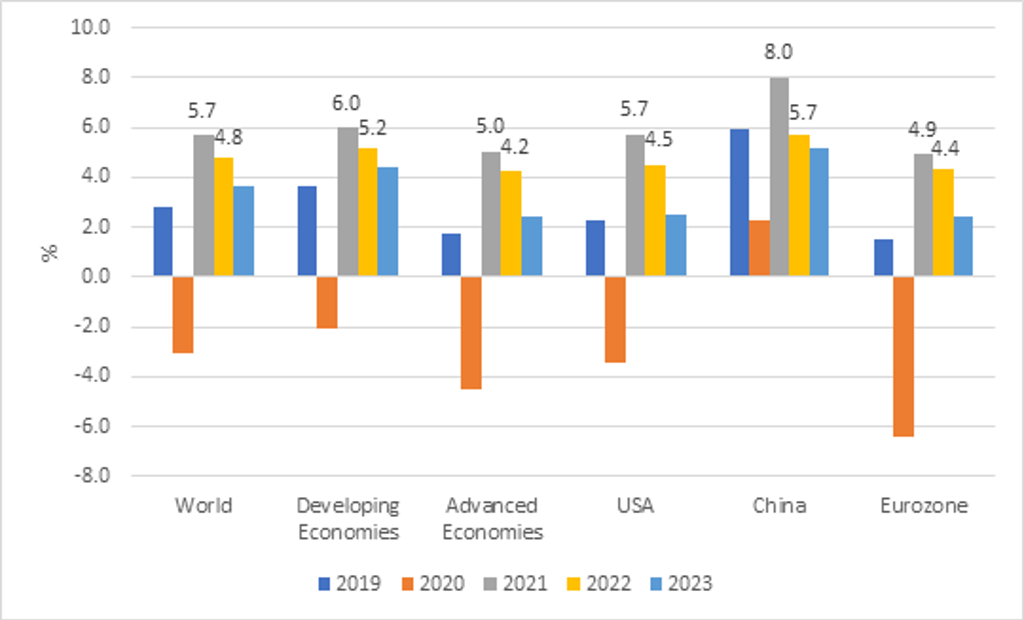

Global Real GDP Index, Baseline and Alternative Scenarios: 2019-2023

Vaccination rates in major developing economies are likely to remain below 50% until 2023, with the notable exception of China, which exceeded a 70% vaccination rate in September 2021. Lower vaccination rates and much weaker fiscal support measures than in advanced economies are expected to cause more persistent economic effects of the pandemic in developing economies. While real GDP levels in advanced economies are expected to recover their pre-pandemic forecast levels in 2022, real GDP levels in developing economies are expected to remain on average 3% below their pre-pandemic forecasts in 2022.

Supply constraints are slowing down economic recovery

Supply constraints are the other significant drag on global economic recovery, due a mix of pandemic-related travel and transport restrictions, underinvestment in transportation infrastructure and electronics production (preceding the pandemic), and the reluctance of potential workers to return to some high-risk COVID-19 sectors. These supply constraints have coincided with a rapid increase in global demand, leading to occasional shortages and filtering into higher price inflation. Key supply constraints include a lack of shipping containers, port closures and delays, a shortage of truck drivers, lack of computer chip production capacity, electricity shortages in China and India, and rising global commodity prices. These factors are likely to have raised global inflation by 1.5 percentage points in Q3 2021, according to OECD estimates.

