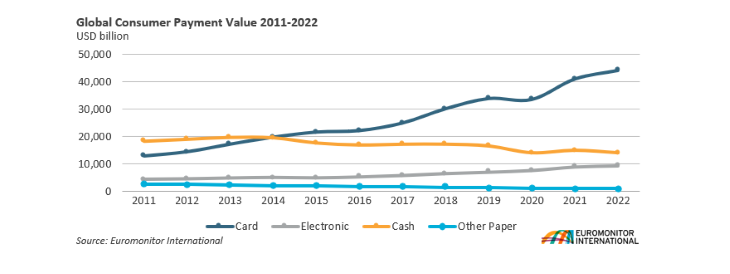

Euromonitor projects total card payment value will increase by USD18 trillion over the next five years with the growth nearly evenly split between credit and debit cards. Cash reached the lowest rate in 2022 as a portion of consumer payment value at 22% as consumers turn to electronic and card alternatives. The high level of card conversion for consumer payments does not match B2B payments which heavily favour electronic direct and paper channels over financial cards offering an opportunity for card networks, issuers, and digital payment platforms.

Cash continues decline across markets

Global consumer paper payment value dropped by USD3.8 trillion from 2017 to 2022. The decline was not confined to certain markets, with only eight of the 47 researched gaining in consumer paper payment absolute value over the previous five years. Singapore had the highest drop in consumer paper value over the same time frame with an 89% decline.

The migration of consumer payments to financial cards and electronic direct channels has been accelerated by government efforts to increase transparency and security of consumer payments overall. Also driving the conversion is the access to financial services and efforts to make card acceptance universal. Fintech has played a leading role in making financial products and services easier to use and lower the overall cost for consumers.

Ever-increasing share of m-commerce, benefiting from shifting retail format

The migration of retail online contributed to rising m-commerce which has increased globally by USD3.5 trillion from 2017 to 2022. Together with the ease of access offered with mobile devices, this is expected to further drive use to reach USD10 trillion by 2027.

While a large portion of m-commerce growth will come through proximity m-commerce, it will grow slower than remote m-commerce and is expected to account for 35% of total by 2027, down from 39% in 2022. The single market that is driving m-commerce payment value has been China, which accounted for 55% of all m-commerce in 2022. However, with greater global adoption the country’s share is expected to fall to 47% by 2027.

Asia Pacific secures its position in payments

Since 2017 Asia Pacific has been responsible for at least half of all consumer payment value. The region’s share of card payment value has consistently increased and is projected to account for 63% by 2027. While China accounted for 81% of the payment value in the region, the country’s share is expected to decline as other emerging markets in the region achieve higher rates of financial service adoption. Generating the most card payment value has created the world’s largest card issuers and network by processed value and contributed to rapid innovation in acceptance and access.

B2B payments represent biggest opportunity in terms of cash conversion

Euromonitor identified USD32 trillion in commercial paper payment value globally with the vast majority of other B2B taking place electronically. This is two times the opportunity for card and electronic payment providers who have traditionally focused on capturing the remaining USD15 trillion in consumer paper payment value. In 2022, commercial card value only accounted for 2% of global B2B payment value. Increasing cards share of total B2B will require developing compelling incentives and rewards to merchants, primarily small and medium businesses.

BNPL becoming established lending method

Total BNPL lending across the researched markets increased 9% from 2021 to 2022 to reach USD156 billion. The rapid rise of the lending channel has unlocked significant consumer spending and increased the products and services available to all income segments but is facing several challenges going forward. Regulations, rising interest rates and a potential economic recession could all upend the lending channel in the medium term. Additionally, the number of companies offering BNPL solutions continues to accelerate further driving down the potential profitability of the channel going forward.

For further insight and analysis, please read our report, World Market for Consumer Finance