Coronavirus (COVID-19) has negatively impacted most consumer goods industries, including beauty and personal care. However, compared with other industries which have been affected, the impact on beauty and personal care has been less intense.

Despite downward revisions for 2020 in the Q3 update of August 2020, Euromonitor International expects the remainder of the forecast period to improve, with value sales of beauty and personal care set to decline by 2% in constant terms (-3.5% in current prices) in 2020 and a CAGR of 2.7% in between 2021 and 2024.

Factors including attitudinal and consumption shifts, which have supported key categories such as skin care, the fast pace of digitalisation and the recovery of the Asia Pacific region, particularly China, have also proven crucial in protecting the industry from further sales losses, and are anticipated to remain vital in the long-term recovery of beauty and personal care.

Health and self-care influence the recovery of skin care

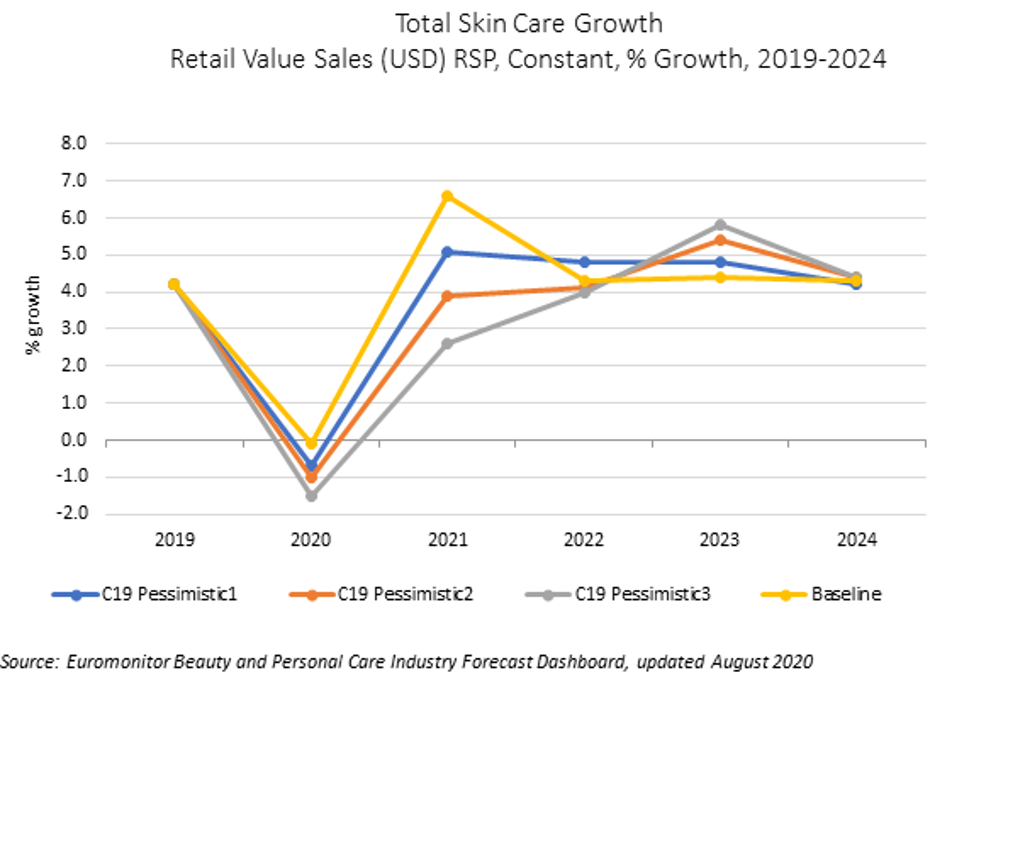

Skin care, the largest beauty and personal care category in value terms in 2019 will remain resilient under all pessimistic COVID-19 scenarios, with the category recovering in 2021. COVID-19 has heightened consumers’ quest for health and wellbeing and a more minimalistic approach to beauty. Skin health has taken greater priority, with products such as facial cleansers, moisturisers and hand care increasingly deemed essential by many consumers.

In addition, a focus on safety, transparency of ingredients and the power of naturals, has become vital in skin care, with companies strengthening their natural propositions. Beauty manufacturers and brand owners will be able to recover more smoothly than other retailers when renewing their messaging to include immunity-boosting, wellness or herbal/ traditional claims, and greater transparency of ingredients.

