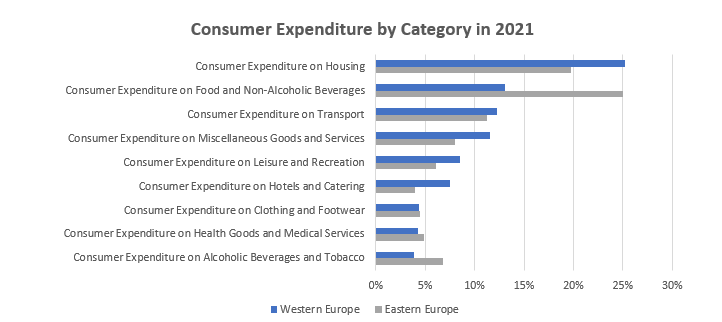

Depending on where we look in Europe, the appeal of organic products to consumers differs. Product penetration of organic packaged food on e-commerce stands at 14% in Western Europe (WE); meanwhile, the online share of organic products in Eastern Europe (EE) constitutes just 9%. This discrepancy is mostly caused by consumer price sensitivity. In WE, consumers allocate about a quarter of their expenditure to housing, and then 13% goes on groceries. Meanwhile in EE, grocery spending constitutes 25%, and in addition housing makes up 20% of expenditure. Such distribution indicates that covering the basics in EE takes a larger chunk of consumers’ budget, leaving them more price-sensitive and less attracted to organic products, which usually carry a higher price tag and are considered a luxury choice by Eastern European consumers. In addition, economic uncertainty and a surge in inflation are motivating consumers to search for value offers. Thus, Euromonitor International’s Voice of The Consumer: Lifestyles survey indicates that along with rising grocery spending in 2022, consumers anticipate buying more private label goods. Such a trend will therefore limit demand for branded organic products for the next few years, as consumers adopt more frugal shopping habits.

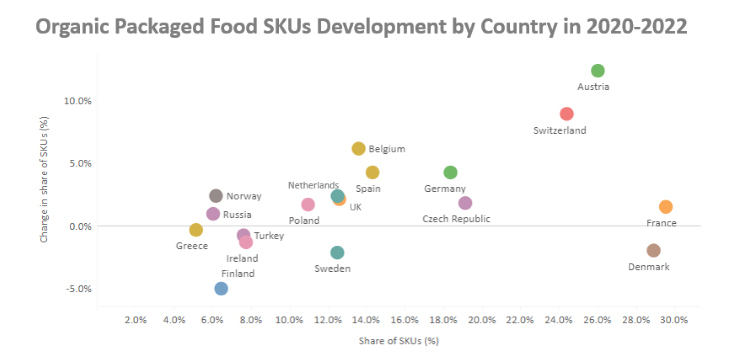

When looking into organic claims development by country over 2020-2022, Austria stands out, as the popularity of organic claims increased due to multiple food scandals boosting food safety concerns. However, strongholds for organic products, such as Denmark and France, witnessed a slowdown. It is not that the organic claim is losing its appeal, but competition is arising from other developing trends and labels. For example, amongst sustainable sourcing labels on e-commerce, the organic SKU count by far outnumbers all the others. Nonetheless, when looking at the growth rate of Fairtrade and Rainforest Alliance labels, in the last two years their growth was twice as fast as organic, thus presenting niche, yet increasing, long-term competition. When reviewing all the claim categories online, in WE the organic label stands as the most popular, followed by gluten-free and vegetarian claims. Meanwhile, at the top of the most popular list in EE stands the no preservatives claim, and only then come organic and gluten-free claims. Competition with different value-added claims is also perceived in large categories such as baby food. Declining birth rates cap volume consumption prospects; therefore, instead of offering the traditional organic upgrade, now brands are actively innovating and offering different attributes of clean label or functionality.

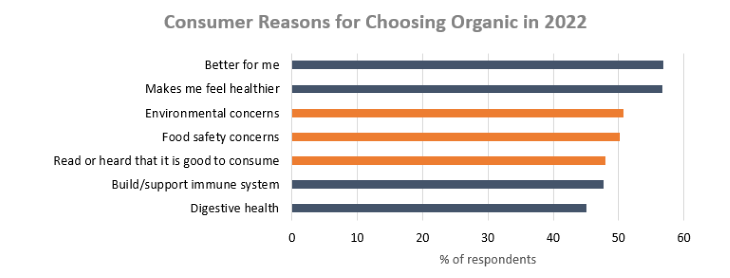

As the competition increases, it is essential to understand what motivates consumers to pick organic vs standard quality. The Euromonitor 2022 Health and Nutrition survey reports that the strongest motivations for consumers to choose organic products still mainly revolve around health benefits. However, in the recent year the only motivations that grew in popularity (marked in orange below) are those relating to food safety and environmental concerns. This direction of consumer reasoning implies a more holistic understanding about organic; it is perceived to provide personal benefits, as well as addressing some global concerns. According to the recent survey, the most stable organic consumer group in the context of recent economic uncertainty is the age group 30-44, as this group is usually more economically established due to peaking careers; also, their preference for food items to be organic is the strongest since 2019.

Bearing in mind all the latest developments and trends, there are three main recommendations for developers of organic products:

- Integrate and clearly communicate value added

Nowadays, consumers are increasingly paying attention to transparency, ingredients lists, packaging, etc. Thus, the organic claim can no longer stand in isolation; instead, it should address the conscious, fast-paced consumer base with products that integrate value-added qualities and clearly communicate those benefits. Clean label, functionality, and product origin are a few important attributes on the list of consumer food preferences that could be considered when drafting new organic product concepts.

- Aim for more impactful sustainable product solutions

Growing consumer awareness and the motivation to choose organic for environmental reasons should encourage manufacturers to walk that extra mile in their overall strategy. One example of a creative solution was seen in France early in 2022. The well-known organic dairy brand Les2Vaches, in addition to its Fair for Life claim, also adopted the Too Good To Go claim, which encourages the fight against food waste. It is not only the claim logo that marks its commitment, but this organic brand also adds instructions to inform consumers how to check their yoghurt to determine if the product is still good to eat after the expiration date. A little cow illustration on front of the pack suggests: “Look, Smell and Taste, Don’t Waste”.

- Explore new product categories

New consumer priorities, such as shopping via e-commerce, raise awareness about organic benefits and help innovative producers to enter new categories and reach new audiences. One such example comes from Germany, where the Oceanfruit brand introduced its award-winning organic prepared seaweed salad. In addition to offering a variety of products, the brand also supports product adoption by suggesting various recipes on its website.