Global inflation is forecast to moderate in 2023-2024. The global inflation rate is forecast to reach 6.9% in 2023 and moderate to 4.4% in 2024. Slower economic growth, stable commodity prices and supply chain improvements will contribute to the slower price growth. However, the inflation rate for 2023-2024 remains above central banks’ targets and tighter monetary policy is expected to continue.

Higher energy costs in the second half of 2023, tight labour markets (number of job openings available exceeding number of workers available) that drive up services inflation, and ongoing globalisation reset which could offset some of the efficiency gains in the global supply chains are among the key risks that could increase inflationary pressures in 2023-2024. Sustained faster economic growth in China could also lift demand for commodities and increase supply-side inflationary pressures in the second half of 2023.

Food price growth moderates but rising prices of services add to non-core inflation

Moderating food prices in large part contributed to the easing of inflation in Q1 2023. For example, average unit prices of staple foods and household essentials across the largest economies showed moderate growth in Q1 2023, with similar trends expected to prevail in Q2. Improved supply of agricultural commodities, easing of transportation bottlenecks and stabilisation of energy prices helped to cap the price growth of food products and other essential items.

However, tight labour markets and, consequently, fast wage growth continued to contribute to the rising prices of services and the high core inflation level (excluding food and energy prices). Prices of services highly correlate with the general conditions in the labour market, and sustained wage growth is likely to contribute to the inflationary pressures in 2023-2024. Education, healthcare services, retail and entertainment services are some of the most labour-intensive sectors and will feel the highest pressure from the rising wages. In addition, relatively high labour costs in the agriculture sector will add to inflationary pressures on commodities, supply side.

The issue of an ageing population in the largest economies and a consequently shrinking labour pool will continue to add to the labour market challenges over the long term. This, in turn, will make it more difficult to curb price growth of services and challenge long-term price stability.

