Top Five Global Trends in Households

As global businesses continue to face uncertainty and challenges posed by the Coronavirus (COVID-19) pandemic, insights into household trends are critical in corporate strategy planning. Euromonitor International has identified the top five trends to help companies adapt to changes in consumer profiles and needs, and identify business opportunities.

Working from home becomes the new normal

Working from home was already on the ascendancy before COVID-19, and now that businesses have had to adapt to a remote workforce, the initial fears concerning loss of productivity are likely to have diminished. This will lead to a far greater degree of remote working even after the COVID-19 restrictions have been lifted.

Many consumer goods and services businesses have had to shelve innovation pipelines and shift their focus to operational planning. It is clear, however, that there are several new consumer needs brought about by different aspects of sustained remote working. Some may be only partially (or poorly) addressed by websites and apps, requiring product innovation.

In the long term, remote working could be a force of disruption, as consumers and businesses alike reassess their priorities and spending. The impact is likely to be felt most by those strongly linked to densely populated urban centres, as these areas are likely to experience the largest change.

Hometainment accelerated by the pandemic

Hometainment – the trend of entertainment in the household – has been accelerated by the impact of COVID-19, increasing investment in the technology and infrastructure necessary to bring more away-from-home experiences into the home.

This has been further enabled by a rise in household internet access, and increased ownership of smart durables and general electronics across the world, as consumers spend more at home due to lockdowns and quarantines. Going forward, the most effective brands will be those that are using the data and insights from in-home consumption to drive both new products and better at-home experiences.

Home learning enters the mainstream

The COVID-19 pandemic has resulted in an unprecedented push towards online learning at home. Widespread school closures forced millions of students and educators to rely on education technologies (edtech), including digital learning management systems and Massive Open Online Course (MOOC) platforms.

As a result, edtech companies have gained traction among investors and witnessed exponential growth over the year. For example, according to EdSurge, in 2020, US edtech start-ups secured investment worth around USD2.2 billion, compared with USD1.7 billion in 2019.

Educators around the world are using technology to increase access to education. In addition, education institutions are increasingly integrating technologies such as artificial intelligence (AI) and big data to change the conventional methods of teaching, boost collaboration among students, create personalised educational experiences and improve learning outcomes.

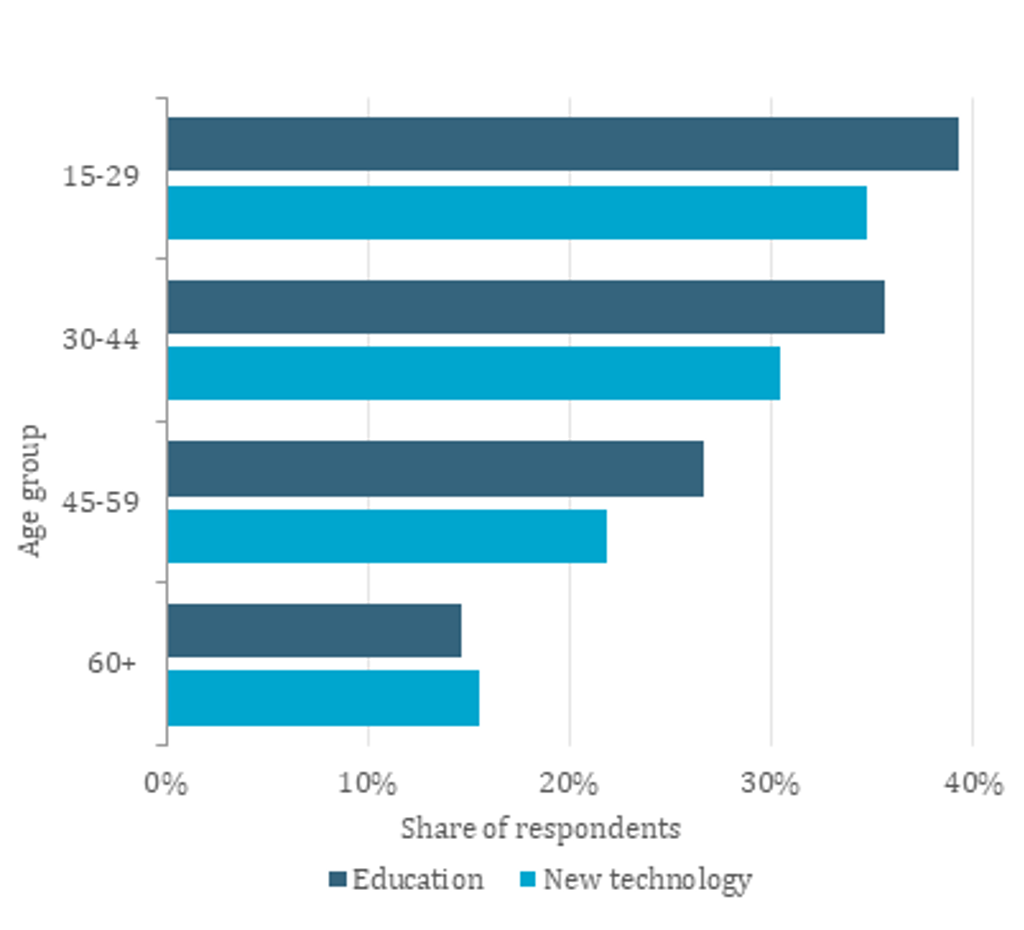

Plans to Increase Spending on Education and New Technology by Age Group, 2021

Wellness-related technology becomes mainstream among consumers

Wellness-related technologies, such as apps, wearables, virtual care and chatbots, are increasingly being adopted by consumers at home – a trend that was already apparent before the outbreak of the COVID-19 pandemic. Younger generations, including millennials and generation Z, have been the major drivers of this trend, given their tech-savviness, as well as valuing convenience and customised experiences.

