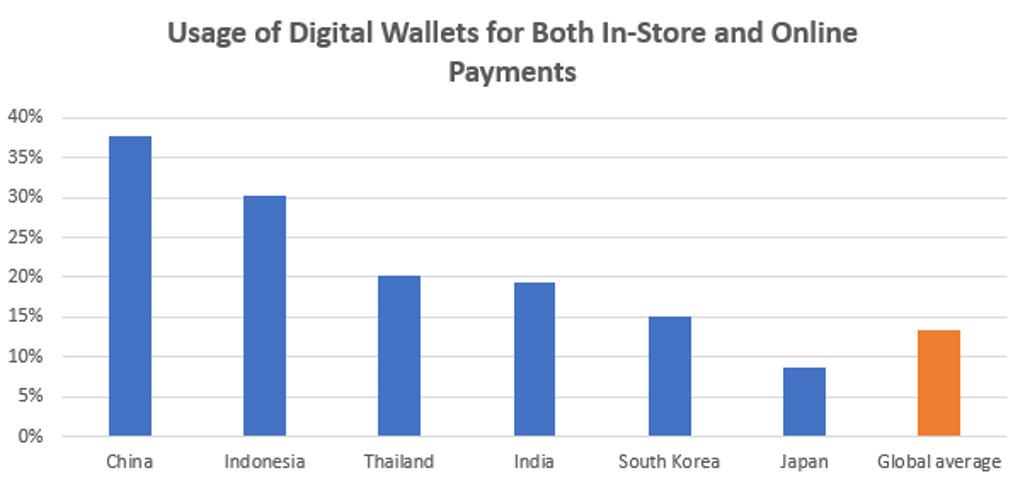

In the latest Digital Consumer Survey conducted by Euromonitor International in 2020, Indonesia ranked second globally in digital wallet usage, at 30%, after China, at 37%. High usage is having a major influence on consumers’ choice of payment and merchant acceptance in Indonesia.

Source: Euromonitor International, Digital Consumer Survey 2020

Accelerating the shift from cash to cashless

As Indonesia’s unbanked population remains high at 42% in 2019, cash still leads the payment landscape in Indonesia. However, the government has been making concerted efforts to shift the nation towards a cashless society. One method is through regulation that allows consumers to top up digital wallets using cash without the requirement of a bank account or financial card. Another initiative since early 2020 is the launching of the standard, single-code QR system (QRIS) as part of its Indonesia Payment Systems Blueprint 2025. This simplifies the set-up of mobile payment for both merchants and consumers, thus significantly boosting the use of digital wallets for in-store payment.

In order to promote digital wallets among the cash-spending consumers who are price-driven, digital wallets in Indonesia also offer massive discounts and cashback as a key strategy to attract and maintain its user base. It is expected that this rewards strategy will eventually decrease, as wallet players face pressure to generate greater profit. However, in the short term, wallet players will still maintain the frequency, while cutting back on the scale, of their offers, leaning more towards rewards points/cash back instead of straight discounts.

Preferred by small-scaled and local merchants

Each merchant’s decision on their accepted payment methods depends on their targeted customer demographics, the prioritised sales channel (online/offline), the transaction value, the payment methods offered by their competitors, and finally the actual cost for the merchant to provide the payment method, i.e. the fee per transaction and minimum transaction value requirement.

Acceptance of digital wallet payment instead of other payment modes subsequently happens more often for businesses that fall under Micro, Small and Medium Enterprises (MSMEs) in Indonesia. MSMEs usually target a specific group of consumers and are therefore more likely to limit their accepted payment methods to the one most used by the targeted customers. On the other hand, mass retailers, and bigger-scaled merchants usually opt for both options, providing as many options as possible for their customers.

Businesses that target low-to-middle income customers might also prefer digital wallets for low-cost offers. For those that serve high-end customers, card acceptance is still preferred, to present a more premium positioning. Digital wallet is also more relevant for businesses that serve local customers as it is harder for foreign consumers to own and use local wallets.

Impact of digital wallets on other payment types

Most digital wallets aim to take share from cash payment, targeting the group of consumers that are more attracted to the convenience and low-cost aspect of digital wallets. As for its impact on physical card payment, this varies by transaction characteristics.

For example, the impact of digital wallets on credit cards is insignificant since the usage of credit cards in Indonesia focuses on high value but less frequent transactions, with payment on credit (in instalments) options. Even in the light of the new, “pay later” credit service being rolled out by some wallet players, the impact is not yet major. Most such offerings are at higher interest rates without the instalment option, while at the same time still having to process under a set limit for wallet transaction value. On the other hand, digital wallets impact on debit card payment is clearly recognisable, since wallet payments usually offer higher rewards than debit card payments. However, Indonesian consumers still rarely use debit cards for low-value transactions, therefore this remains a marginal consideration.

The impact of digital wallets on other non-cash payment types is relatively limited now. However, with the rise of e-commerce and contactless payment after COVID-19, the acceleration in digital wallet usage will intensify the competition between payment companies, including global network operators and financial institutions. On one end, digital wallets can be considered an emerging revenue stream within the existing payment ecosystem, opening a door to the untapped market of cash spenders. On the other, wallet players with ongoing technological innovation pose a challenge to conventional payment companies, which will need to reinvent to stay relevant and sustain the branding of their core products.

For more information, access our Digital Consumer Survey 2020: Key Insights Report and Financial Card and Payments in Indonesia report.