Partly supported by government campaigns, Vietnamese brands across diverse categories have seen strong growth in recent years. Many local names have attracted consumers’ attention and helped form a culture of consuming domestic products, in turn helping to boost the country’s sustainable economic development.

Government call to action supports local brands and prioritises purchases of Vietnamese products

During the 10 years of the "Vietnamese people give priority to using Vietnamese goods" campaign, it has helped create positive change in consumers’ awareness and behaviour, leading them to prioritise buying and using Vietnamese products to support local enterprises. In particular, events such as market days, that bring Vietnamese goods to rural areas, have helped contribute to changing local consumers’ consumption habits, guiding them towards Vietnamese goods.

The campaign has been identified by the Party Central Committee's Secretariat as one that is necessary and important to continue the country’s socioeconomic development. In 2021, the government signed Directive 28/CT-TTG to further strengthen the implementation of this campaign in the ‘new normal’ life post-COVID-19. It has requested the relevant ministries, branches, localities and agencies propagate the necessary information that will help people become more aware of the quality of local branded products and convince more consumers to buy local.

Vietnamese brands show trust in evidenced quality and value continued development

Within the consumer electronics industry, local player Vingroup JSC offered consumers new experiences in its smartphone and television series. The company’s smartphone, Vsmart, which was launched in 2018, quickly grew to become one of the top five brands in Vietnam. Along with offering an under-display selfie camera and quantum security in its Vsmart Aris model, the company also introduced the 4G Vsmart Beeline, priced at VND600,000 (USD26), which was the cheapest item equipped with 4G features in the market. Affordable pricing along with latest features helped the brand grow strongly. Even when the company announced that it was going to stop its smartphone and TV business in 2021 to concentrate on electric cars and smart home development, local people aggressively sought out the company’s smartphones to keep as a souvenir.

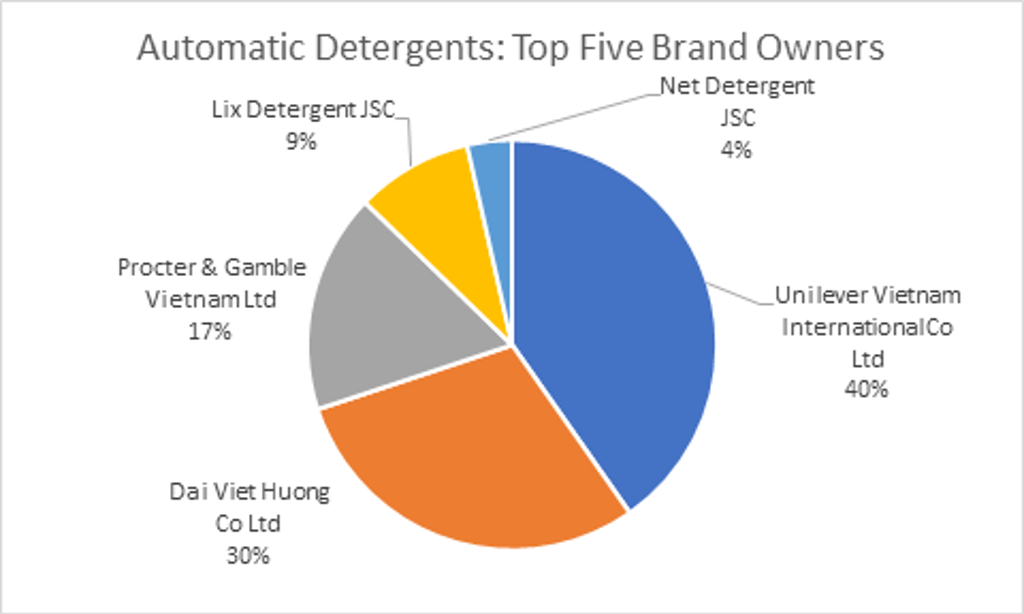

Looking at the home care industry, local enterprises Lix Detergent JSC, Net Detergent JSC and Dai Viet Huong Co Ltd have seen stable growth, as top five laundry care players in Vietnam. Their success can be attributed to their product quality, retail expansion and smart marketing strategies. Net, for instance, has been able to grow well thanks to its promotional programmes, competitive pricing, and wide distribution network in rural Vietnam.

Source: Euromonitor International Home Care 2022ed

In terms of retail, Lix Detergent JSC has wide coverage across the country, with products displayed across supermarkets and mini supermarkets such as Bach Hoa Xanh and Winmart. After Massan acquired a 52% stake in Net Detergent JSC, its products are being sold across 3,000 Winmart stores, as well as over 300,000 traditional retailers. The brand also boosted its online sales through e-commerce.

Another interesting spotlight is the growth of ABA from Dai Viet Huong Co Ltd. With sales focused in the South, Mekong Delta and parts of rural areas across the North Central, Northwest and Northeast, the company has developed its unique style of marketing message, which is based on a deep understanding of local culture. By doing so, the company was able to quickly attract consumers and maintain stable sales.

What next?

Vietnam’s GDP increased at a CAGR of 5% in real terms over the past 20 years – faster than the global average. In 2020, when the pandemic created significant disruptions in the global economy, Vietnam’s GDP continued to register positive growth of 2.3%. Even in 2021, after being hit by the COVID-19 Delta variant, and despite the ensuing lockdowns, the economy grew by 2.5%. Over the forecast period 2022 to 2027 the country’s GDP is expected to grow at a CAGR of 6%.

As income levels continue to rise and more people enter the middle class, consumers are expected to have higher purchasing power. The government is also continuing to support the “Vietnamese people give priority to using Vietnamese goods” campaign. Most recently, Da Nang launched the campaign in the province in 2022, with a series of activities in a bid to change local consumers’ shopping habits and encourage them to opt for locally produced goods and services. Expected growth in consumption power along with supporting government policies are likely to further encourage consumers to prioritise Vietnamese brands.

Even though local brands are forecast to grow well in the coming years, competing directly with global brands seems challenging, as local brands usually have smaller budgets. For local brands to grow well, they will need to adapt to local consumers’ needs, ensure good product quality, continuous product development and the right pricing strategy. Targeting specific consumer segments by region, along with a deep understanding of local cultures, will be crucial to construct effective marketing messages.

Besides this, pricing strategy will remain an important factor. Brands need to ensure that their pricing strategy helps the consumer find true value in their products. The consumer should feel as though they are getting a real bargain with extra benefits compared with competing brands. However, the product itself should not be a shadow of global brands. It must carry its own USP and differentiating innovation.

Finally, labelling and packaging must also be in line with evolving trends. Contemporary labels and packaging are usually more appealing to consumers and more likely to grab their attention.

Retail expansion beyond urban centres, higher living standards, growing internet penetration and a rising digitally native consumer base provide a ripe market for brands to unlock the potential. Along with this, as millennials and gen Z increasingly become the key spending cohort, understanding the nuances of these demographics will also play a key role in the rise of brands.

For further insight, read our report Home Care in Vietnam.