Read the report: Uncovering price gaps: UK champagne

As companies and retailers compete in an increasingly dynamic e-commerce market, the need to understand price, attribute and assortment trends has never been higher. By exploring the UK alcoholic drinks market as an example, this report focuses on uncovering price gaps within a category, in this case champagne products retailed online. However, the same analysis can be applied to any price tier or any given category.

The report illustrates how large volumes of well organised and structured web extracted SKU data can be used to identify price gaps that can potentially capture greater sales, category share, margin and maximise profitability. The optimal price gap for any given supplier will be dependent on several strategic and tactical variables such as target unit margins, degree of penetration within a given price tier, expected/target sales within a chosen price tier and the nature of online retailer partnerships amongst others.

This report examines the full price distribution of available champagne SKUs (750ml bottles), the price tiers that exist within the category and a straightforward manner through which it is possible to identify price gaps among a large number of SKUs. Over 900 champagne SKUs and the brands of 51 suppliers, available through online retailers in the UK, were evaluated to pinpoint significant price gaps. The focus of the analysis is on 750ml champagne bottles priced below US$30. Nonetheless, the same analysis can be applied to any price tier identified in the report or for any other FMCG category.

Six price gaps with differentials between 4-17% identified in the sub-US$30 tier

A price differential is the percentage difference in median price between two adjacently priced SKUs, such that SKU1 is the lowest priced SKU and SKU2 is equal in price to SKU1 or the next highest price point, and so on for SKU3, SKU4 onwards.

A review of SKUs retailed online under US $30 uncovered six areas with price differentials between 4% and 17%. The median price differential across the entire price distribution for champagne SKUs was 0.75%. Consequently, these areas with significantly higher gaps could present opportunities for competitor suppliers to brands on either side of the price gaps identified.

LMVH markets the largest champagne assortment by far

LMVH Moët Hennessy Louis Vuitton SA, with an assortment of 250 SKUs (750ml) has a portfolio four times larger than the next player, Champagne Louis Roederer (CLR) SA. Both these players had significantly higher median prices over the course of 2020. LMVH, plays across all price tiers from the lower end to super-premium offerings. CLR, the second largest player by volume of SKUs available, has an assortment weighted to the premium end of the market. The majority of the top 10 players offer SKUs with median prices between US$70 and US$170, a tier where a large number of SKUs are to be found with very limited price differentials, suggesting a very robust competitive environment.

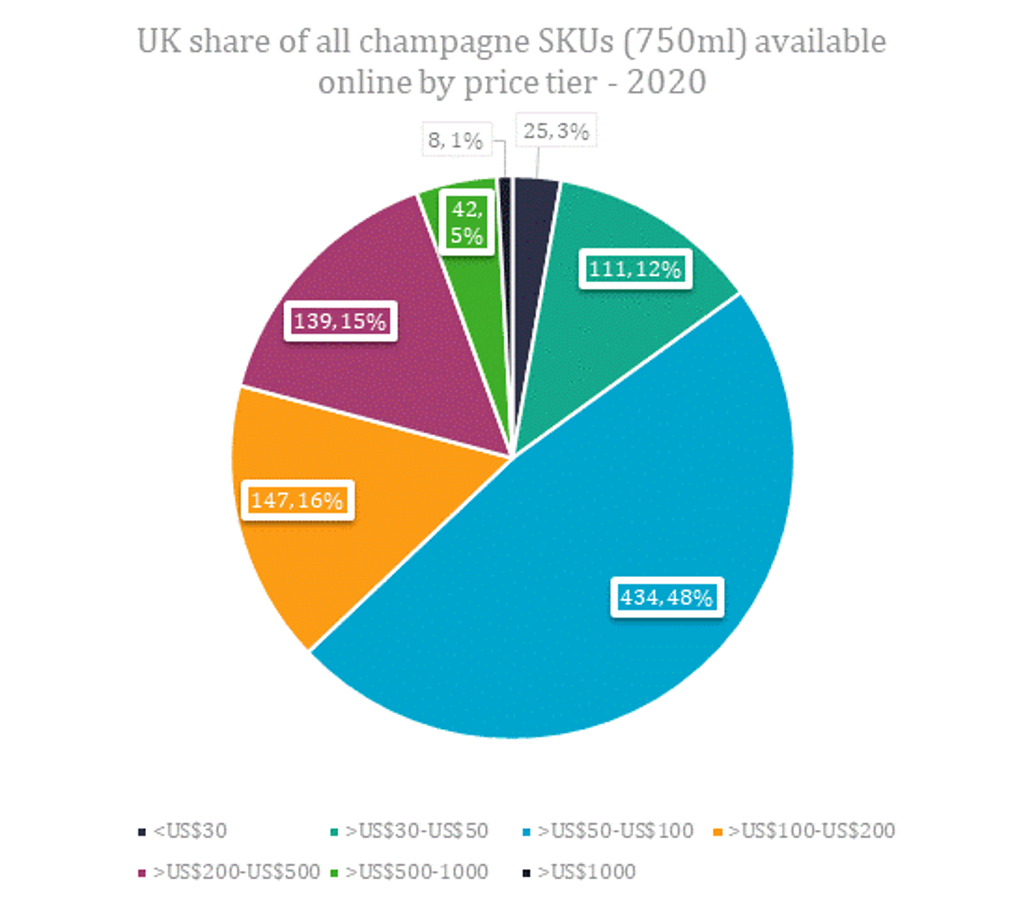

Half of champagne SKUs are priced between US$50 and US$100

The most competitive price tier, and where price differentials are the lowest, is for SKUs priced between US$50-US$100, accounting for 48% or 434 SKUs available through online retailers in 2020.

A further 30% of SKUs were priced between US$100-US$500. At the lower end of the price spectrum, below US$50, 15% of all available SKUs were to be found, with the largest price gaps found under US$30 per 750ml bottle of champagne.

With Euromonitor’s Via, you can utilise over 30 million online SKUs across 40 countries and 1,500 retailers to unlock key strategic and tactical insights for your organisation. For more information on the e-commerce data we capture using Via across other industries, countries, retailers and suppliers, as well as any questions relating to price gap analysis, please request a demonstration and read the full report ‘Uncovering Price Gaps: UK Champagne’.