Quick Commerce in Western Europe: Trends, Operational Models and Prospects

Quick commerce is gaining traction in Western Europe with Euromonitor International counting 30 companies currently competing on the market, most of which established in the past 10 months and is mainly focused on grocery deliveries. With consumers in the region getting accustomed to fast and ultra- fast deliveries, it is important for brands and retailers to understand the trends, operational models and prospects ahead.

Why is quick commerce growing in Western Europe now?

Quick commerce is defined as the third generation of commerce, based on fast (less than one hour) and affordable delivery of small quantities of goods. It is certainly not a new concept, already well developed in markets like South Korea and India, but recently Western Europe has become one of the most attractive regions for investments globally. There are several reasons for this.

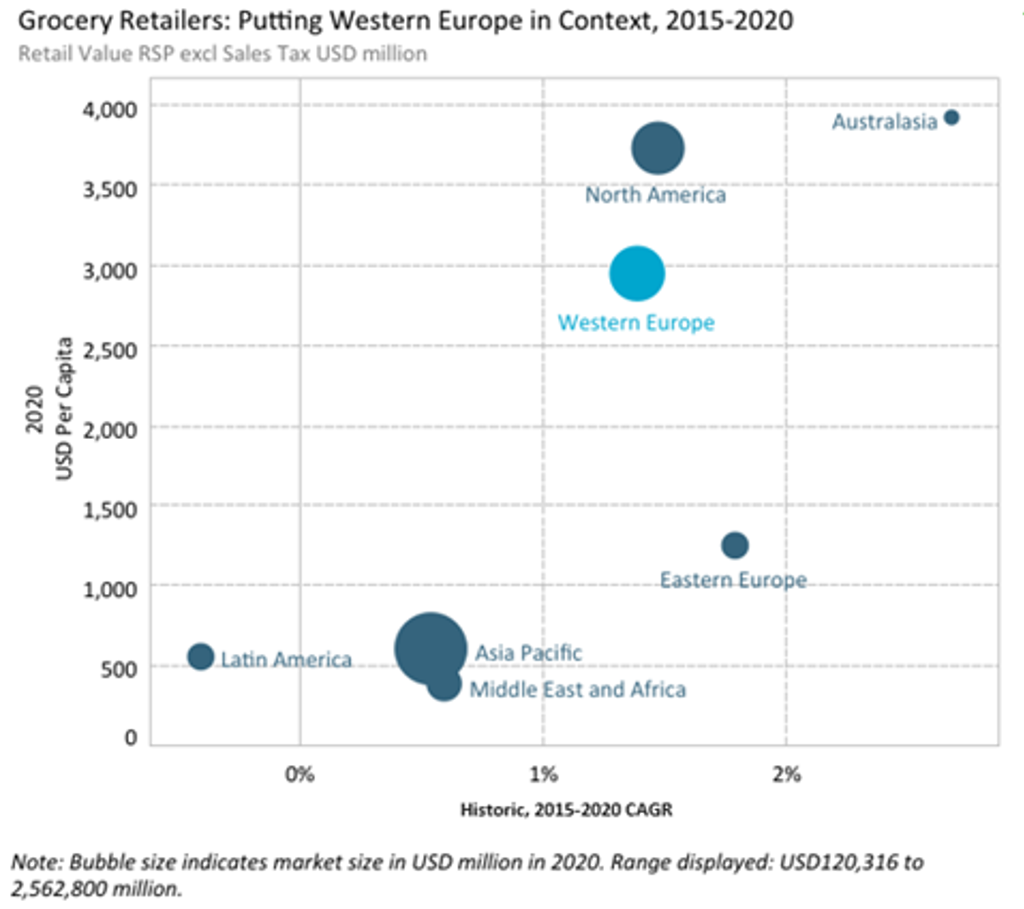

Firstly, Western Europe has the third highest per capita consumption level in store-based grocery retailing globally, growing 4% in 2020, as consumers needed to prepare more meals at home during lockdowns and work-from-home mandates due to the pandemic.

