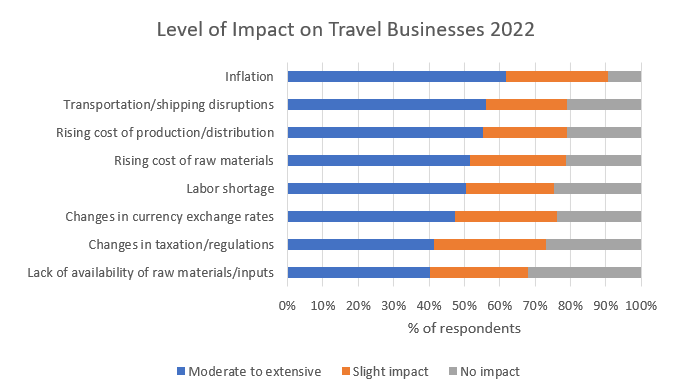

In 2022, 62% of travel businesses in Euromonitor International’s Voice of the Industry: Travel Survey reported that inflation was by far the most disruptive factor that they face, having a moderate to extensive impact on their daily operations.

As costs rise, businesses have fewer options from which to choose, where 56.5% of travel businesses have raised all, if not some, of their prices in response to escalating costs. The grim alternative is to absorb rising costs without passing them on to consumers. However, that then leads to living with a lower profit margin, as noted by 44.2% of respondents. Furthermore, 29.6% of travel companies reduced their marketing spending, while only 6.5% lowered employees’ wages.

In turn, by far the biggest obstacle for consumers’ willingness to travel is high air fares, accounting for 83% of travel companies saying that this was a discouraging factor for their customers, followed by higher hotel prices (76%), compared to 66% continuing to struggle with ongoing COVID-19 travel restrictions.

Technology helps to ease the pain of spiralling costs

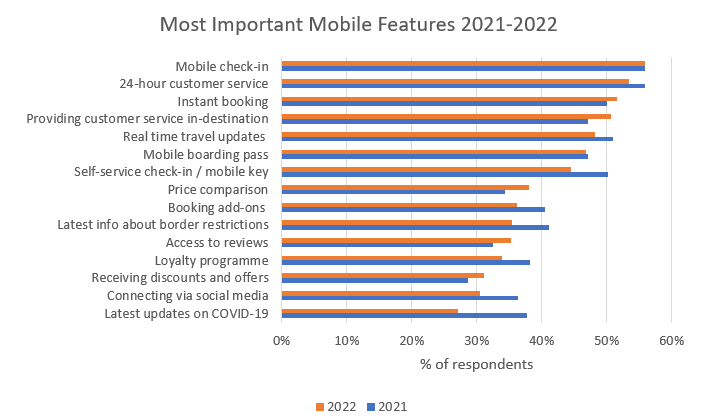

Digitalisation is an antidote to spiralling costs by enabling consumers to find the best price in times of high inflation and economic uncertainty. It is no coincidence that a higher number of travel businesses reported providing a mobile app to their customers, standing at 45.1% in 2022, and up by an impressive eight percentage points on the previous year. This is all part of delivering the most consumer-centric and seamless travel experience, which delivers what consumers need at the right time and place, and ensuring that they obtain the best deal for them.

Unsurprisingly, considering the current climate, providing price comparison functionality via mobile was the fastest growing area of activity seen by travel businesses, an increase of 3.7 percentage points to account for 38%. Discounts and offers also enjoyed an increase in uptake, whilst loyalty fell. Rising brand disloyalty is a major challenge for travel brands to overcome as consumers become increasingly brand agnostic as inflation takes its toll on their budgets and eats into their spending habits.

Will price sensitivity push consumers away from sustainable travel?

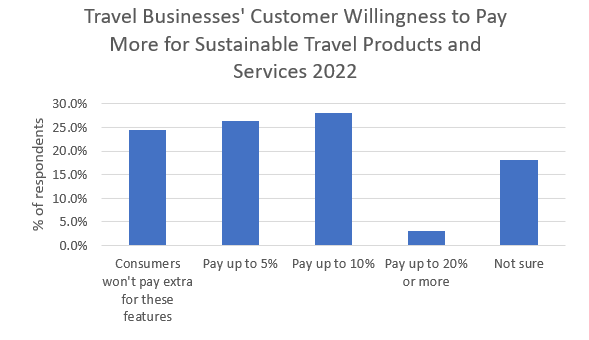

So far, travel businesses – despite inflationary pressures – are not seeing consumers turn their back on quality, sustainable travel options. In fact, a surprising 57.5% of customers are willing to pay more for sustainable travel products and services in 2022. Asia Pacific showed the highest number of travel businesses (77.5%) to have seen increased interest from consumers in all aspects of sustainability and travel.

Globally, consumers continue to be concerned about climate change and these deeply held attitudes are transforming the way that they book and enjoy travel. One of the most popular ways that consumers are choosing to make sustainable travel choices is by supporting local businesses and communities, rising by 6.5 percentage points over 2021-2022 to reach 66%. Other ways include choosing travel providers that use renewable energy or offset their carbon emissions (25%), whilst the strongest interest grew in companies offering carbon tracking tools for visitors.

The number of travel businesses offering such tools grew by a remarkable 11 percentage points to 29.9% in 2022, illustrating that carbon tracking on the consumer side is gaining traction and uptake.

Placing carbon front and centre of the travel booking process, whether at the time of inspiration, at the time of booking or in-destination, is a vital way to ensure that travel and tourism can deliver on its promises to become net zero by 2050, if not sooner.

For more insight and analysis please read, Voice of the Industry: Travel Survey – Facing New Challenges, published in May 2022