Inflationary pressures moderate amid weaker economic and demand growth

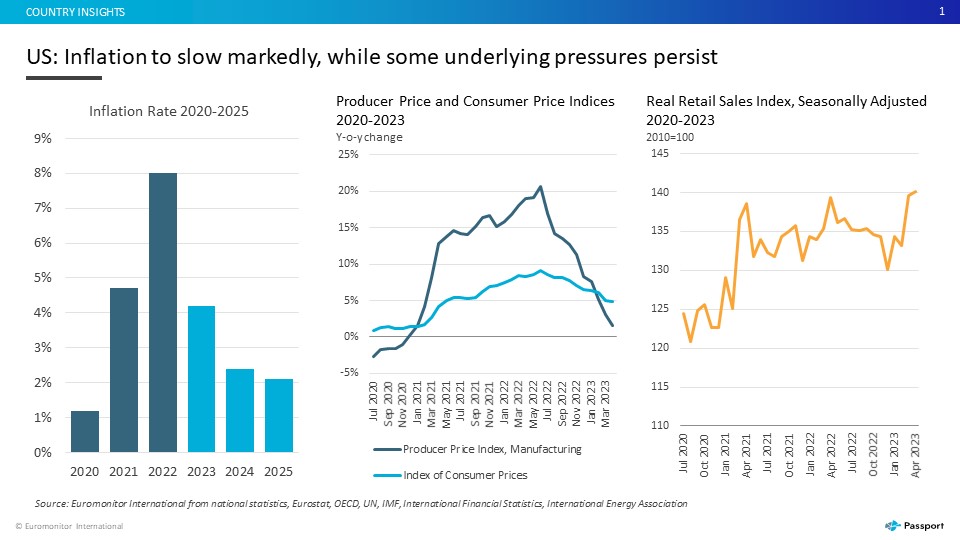

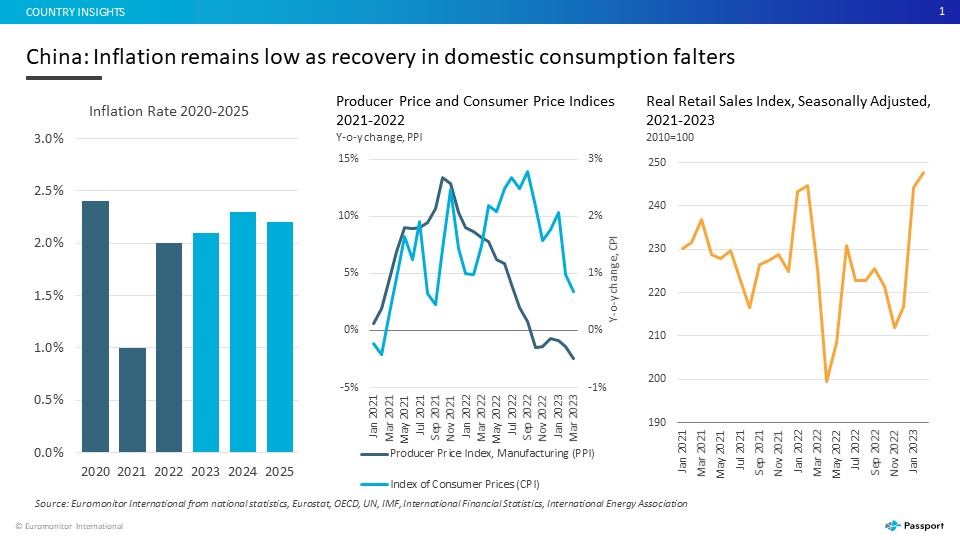

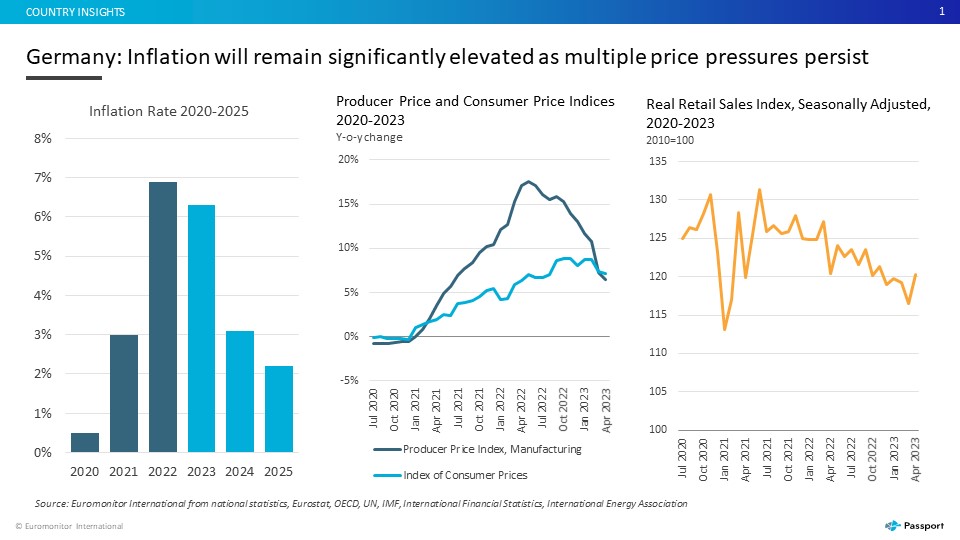

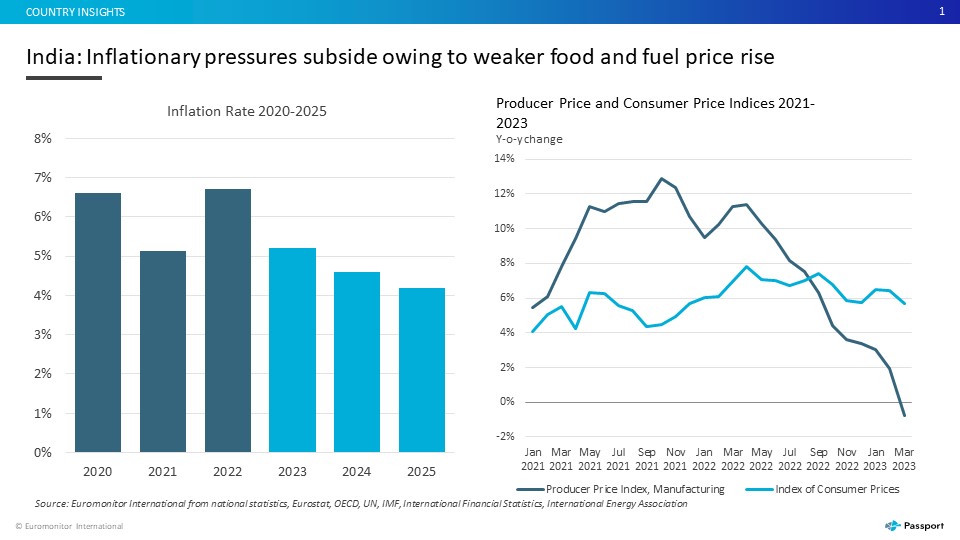

Inflation in the largest economies continues to moderate as slower economic growth and, consequently, weaker demand help to cap price growth. Inflation forecasts for the US and the Eurozone remain largely unchanged compared to estimations in the previous quarter as easing price pressures of manufactured goods and commodities help to curb inflation. Inflation forecasts for emerging markets are revised downwards as supply chain improvements and lower commodity prices contribute to the easing inflationary pressures.

- Inflation in the US is predicted to reach 4.2% in 2023 and ease to 2.5% in 2024. Normalisation of the energy prices and tighter monetary policy set by the Federal Reserve are contributing to the moderating inflation. Tight labour markets are forecast to be among the major headwinds pushing up inflationary pressures in 2023-2024.

- Inflation in China is forecast to reach 2.4% in 2023 and 2.3% in 2024. Inflationary pressures in China remain mild despite the reopening of the economy and faster-than-expected GDP growth in Q1 2023. Chinese households remain cautious, owing to weak income and labour market prospects. Lower energy and metal prices also contributed to the declining producer prices in Q1 2023, further easing inflationary pressures.