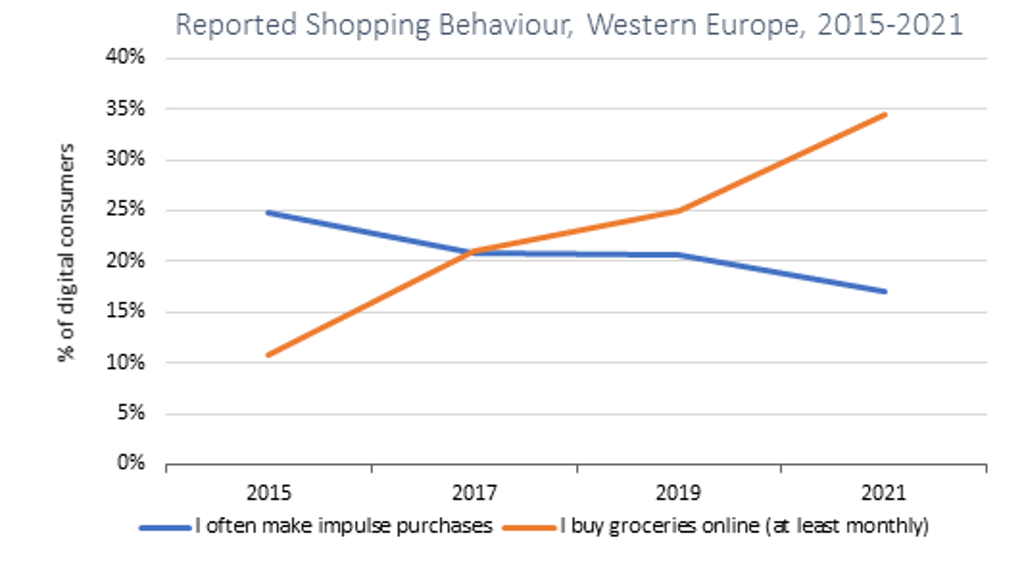

With many consumers avoiding unnecessary shopping excursions wherever possible, impulse touchpoints (eg endcaps, checkouts, special displays) were lost and online grocery sales have been propelled to record heights. Delivery and click-and-collect service models were viewed by many as a way to minimise the risk of infection. Yet, delivery times have proved problematic with 37% of Western European consumers identifying a longer than expected wait as the number one challenge for delivery, according to Euromonitor’s Voice of the Consumer: Digital Survey, fielded in March 2021. Also, given in some markets like Spain, France, Greece and Germany, a night curfew was also imposed, sometimes for weeks at a time, an urgency was created for delivery services to respond quickly to impulse and dinner shopping occasions and develop more locally-focused distribution webs, positioning products closer to the end-consumer and thus, cutting delivery times.

Additionally, Western Europe has high disposable income (8 out of top 20 global markets in terms of highest per capita disposable income are located here); high levels of urbanisation (78% of the population lives in urban areas) and a large portion of single households (33% of all households types), factors which have led to rising demand for smaller grocery baskets for the past couple of years.

All of these consumer and market trends, coupled with a total grocery market of USD1.5 trillion, excluding VAT, in Western Europe, and with a low online penetration of just 3% in 2020, has created the perfect storm and opportunities for investments to flood in, with quick-commerce proving a favourite of European entrepreneurs and VCs over the past 18 months.

What are the type of companies currently competing in this environment?

