Euromonitor International forecasts that Latin America will be the region with the highest rate of inflation in 2022 at 15.1%. Consumers are generally expected to exhibit increasingly price-sensitive behaviour when shopping for home care products. They are expected to purchase in bulk and look for promotions and discounts more frequently. This inflationary backdrop is affecting consumers, regardless of their income, although the impact is certainly being felt more profoundly among the low- and middle-income population. For instance in Brazil, Social classes D and E (the poorest economic classes) account for more than 75% of the population, considering only individuals above 15 years old.

Private label is expected to benefit from low consumer confidence

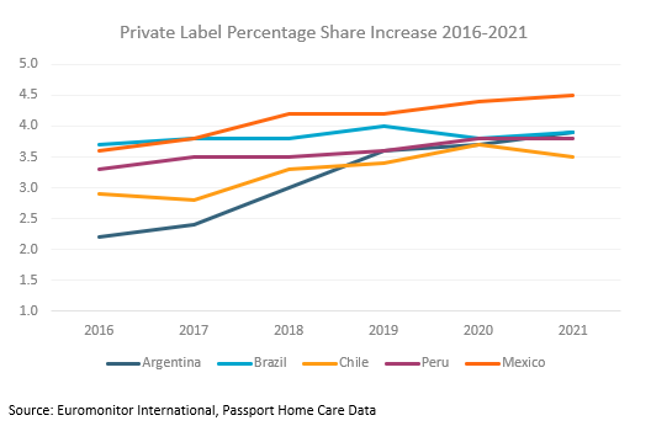

Downtrading to more affordable products can be observed when economic uncertainty poses a challenge to disposable incomes. Between 2019 and 2021, home care private label lines in Latin America recorded retail value growth of around 25%, with growth rates of more than 20%, at current prices, in countries such as Colombia, Brazil and Chile In many Latin American countries, a number of supermarket and hypermarket chains have expanded their private label offering, which enables them to offer consumers affordable alternatives to branded products.

Economic uncertainty boosts illicit trade of home care products

Our industry sources suggest that a growing number of consumers are also participating in the illicit market for illegally produced and distributed home care products. These types of products are typically sold on the street and through street markets at prices significantly lower than those of products sold through official channels. In Chile, for example, thisconstitutes a real health threat, and the country’s Toxicological Information Center reports an alarming increase in cases of intoxication related to vinegar and chlorine used in these counterfeit products.

Changes in pack types and sizes expected to result from inflationary pressures

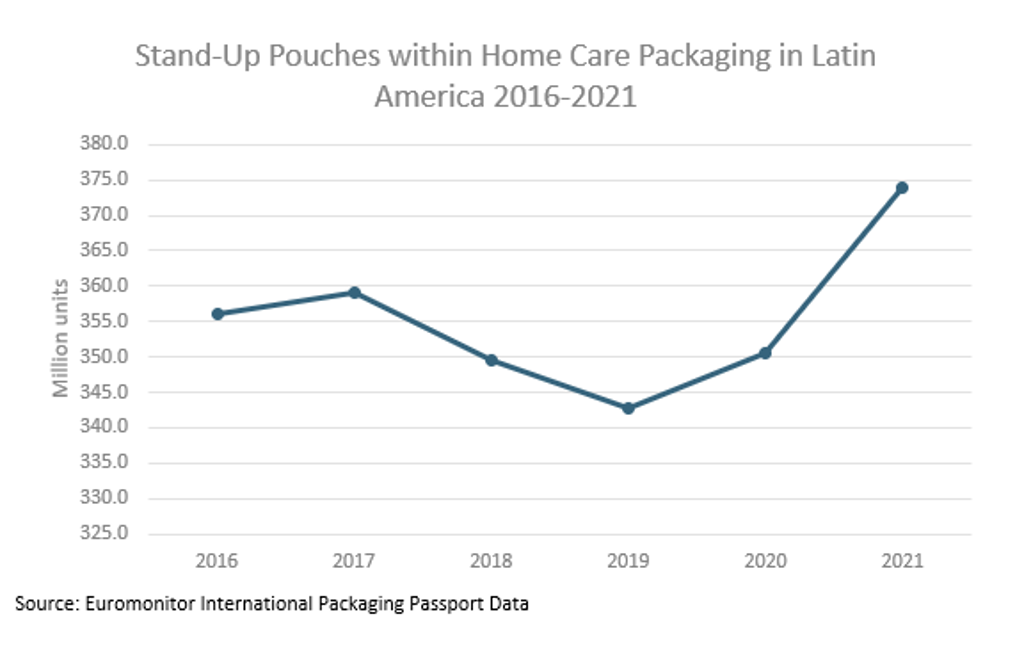

In many Latin American markets, different packaging options are seen by manufacturers as a way of cutting costs – with examples being seen across products like window cleaners, disinfectants and hand dishwashing. Products sold in pouches are typically lower priced and therefore preferred by consumers over trigger packaging when they want to save money. With regard to the available packaging types, the price differences vary within each market, although Latin American consumers as a whole are generally well aware of these options to tackle inflationary effects. For example, some products in Brazil now feature both types of packaging, with consumers looking to save money likely to purchase pouches.

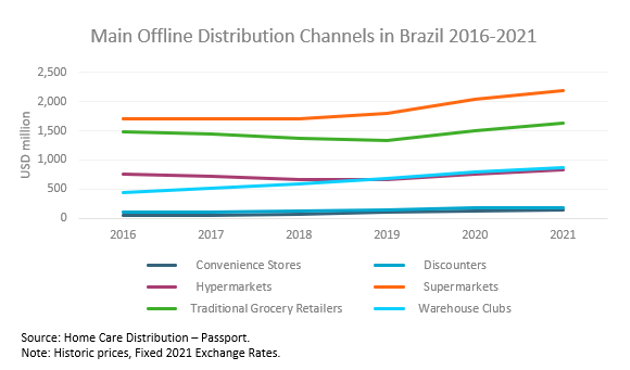

In terms of distribution channels, Brazilian consumers shopping in warehouse clubs often prefer bulk purchases to gain access to discounts, which will be one of the positive drivers of growth in the forecast period. The graph below shows the growth in major distribution channels in Brazil, including warehouse clubs.

To ensure sustained growth the industry must adjust to a new reality

Currently, the economic and political situation in Latin American countries remains uncertain. According to Euromonitor International’s Economies and Consumers forecast data, the inflation rates in Brazil, Argentina, Paraguay and the Dominican Republic are among those expected to stand out in 2022. Companies are advised to focus on business adaptations and data-driven decisions, especially related to consumer behaviour at point of sale:

Since the informal market has been expanding in the region, it will be crucial for manufacturers and retailers to develop more sophisticated pricing strategies, also based on retail channel information on product demand.

As the importance of cleaning is still top of mind among consumers due to COVID-19, hygiene should continue to be a key driver of sustained growth.

Taking into consideration problems stemming from social inequality in some Latin American countries, examining the framework and the reasons behind consumers’ purchasing decisions will be essential when developing brand awareness campaigns.

In the long run, players should look to improve consumers’ perception of their products with regard to quality and the cost-benefit relationship, so that brands can gain penetration of as many households as possible in this challenging environment.

See also Continuous Hygiene Focus to Protect Home Care Against the Effects of Inflation for further insight.