This article is part of a series on COVID-19 focusing on how the outbreak is affecting industries.

Euromonitor has been following the spread of the coronavirus in China and its impact on the global economic outlook. So far, it is too early to form a definitive economic impact assessment. A spread of the virus to other major cities beyond Wuhan could significantly dampen spending on consumer services (e.g. entertainment, restaurants) as well as cutting tourism/travel spending.

However, there is likely to be a substitution of online consumer purchases for physical store purchases that would cushion the effect on retail sales. Also, there is a likely substitution of holidays now towards later in the year, or towards spending on other big items such as consumer durable goods. Nevertheless, Chinese retail sales volumes annual growth rate could decline in the first quarter of 2020 from 5-6% to around 2-3%.

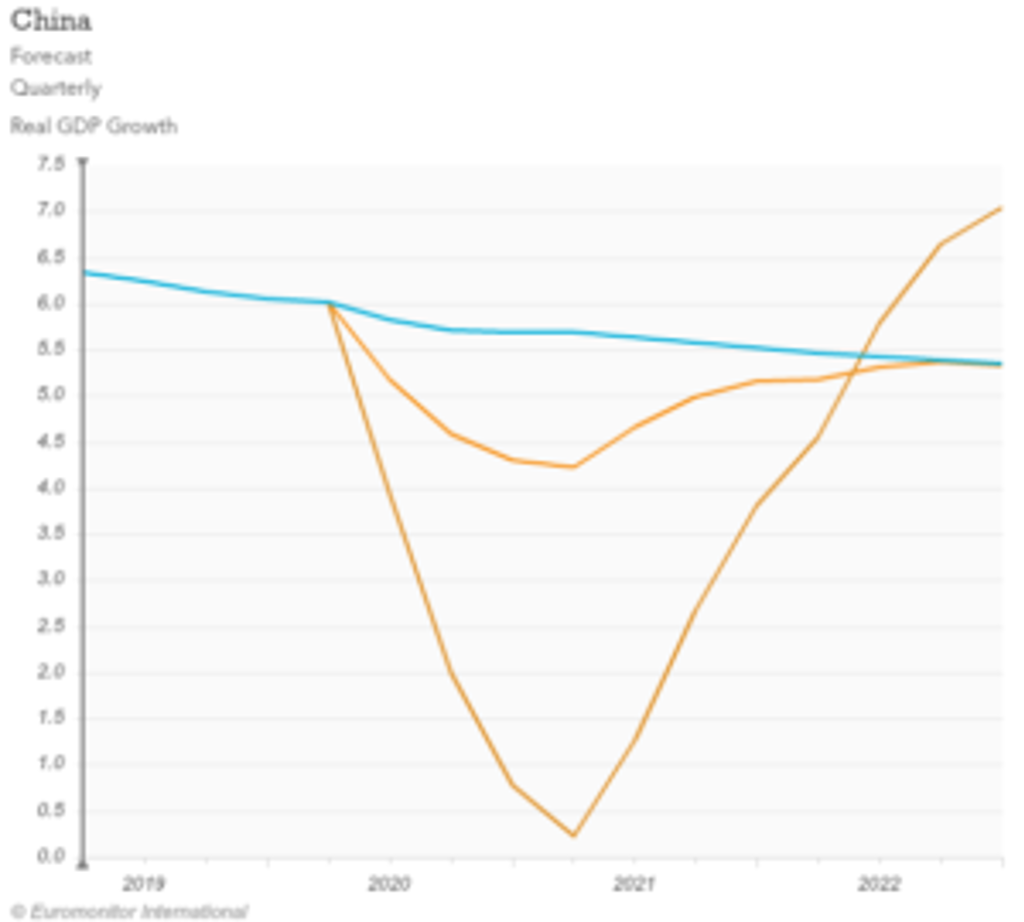

For now, the impact of the outbreak on China’s economy is likely to be within the normal range of our baseline 2020 GDP growth forecast of 5.4-6.1% (centred at 5.8%). The evidence so far is that the coronavirus is less deadly than the SARS outbreak of 2003, and the impact is likely to be mainly in Q1, with a rebound in economic activity in Q2 and the rest of the year. However, the risk of more prolonged spread of the epidemic raises the probability of a more significant growth slowdown scenario, in which China’s GDP growth in 2020 would decline to 4.7-5.4%.

The global economic impact in the baseline forecast is likely to be small, on the order of 0-0.2 percentage points lower economic growth in 2020. However, a more prolonged outbreak spreading in Asia or globally would have significant negative effects on consumer spending and business investment, as well as leading to tighter financial conditions.

This leads us to maintain our Q4 2019 previous assessment of a relatively high global downturn scenario probability in 2020 of around 15%, despite the positive effects of lower US-China trade tensions since December. A global downturn would push global GDP growth in 2020 towards 0-1%, compared to the baseline forecast of around 3% growth.