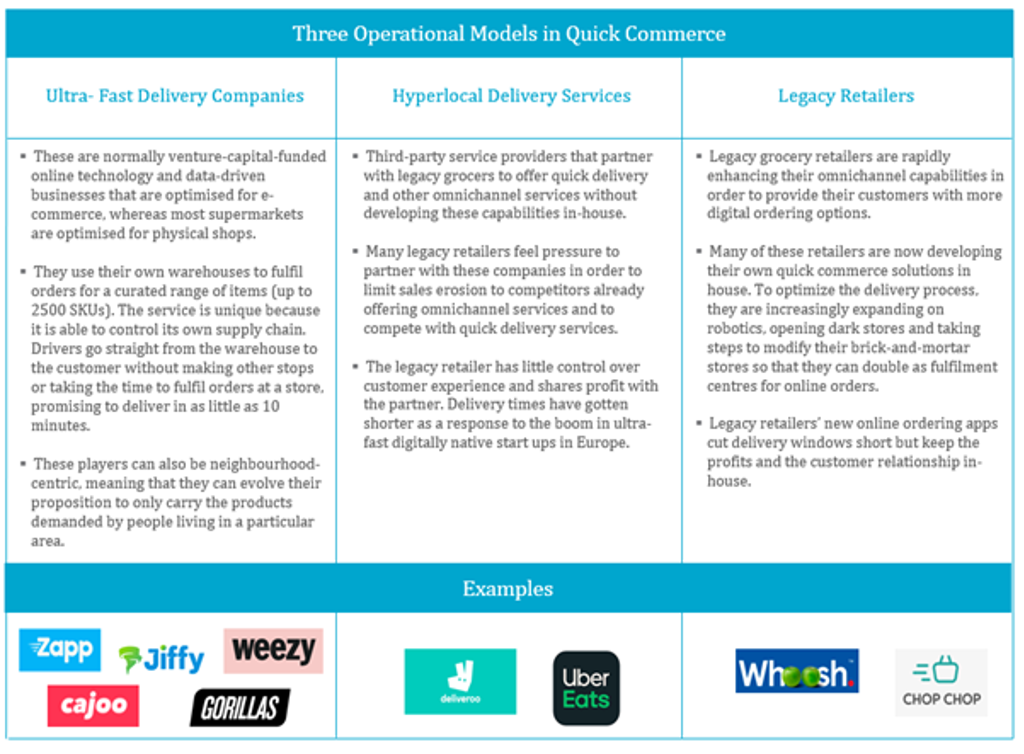

A wide range of players are exploring the quick commerce market; ultra- fast and hyperlocal delivery services leveraging their existing tech and supply chain options and legacy retailers looking to expand and curate their omnichannel experience.

What are the long-term prospects ahead for quick commerce?

Doubts around the market potential for quick commerce, its utility post lockdown and its economic equation are covered constantly by analysts and investors. Most commentators and some players seem to think that profitability can only be achieved by the player who manages to capture most of (or the entire) market, much like Uber. There is pressure to burn through investor money to gain market share, but profitability is still quite far away, and may never be achieved given the play is currently mainly in grocery retail, which has notoriously low profit margins.

The novelty factor, however, is quite strong. People are curious and they do like the convenience, even if a supermarket/convenience store is a short walk away, which is often the case in large European cities. But once they try the service, according to key players on the market, repeat purchasing seems to be low and thus, volumes remain below expectations. Part of the reason for this is that brand loyalty is typically low. With VC cash sloshing around, there is always a company offering bigger and better discounts and with little differentiation between offers, outside of price, consumers are switching quickly between apps. Currently, none of the digitally-native quick commerce models is positioned better than the other, and players are focused on establishing the right infrastructure supporting the deliveries. Certainly, legacy retailers’ own apps benefit from a large following from the start, and an established retail-built environment to facilitate deliveries. Their aim, however, is to provide customers with more digital ordering options and not necessarily to become profitable solely from their quick commerce service.

What should quick commerce players think about right now to ensure future success?

To be able to become neighbourhood-centric, possibly catering via completely different product ranges from one area to another, can be an even greater advantage for market players. However, at a time where there has been a flood of new players and no brand loyalty, “learning as you go” and only utilising internal data about preferred brands and products in a particular area, may simply not work quickly enough to secure repeat customers. External partners’ data and insights that can help determine best products and brands resonating with consumers in particular areas and markets may prove to be the difference between success and failure.

Additionally, success will be possible when companies dig deeper in understanding their consumers, and go wider in seeking inspiration from adjacent industries and categories, to find opportunities for growth. For instance, quick commerce is already taking a share of convenience stores, but more limited sales from consumer foodservice. Exploring dark kitchens and fully going head to head with foodservice could open create a new customer base, and companies like goPuff are already exploring this avenue. Adding an additional option of delivery of different product categories, could arguably make the quick commerce business model much more complex, but again external partners who can advise where to play here will be crucial.

What should brands and retailers know about how to play (and win) with this model?

- Quick commerce does not have to be limited to grocery retail: Almost any product can be delivered to a consumer in a short time window if the right infrastructure and logistics are in place. Certainly, in Western Europe, quick commerce is still somewhat limited to grocery items but a player like Glovo, for instance, has been expanding its product delivery range in selected areas, including electronics and even furniture items.

- Partnership may be the best way to achieve significant market share and thus profitability: While most ultra-fast delivery companies still shy away from partnerships with retailers and are focused predominantly on growing the number of their dark stores, it is very likely their idea of “going/ doing alone” and attempting to achieve the highest share possible, would change soon. Certainly, with hyperlocal delivery services, we have seen several successful partnerships such as Estée Lauder Companies partnering with Uber on one hour delivery in May 2021.

- Quick commerce may not be a worthwhile addition to all legacy retailers; understanding where and what is key: While physical retailers and e-commerce giants have invested heavily in logistics to speed up delivery times, this was still not fast enough for some categories. In some ways, the gap between when a consumer wants the item and when it can delivered is so wide that it can hurt e-commerce uptake. The bottom line, which is rarely discussed, is that quick commerce should be viewed as an extension of the store. Utilising dark stores and existing stores to achieve maximum gains will be key moving forward. Increased partnerships and merger and acquisition can be expected to follow. Some have already made smart moves in this area – Carrefour and Cajoo, Rewe and Flink, Amazon and Deliveroo – but the established players often find quick commerce a bit too risky and not necessarily a strong addition to their existing business model. The boom in quick commerce in 2020 and 2021 is just a preview of the upcoming changes in the role of store and the permanent shifts towards e-commerce and legacy retailers will be further exploring investment opportunities in the space.