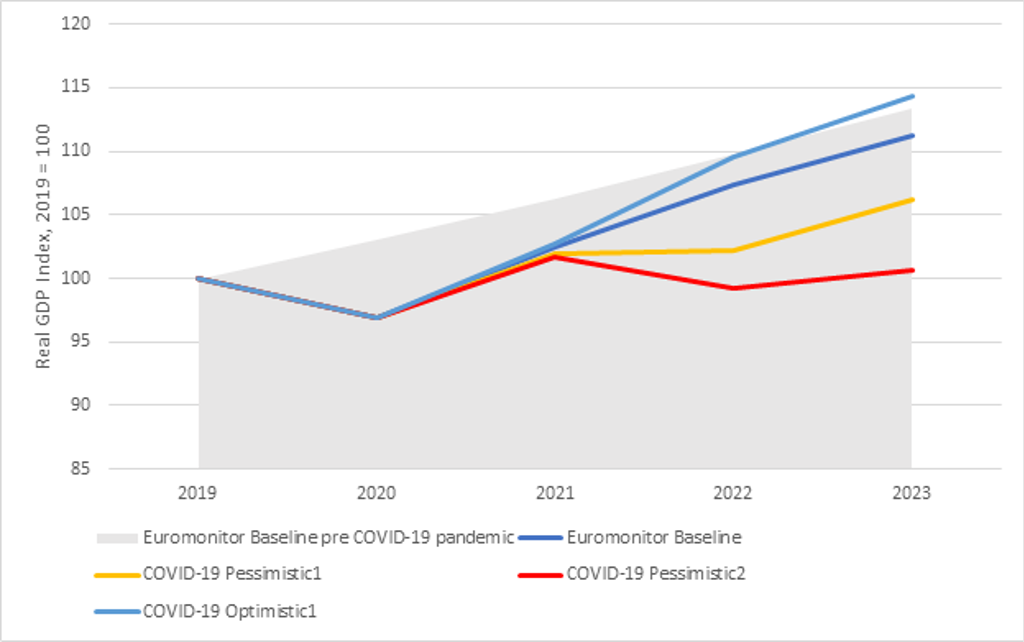

Inflation Baseline Forecasts: 2019-2023

Substantial supply bottlenecks are likely to continue into 2022 and even 2023 for some production inputs and sectors, with a gradual improvement. As a result, global inflation is expected to reach 4.0% in 2021 and 3.6% in 2022, declining towards 3.0% in 2023-2024. However, there is substantial uncertainty around the baseline inflation forecasts, with significant risk of a more prolonged period of high inflation. Key factors contributing to more persistent high inflation would be a shift in long-term inflation expectations of the private sector, ongoing housing price increases and ongoing global supply shortages of key production inputs. The current supply constraints may also cause a longer-term shift to more localised production, with lower reliance on vulnerable global supply chains, as part of an ongoing globalisation reset.

Forecast risks remain tilted to the downside

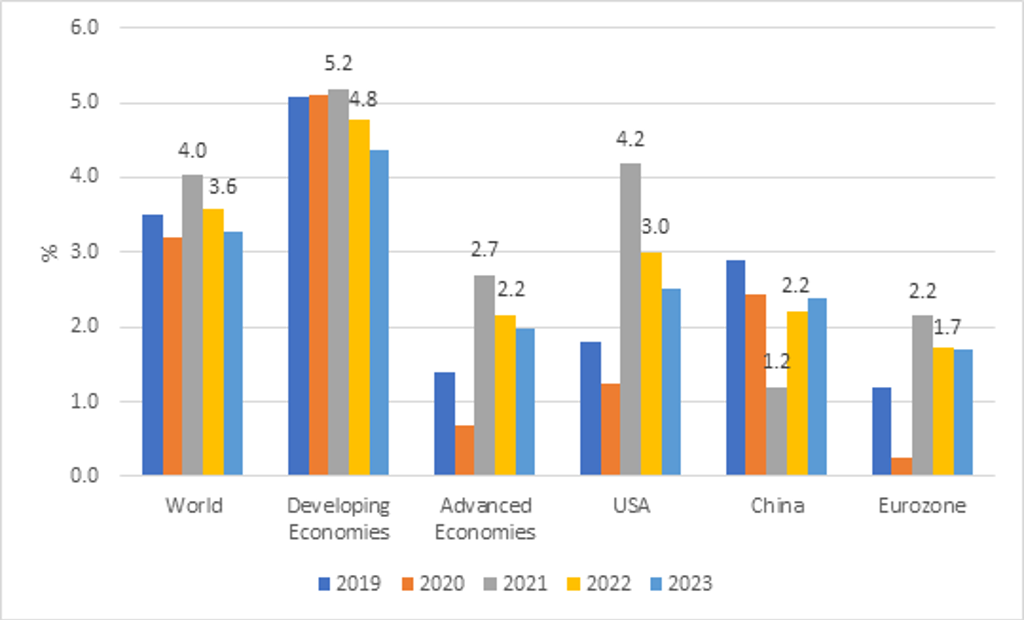

The baseline forecast is now assigned a 65-75% probability. A more optimistic global economic recovery scenario, with global real GDP growth of 6.2-7.2% in 2022, is assigned a 2-6% probability. More negative economic scenarios are assigned around 26% probability.

Real GDP Growth COVID-19 Optimistic1 Scenario: 2019-2023

The main global downside risk factor is the emergence of new more infectious or vaccine-resistant variants of the virus. In the COVID-19 Pessimistic1 scenario the spread of more infectious and more vaccine-resistant COVID-19 virus mutations leads to renewed lockdowns and stronger social distancing measures. In advanced economies, sufficient vaccination rates to control the pandemic are only attained at the end of 2022 or early 2023. Vaccination rates in developing economies remain low until 2023-2024. Longer-lasting social distancing measures cause large drops in consumption, business revenues, employment and wages relative to the baseline forecast in 2021-2022. Global real GDP growth declines into a range of -0.7% to 0.8% in 2022. This scenario is assigned a 18-28% probability.

Real GDP Growth COVID-19 Pessimistic1 Scenario: 2019-2023

COVID-19 Global Scenario Probabilities and Assumptions