Technology is redesigning traditional care models by improving access and affordability, making it an integral part of the holistic approach that consumers follow nowadays to take more control of their health and wellness, and achieve their wellbeing goals.

COVID-19 has accelerated digital adoption among consumers, including older demographics, who have become more comfortable with technology during the pandemic. Combined with the heightened demand for healthcare and self-care, this creates significant opportunities for digital wellness products and services at home. Nevertheless, the existing digital divides (between the young and the old, and the haves and have-nots) as well as privacy and security concerns, remain major obstacles to digital adoption.

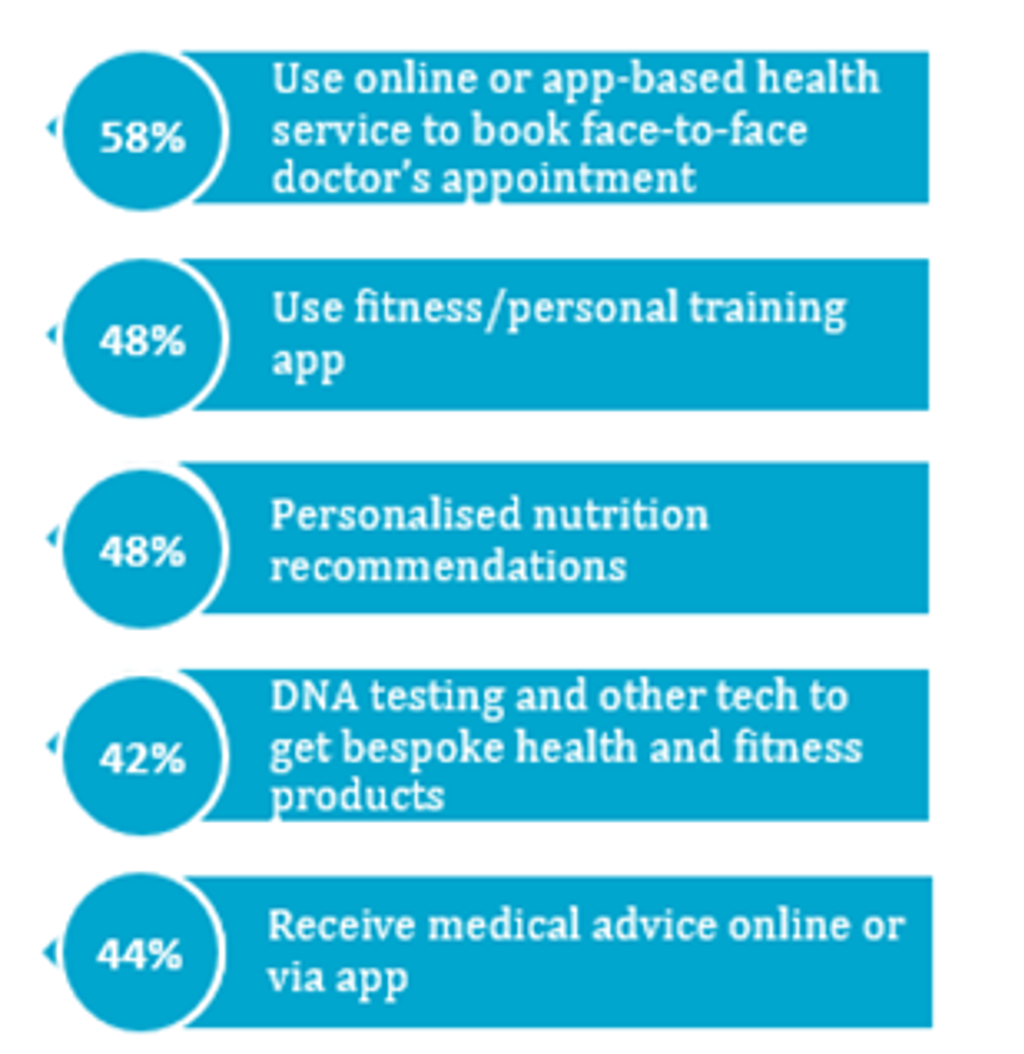

Top Health-Related Technologies with which Consumers Feel Most Comfortable, 2021

% of global respondents selecting “extremely” or “very comfortable”

Urban expansion leads to a suburban surge

As the number of urban households globally continues to expand rapidly, suburban areas are seeing an equivalent rate of expansion. While COVID-19 may temporarily slow down the rates of growth in cities, growth is likely to continue when the pandemic is brought under control. Globally, the number of urban households is predicted to expand by 36% over 2020-2040.

A growing proportion of consumers, largely due to reasons of comfort, ecology and real estate prices, are choosing to live in suburban areas and satellite towns, foregoing urban enclaves whether by choice or necessity. This is the case globally, in both developed and developing economies. As household inhabitants are able to do more jobs and other activities remotely than ever before, an urban location is no longer viewed as essential. Shopping centres, tech companies and retailers will need to branch out in the context of these new ecosystems.