- Inflation risks in the Eurozone have eased largely due to the stabilisation of the energy prices. Inflation in the largest Eurozone economies, Germany and France, is forecast to reach 6.4% and 5.2%, respectively, in 2023. Still high volatility in the energy markets, rising prices of services and the phase-out of government subsidies that helped to ease inflationary pressures for households continue to keep inflation above central banks’ targets.

- Inflation in India is forecast to reach 5.2% in 2023 and moderate to 4.6% in 2024. Softer food and energy prices helped to cap price growth and keep inflation within the target of the Reserve Bank of India in Q1 2023. Weaker household spending amid higher borrowing costs, fading pent-up demand and weaker global commodity prices are expected to further contribute to the moderating inflation.

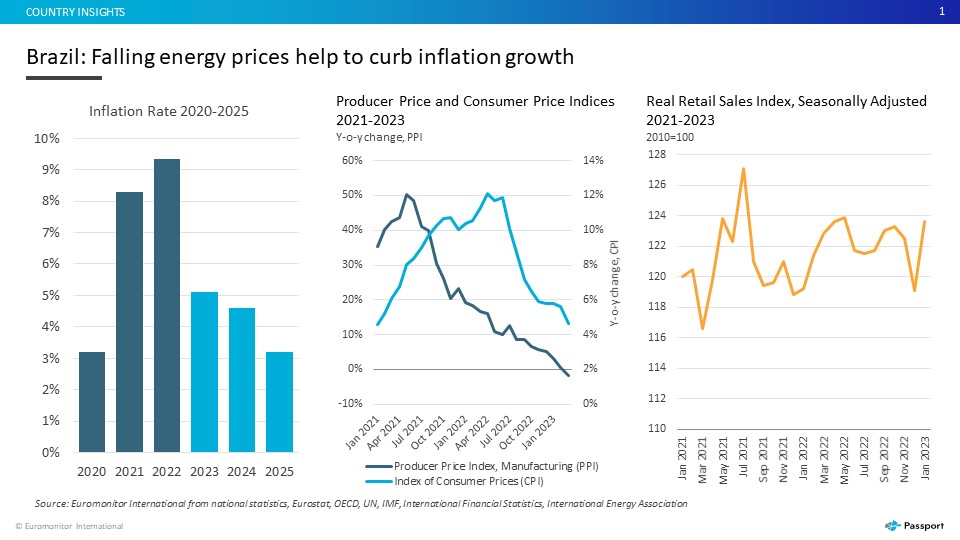

- The inflation rate in Brazil is forecast to reach 5.1% in 2023 and ease to 4.6% in 2024. Moderating energy and food prices, slower economic growth, weaker consumer demand and higher interest rates contribute to the slower price growth. In response to the cooling inflation, Brazil’s central bank kept the base interest rate unchanged at 13.75% during its latest meeting in May 2023.

Further insights into key economic and inflation trends are available at Global Inflation Tracker: Q2 2023 and Global Economic Forecasts: Q2 2023.