The economic pressures of recent years have caused Turkey’s inflation rate to soar. In fact, in 2022, Turkey ranked first in Western Europe in terms of inflation, with rates upwards of 80%.

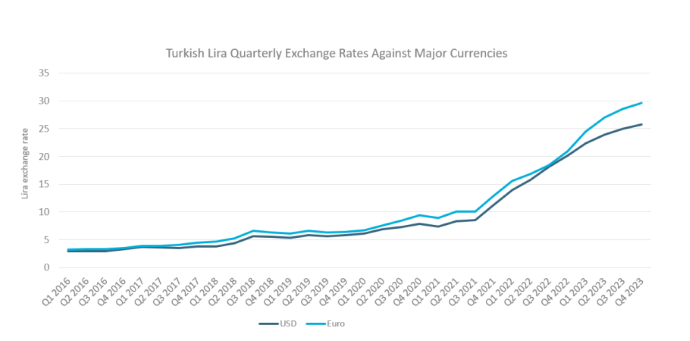

At the same time, the Turkish retail tissue market – which includes toilet paper, paper towels, paper tableware and facial tissues – has exhibited rapid growth, with retail value more than doubling in just five years (2016-2021). But this growth needs to be understood within the context of dramatic price increases, as the Turkish lira slips to record lows. Given that, growth in constant terms, over the same period, is more moderate at a 4% CAGR.

Growth under these challenging market conditions is driven by the fact that Turkey is still an unsaturated market for retail tissue. Average per household expenditure on retail tissue was recorded at just over USD28 in 2021, which ranks Turkey alongside markets like Brazil and Colombia, though somewhat behind the global average of USD39 for the same year.

Inflationary pressures challenge profitability

The macroeconomic environment is impacting consumer activity across the entire retail landscape. As some consumers struggle to afford basic products, spending habits are shifting to private label and discounters. This has resulted in squeezed margins for retailers, with profitability also being negatively impacted by supply chain issues associated with the import of raw materials, manufacturing and distribution of retail tissue products.

Rapid change in channel distribution

In addition to the effect of inflation on retail tissue products, the grocery retail sector in Turkey has undergone significant change over the past decade – a combination of the erosion of traditional grocery retailers and the rapid expansion of discounters, such as Bim and A101 which have benefited from rapid store expansion strategies. This retail transition has also had the effect of embedding private label among Turkish consumers as a cost-effective and often high-quality alternative to major brands.

In addition, Turkey is no exception when it comes to uptake of e-commerce. After increasing by 40% in 2021 from the previous year, primarily due to the effects of pandemic lockdowns, Turkey's e-commerce sales of retail tissue are expected to increase even further, with the channel capturing 7% of total retail tissue value sales in 2021.

Euromonitor International estimates that Turkey’s e-commerce is one of the fastest growing in Europe for the proportion of fmcg purchased via online channels. It is expected to expand even more due to consumer demand relating to pricing and availability. According to Euromonitor’s Voice of the Consumer: Lifestyles Survey 2022, Turkish consumers’ top motivations for buying online include best pricing (43%) and variety of brands (41%), along with order at any time, from anywhere (38%) and free shipping (33%).

Private label's share rises

Due to the pressures now facing them, Turkish households are cutting back everywhere they can, even on necessities, and private label is predicted to benefit from this price sensitivity at the expense of more expensive branded products. Private label accounted for 47% of the retail tissue market value in 2021.

Brand strategies: Hayat Kimya strengthens its position

o how do branded manufacturers compete in such a challenging environment? One of the big success stories over the past decade has been the rise of Hayat Kimya, which is a market leader in Turkey, ranking second in the country’s fmcg industries: hygiene, home care and sanitary tissue. Part of its success is its investment in local production. In 2019, the firm committed to invest TRY450 million in a new sanitary tissue manufacturing facility, bringing its total investment in Turkey over the next five years to TRY2 billion. With an annual production capacity of 70,000 tonnes, the new plant ensures the company's leadership position as Turkey's second largest tissue manufacturer. This will boost the company's total capacity in Turkey to 280,000 tonnes, and its capacity in Mersin to 140,000 tonnes.

The facility will also be used to produce roll paper, toilet paper, paper towels, napkins and tissues for the company's distribution centres and retail outlets. Equally, Hayat Kimya is the most water-efficient tissue paper producer in the country, as well as cutting-edge in research and development for the retail tissue industry. This will allow product innovation, as well as keeping prices at a competitive level.

A challenging market in the short and medium term

Over the coming years, the retail tissue industry in Turkey is expected to face significant challenges, particularly given the inflationary forces impacting the economy. Growth opportunities will largely be driven by private label or value for money products, as shoppers trade down or turn to discounters during inflationary times. Euromonitor predicts decreasing volumes for products such as kitchen towels and paper tableware, as consumers cut back to necessities only, even as the country’s population has expanded. As such, brand manufacturers will need to look to local production and promotions to keep their pricing competitive.

For further insight and analysis, read our briefing, Global Inflation Tracker Q4 2022: Inflation Forecast to Stabilise in 2023, Although Key Risks Remain