The 2023 National Restaurant Association (NRA) Show brought together companies and foodservice operators to showcase the latest trends in the food and drinks industry. With the COVID-19 pandemic still in the memory of many, the show was a vibrant way to look into the future of foodservice and drinks in general.

Traditional non-alcoholic beer's increased presence in the show

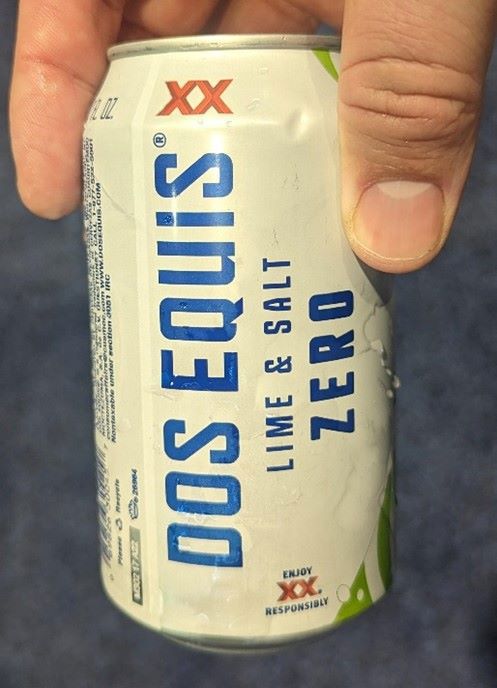

Two of the biggest names in non-alcoholic beer continue to make the case for their category in the on-trade space. Heineken, while highlighting its newest Silver product as a formidable competitor in US premium lager, positioned its 0.0 product in equal measures to its alcoholic portfolio. A highlight was another of its new products: Dos Equis 0.0 with lime and salt. While not venturing headlong into burgeoning chelada, the beer was as refreshing and clean as it was bursting with briny citrus character and earned its place on a menu at a beachside patio.

Source: Euromonitor International, picture taken at the show

The other big name in non-alcoholic beer, Athletic Brewing, saw it in the same company as craft soda and juice offerings under the Keurig Dr Pepper banner. Athletic came prepared with a wealth of craft alcohol-free beers, offering everything from a hazy IPA to a Belgian-style Wit to a light lager. In a retail and a foodservice market that have chosen to pare down their shelves and menus, respectively, Athletic successfully eschews the single-SKU safety that many sellers seek. Representatives from the company were happy to chat about its recent placement on Jet Blue flights as well as its collaborations with both Netflix and chef David

While non-alcoholic beer has been able to secure its place in at-home consumption and in growing social occasions, the growth potential within the recovering on-trade space is still ripe for opportunity. More menus will expand their non-alcoholic selection beyond singular consolations and more players will be given a chance to vie for cross-channel ubiquity.

Craft, premium and functional drinks aim to rebuild social consumption occasions

Premium, craft and functional drinks were all over the show floor. Soft drinks companies were eager to show innovation regarding flavour, customisations and new product launches. The show exemplified the variety of choices consumers and foodservice operators have regarding drinks. However, one trend was clear: the need to rebuild social consumption and bring new and enriching experiences to on-trade (and possibly off-trade) consumption. Manufacturers aim to do this in a couple of ways: craft and premium product offerings or with functional and experience-based consumption.

On the premium and craft side, companies were quick to show credentials for high quality and organic ingredients in juices and carbonated drinks with particular attention to positioning their brands as an above-the-line option for consumers. Although in this avenue, craft beers are far from new, seeing an option that could pass as a more sophisticated drink option was refreshing. The strategy here is straightforward – better-quality ingredient products and more specialised brands help companies rebuild that social consumption occasion and charge a premium.

On the other hand, offering new experiences to consumers has meant offering more functional drinks that revolve around social consumption occasions and specific need states; for example, products with energy boosting, mental wellbeing, mood enhancing, and stress relief claims.

Products in the US with claims of energy boosting, mental wellbeing, and stress relief grow by 6% from 2022, with mood enhancing claims growing by more than 13%

Source: Euromonitor International

This trend manifested in a very particular way on the show floor with cannabis-infused drinks. Companies could showcase products containing THC and CBD targeted to compete in the soft drinks and alcoholic drinks adjacent space. In some cases, cannabis drinks were positioned as stand-alone functional drinks that consumers choose to relax and, in other cases, as alcohol-free analogues to imitate the effects of alcohol. In both cases, social consumption was a strong part of the appeal.

US cannabis drinks sales are set to grow at a staggering 30% CAGR over the next five years

Source: Euromonitor International

Cannabis drinks companies were adamant about their interest in distributing in on-trade channels to improve access to the products also connecting the products to the social experience.

Technology and customisation take centre stage at the show

Drinks product and equipment brands emphasised that the quality of drink selection at a restaurant can be important to stand out from the crowd.

Drinks sales at full-service foodservice locations are expected to grow by 17% through to 2027, outpacing food sales growth

Source: Euromonitor International

Drinks solutions aimed at consumer foodservice operators were widespread across the show, but many had a similar focus: how can restaurants’ drinks offerings allow for customisation without adding excessive strain on the workload?

Consumers want to feel they have a relationship with brands, and allowing consumers ownership over the make-up or flavour profile of their drink can be a strategy to achieve this. One of the main barriers is the need for much manpower and staff expertise. To remedy these problems, many exhibitors at the NRA Show looked to combine personalisation and automation.

An example of this was the Drink Bot from Botrista. The Drink Bot allows foodservice workers or consumers themselves to pour drinks with personalised flavour combinations in categories ranging from coffee to health drinks to cocktails. The Drink Bot is a way for foodservice locations to elevate their drinks offerings without having to employ someone with specific training and without spending excess time on drink preparation.

Source: Euromonitor International, taken at the show

Another way in which foodservice operators are using drinks to stand out is by producing drinks in their own space that can play to consumer sentiment about how small-batch, locally-produced things are higher quality and, in some cases, even perceived as better for you. For example, automated brewing systems by SmartBrew allow restaurants and bars to brew craft beer on site with no brewer experience necessary. Brewing beer in-house can allow a foodservice establishment to stand out and create strong associations of quality with their brands. The key for brands will be how they are able to integrate new technology and how they are able to communicate their unique offerings to consumers. Without these key aspects, investments in new technology will do little to drive consumer interest and loyalty.

The NRA Show 2023 showcased how drinks can be a key offering for foodservice locations, allowing brand recognition and consumer personalisation, and how automation can be a key tool to this end.

Read our article, Japan Leads the Sober Curious Culture in Asia Pacific, for more insight on how the sober curious culture is shaping the drinks industry.