World Performance and Outlook for a 3.8 Trillion Unit Consumer Packaging Industry

The global consumer packaging industry is one that has largely, if not exclusively, exhibited resilience in the face of the coronavirus (COVID-19) pandemic, recording retail packaging growth of 3% in 2020, to reach 3.8 trillion units. There are a number of trends and influences at play as consumers’ purchasing habits and priorities evolve while the external pressure of environmental regulation and sentiment will also continue to shape the consumer packaging mix, in the years ahead.

Home as safe haven secures packaging demand

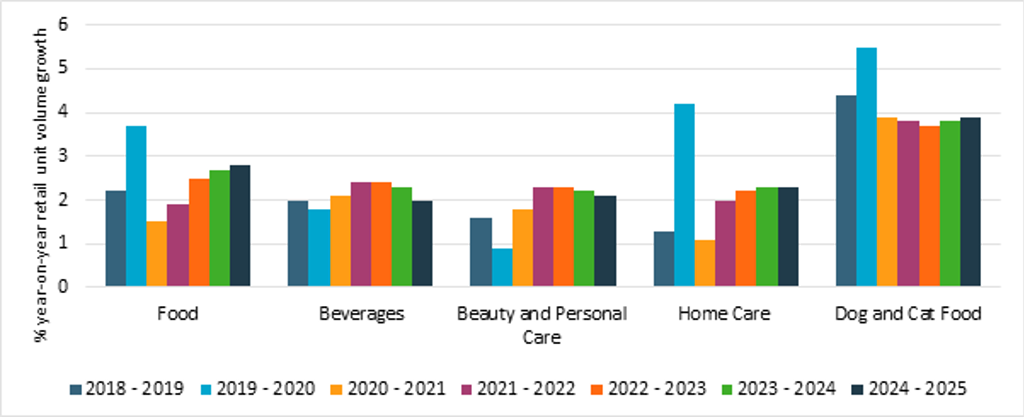

COVID-19 social distancing and foodservice restrictions have put at-home living in focus in a way not seen before, and, in turn, increased consumers’ reliance on purchasing retail packaged groceries. The food industry witnessed particularly strong performance, from searching out ingredients for baking and scratch cooking to snacks for hometainment, global food packaging unit volumes increased 4% in 2020, compared with 2% growth in 2019.

The contactless, hygienic safety afforded in consumers buying packaged and online has further accelerated packaging growth. Consumers’ hygiene concerns are apparent in the steps taken for a virus-free home environment that explain the 4% rise in 2020 home care packaging sales, with rigid and flexible plastics across surface care, bleach and laundry care in especially high demand.

Consumer Packaging Growth by Industry 2018-2025

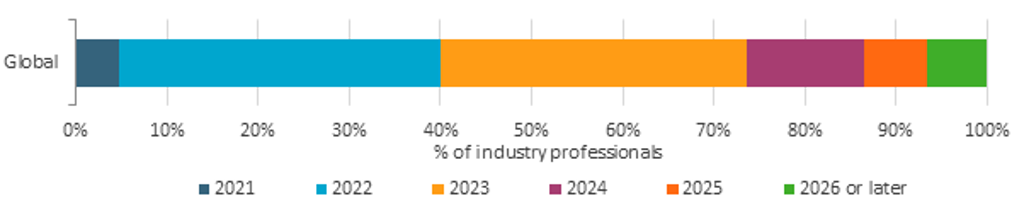

Home-centric lifestyles will continue to feature as industry concedes that a return to a semblance of pre-pandemic normality is still some way off. Industry professionals participating in Euromonitor International’s Voice of the Industry Food and Nutrition 2021 Survey, conducted in March 2021, largely see this as being in 2022 or 2023.

Food Industry Professionals’ Forecast of When Food Spending at Away-from-home Channels Will Return to Pre-Pandemic Levels

Source: Euromonitor International Voice of the Industry: Food & Nutrition survey, fielded March 2021

Adapted lifestyles, including the rise of hybrid home-working models, further presents a positive outlook for packaged groceries, if at a more moderate rate compared with the 2020 pandemic peak. As such, we forecast a 2.3% CAGR for consumer packaging over 2020-2025.

