A legacy of the pandemic has been a shift in attitudes towards obsolescence and avoidable waste – consumers have always disliked items breaking too early or too easily, but their tolerance for knowing they are trading down to receive low quality as well as low prices has collapsed.

The 26% of respondents in 2019 who did not mind trading price for quality dropped eight points in four years to fall below 18% by 2023

Source: in Euromonitor International’s Voice of the Consumer: Lifestyles Survey

Many consumers took the extended time at home during lockdown as an opportunity to declutter their homes - they were forced to acknowledge and then remove a decade’s worth of packaging and product waste when their limited living spaces proved to be a challenge, impossible to navigate safely, and thus intolerable. The consumption guilt that accompanied this visceral disposal experience left a mark - across regions, generations and time.

Brands are upgrading material choices to deliver products that last longer

In plastic, Tritan is proving to be a game changer, impacting food storage and refillable drinking bottles the most so far, and due to regional material preferences, this is also impacting North America more than most other regions. Tritan is an award-winning material for brands such as Rubbermaid, with the latter using it in its Brilliance premium range.

Image source: Rubbermaid’s Brilliance range using Tritan

Tritan is an upgrade versus anything HDPE or food grade PP can offer; it is an extraordinarily tough plastic for both physical and chemical resilience, whilst being lighter than glass, BPA-free, and giving a visual clarity level similar to the best polycarbonate could manage (without the reputational issues for food leaching and contamination potential associated with the latter).

Two aspects increase the service life, beyond reduced impact breakages – Tritan is able to withstand staining, with food sauce stains (especially tomato-based sauces) eroding and marking plastic, and creating one of the major causes of “early retirement” for product use. Tritan is also better at standing up to the chemical and heat challenges posed by all but the hottest dishwasher steam cycles. The latter point is really important.

Coatings and treatments are the other rising approach to boosting durability

Heat is not a significant issue for metal, but chemistry is a very different matter, particularly when considering the corrosive environment of a dishwasher; a ceramic layer here can make a difference. Cutlery with ceramic coatings are still niche at <5%, but sharply rising since 2019, particularly in Spain, Italy, Norway and South Korea (web scraping SKU analysis in 2023).

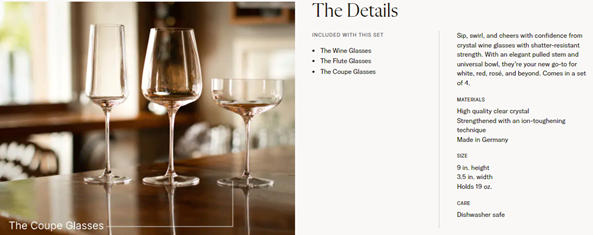

Glassware is seeing a rise in ion-toughening and shatter-resistant treatments, allowing design variations that trend towards a thinner bowl and stem, with Fable’s glassware range as one interesting growth example that combines design delicacy while still delivering a more durable product.

Source: Fable’s glassware using ion-toughening treatments.

These hardening treatments are also being linked to packaging and product claims for a longer life in the dishwasher – and this message is a critically important and consistent one for all stakeholders in homewares.

The lifespan of homewares products is not measured in years and months - it is measured in dishwasher cycles, visible in worsening early failure rates in multiple product types

Source: Euromonitor International

Smart dishwasher usage data reveal that at the height of lockdown, dishwasher cycles were 24% up in Europe (indicative of one extra meal a day, washed by the dishwasher in 50% of homes). In this period of hybrid working between offices and homes, dishwasher cycles are still more than 10% up on pre-pandemic levels.

This is starting to tell on dishwasher failure and replacement rates, but it harms homeware failure rates faster and harder, at a time when consumers are increasingly intolerant of obsolescence.

Sustainability via durability is positive, both for commercial and ethical metrics

An investment to increase the service life of a product reduces material and process inputs, but it also (unlike recycling) reduces the carbon footprint of waste across the logistics chain.

It is pleasing to see that consumers are starting to once again embrace design philosophies for parts and materials choices that drove innovation and manufacturing ideas years ago, before planned obsolescence and unthinking mass consumption came to dominate. Food storage cannot be the limit for Tritan’s value creation in the sector; plastic is used across dining categories and in utensils, and greater durability against knocks and dishwasher use adds value across wider applications than evident so far. Cutlery and cookware are not the only product types where protective non-stick and aesthetic ceramic coatings can add value – utensils being the most obvious space where this will become prevalent.

Hybrid working is likely to remain a relevant trend, and thus, the greater abrasion and chemical damage from dishwasher heat and chemistry will continue to shorten product service lives and add warranty costs, neither of which is helpful to a brand’s bottom line.

The direction of change towards more frugal shopper mindsets, with a less favourable attitude towards disposability in 2023, rewards a greater investment in sustainability via durability, meaning the brands at the forefront of innovation are creating a better future for themselves, both commercially within their premium positioning, but also ethically, pushing one of the most potent aspects of “reduce” when it comes to waste.

For more on this topic and further analysis on homewares and home furnishings trends, please read our report World Market for Homewares and Home Furnishings.

To explore circularity and the sustainability topic in more depth, a good starting point for the latest trends and developments can be read in our report Sustainable Home.