As Coronavirus (COVID-19) has spread around the world, even as most physical grocery stores remain open, many consumers – fearing for the health and safety of themselves and their loved ones – have sought to eliminate all but the most essential visits to brick-and-mortar stores from their daily or weekly routines.

As a result, many grocery retailers have seen their online sales increase at an astounding rate. Perhaps no companies operating within the online grocery sector have seen the shift in demand caused by the COVID-19 pandemic as much as hyperlocal delivery services that focus primarily on the grocery space, as consumers in many markets have turned to these companies to have groceries delivered from their favorite local supermarkets.

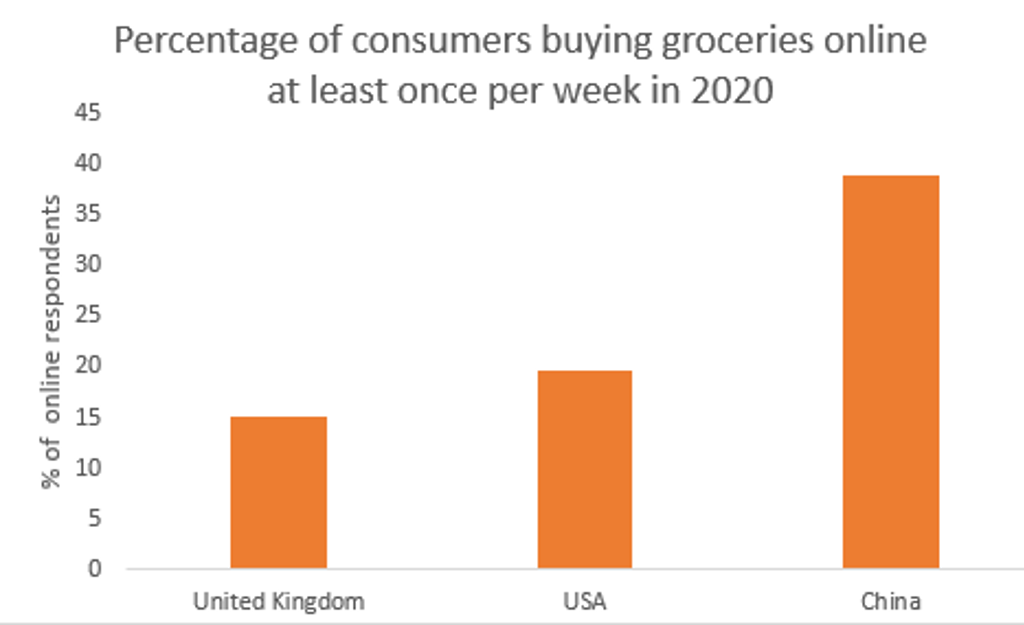

Source: Euromonitor International Consumer Lifestyles Survey – Feb 2020

With demand for grocery delivery at an all-time high, legacy grocers that do not operate their own delivery services – and may have been reluctant to hand over a slice of their sales to third-party service partners in the past – are now scrambling to work with hyperlocal players. As a result, hyperlocal grocery delivery sales have exploded:

• Meituan-Dianping, the Chinese hyperlocal delivery super app, reported a 400% year-over-year spike in sales in February.

• Instacart, a North American hyperlocal player, posted year-over-year sales growth of 400% in April, passing Amazon to become the leading scheduled grocery delivery player of any kind in the region.

• Irish grocery delivery start-up Buymie has raised EUR2.2 million from different investors in April 2020 to expand its operation. The company has extended its trial partnership with Lidl in Ireland, and for the first time has expanded internationally with a partnership with Co-op in the UK that launched in May 2020.

Other delivery players moving into grocery retail space

In contrast, many delivery providers that focus primarily on the consumer foodservice sector have seen restaurant closures as a precautionary measure during the pandemic. Seeing the increased demand in grocery delivery, many of these companies that have had very few grocery partnerships in the past or had not previously worked with grocery retailers at all are now attempting to move into the space:

• In the US, foodservice delivery company DoorDash has partnered with convenience store retailers such as 7-Eleven to offer grocery delivery from its new retail partners’ stores.

• In Europe, ride-hailing giant Uber’s consumer foodservice delivery platform, Uber Eats, has also partnered with retailers such as the likes of Carrefour; as a result, Uber’s reported grocery delivery sales in Europe increased 59% from February to March.

• Discounters have historically been somewhat reluctant to fully integrate e-commerce into their business models due to concerns about the cost efficiency of embracing a potentially expensive online grocery experiment. Yet, today, partnering with third-party delivery services has become one of the most common ways for discounters to enter the grocery e-commerce space. In the face of the COVID-19 pandemic, Aldi UK has partnered with Deliveroo to offer delivery of 150 grocery products to customers in the East Midlands within 30 minutes, while shoppers in Poland can now use the Glovo app to place online orders in Biedronka.

High costs of hyperlocal delivery unlikely to result in longer-term shifts

Although most grocery retailers around the world have been rightly classified as “essential” businesses during the pandemic and remained open, consumers’ needs have rapidly changed during this unusual time. As a result, companies operating in the food retail and delivery space need to rapidly adapt new technology to meet the needs of consumers looking to reduce the time they spend in stores, substitute in-person interactions with digital touchpoints, and smooth out the checkout, payment and logistics experiences. Most companies will not be able to complete an omnichannel transformation overnight, but all can think about small steps to meet the new needs of shoppers.

One such relatively quick, low-cost solution has been seen in the form of partnerships between hyperlocal delivery services and grocery retailers. However, although in the short- run these on-demand delivery services will prove essential for many shoppers and retailers alike, the expected global recession in 2020 will have a negative impact on any possible permanent consumer behavior shifts given that delivery costs of such services remain high and may prove prohibitive as a long- term grocery delivery solution.

To understand more of the immediate and long-term impacts of the pandemic on the grocery retail channel, please follow the link to the report The Global State of Online Grocery in 2020.