Not a complete picture of growth with glass packaging hit hardest in beverages and beauty…but recovery is underway

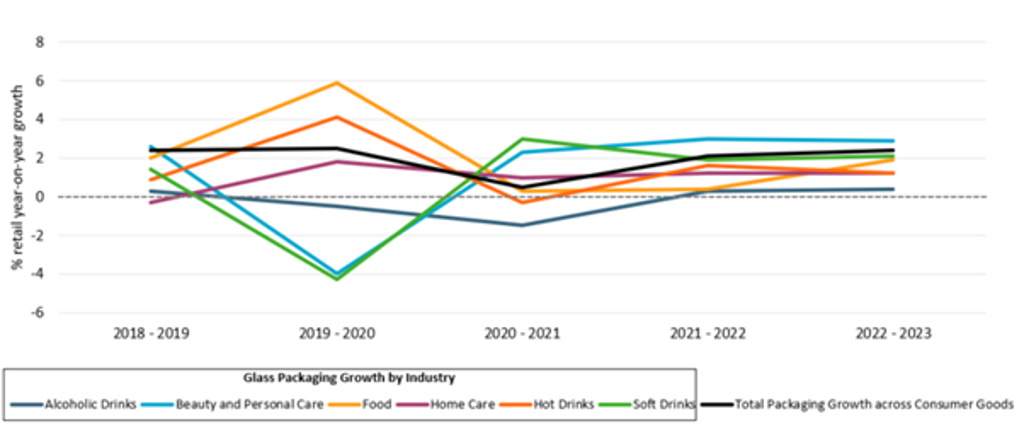

It has certainly not all been a time of accelerated growth for packaging. Our latest research shows how a less socially active, mask-wearing population put paid to rigid plastics and glass growth in personal grooming, severely impacting sales in colour cosmetics, shaving and fragrances. It is glass, however, that has been hit hardest by COVID-19.

Global Glass Packaging Growth by Industry 2018-2023 (retail volume)

In beverages, a retail focus on core skus and the widespread closure of the hospitality sector meant that total glass demand contracted by 14% in 2020, exacerbated by on-trade channel losses where requirement for glass fell by 29% in 2020. Even in-focus retail sales were compromised, reflective of how reduced mobility outside the home affected the purchase of single-serve sizes of soft drinks. More time at home has brought some respite for glass, as the uptick in purchase of packaged coffee and food (sauces, dairy, edible oils, jams and preserves) demonstrates.

Countries remain at different stages, in different waves of the pandemic but nonetheless, there are positive signs of recovery underway in 2021, supported by an easing of foodservice restrictions and a sheer pent-up consumer desire to socialise. An 11% rise for beverages sold in glass bottles through the foodservice channel is expected for 2021, with North America and Western Europe leading growth. Consumers’ health priorities for immunity and broader functional energy benefits are further generating retail growth for water, juices and tonics sold in glass.

Circularity and net-zero push offer huge packaging innovation potential

Sustainability, a headline-making packaging influencer pre-pandemic, continues apace with R&D and brand pack redesigns, government and corporate packaging commitments in tandem with consumers’ sustained concerns about the planet, and related to packaging, zeroed in on plastic use.

Plastic packaging, which accounts for 64% of global grocery packaging sales (2020), continues to have a pivotal role to play offering preservation, convenience and resource-efficiency across food, beverage, beauty and home care industries, in both rigid and flexible formats. Overall demand for plastic packaging is expected to be maintained but its composition will become far more renewable in nature.

There is a growing movement away from fossil fuel, higher carbon-emitting virgin plastics to alternative materials, including recycled plastics (the latter have a lower CO2 footprint). The shift to recycled is already in earnest, especially across rigid plastics, from soft drinks in rPET bottles to ice cream in rPP tubs. Such is the demand for rPET that it even outstrips supply in Europe and North America. This is spurring innovation to improve recycling and capacity of recycled polymers, including through newer recycling technologies. L’Oréal’s venture into developing polyethylene shampoo bottles made from captured and recycled carbon emissions, via its partnering with LanzaTech and TotalEnergies and, separately, L’Oréal’s work with biotech specialist Carbios, to develop enzymatically recycled PET, are just two examples of the future possibilities.

Expect to see greater action to advance recyclability. Flexible packaging is a key area in plastics where collection of materials for re-use globally is very low, due to lack of infrastructure to recycle, in contrast to rigids where recovery, for recycling, either kerb-side, in-store or via bottle banks/recycling centres is better established. Brand pack redesigns from laminates to mono-materials are one way to improve recyclability. Packaging manufacturer Amcor, in the past year, launched recyclable pouches for pet food (with Nestlé) and for microwaveable rice (with Mars), caveat being, recyclable where local waste infrastructure supports. On recovery, there are numerous retailer initiatives being launched to better collect (and so prevent waste) where municipal systems do not exist. Tesco in the UK, has expanded its roll-out of in-store return points for soft flexible plastics/pouches, with the collected material being reprocessed into new packaging.

These developments align with consumer sentiment for action on climate change and on the environment; some 65% of consumers in 2021 expressing their worry about climate change; this concern held at levels comparable to 2020, despite the distraction of a pandemic. Packaging will be increasingly governed by regulation and taxation, for example, in Europe by the Single Use Plastic directive and Packaging and Packaging Waste Directive (PPWD), to bolster recyclability, recycling and re-use.