Note: Baseline: The latest annual forecast data based on a quarterly review.

C19 Pessimistic1: A more pessimistic outline than the baseline based on potential pandemic and related economic adversity, where there are 2-3 global pandemic infection waves over 2020-2021.

C19 Pessimistic2: A more pessimistic outline than Scenario 1 based on potential pandemic and related economic adversity, where there are 2-4 global pandemic waves in 2020-2021 and large-scale distribution of an effective COVID-19 vaccine or treatment is delayed into 2022-2023.

C19 Pessimistic3: A more pessimistic outline than Scenario 1 and 2 based on potential pandemic and related economic adversity where there are 3-5 global pandemic waves in 2020-2022 and large-scale distribution of an effective COVID-19 vaccine or treatment is delayed into 2022-2023.

The rapid migration to digital technologies driven by the pandemic will continue

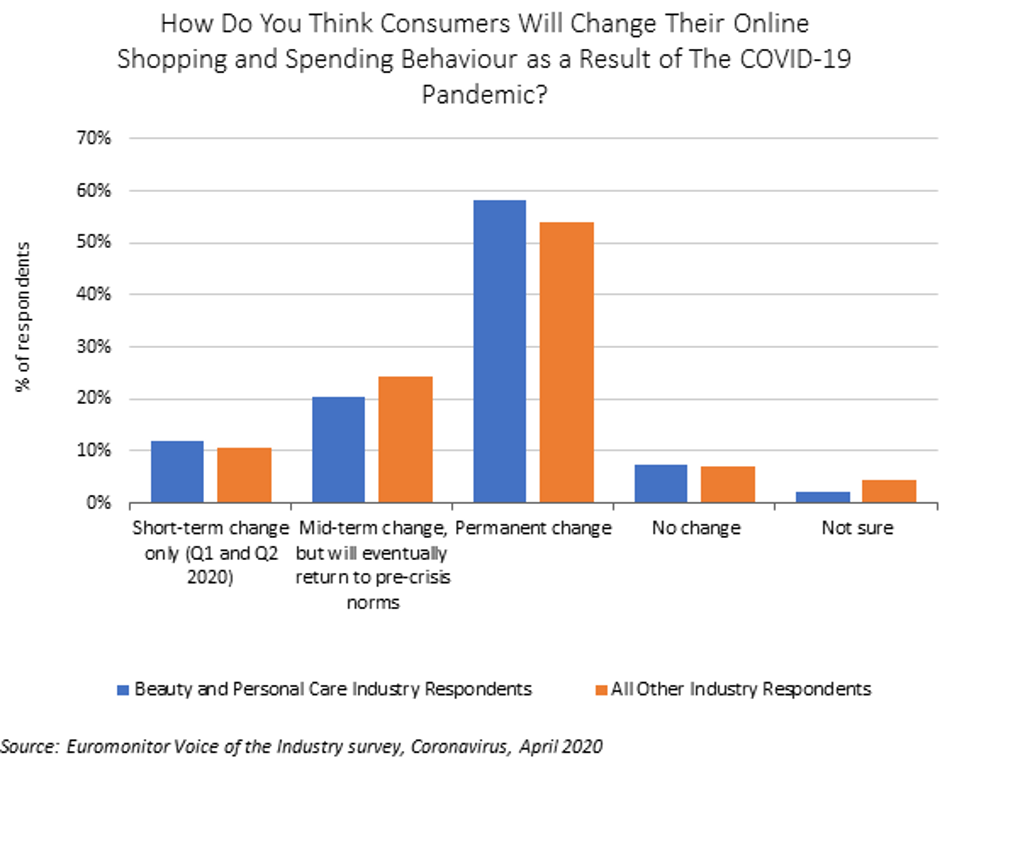

A customer-friendly digital presence and strong e-commerce capabilities have proven crucial during the pandemic. Retailers and brand owners are pivoting their businesses and launching new digital offerings to strengthen their relationship with customers. Channel diversification and digital engagement will be more important than ever.

Existing e-commerce disruption has prepared beauty players for a more permanent shift to this channel, with e-commerce sales in beauty and personal care anticipated to continue to grow in the next five years. Beauty players should aim to build better virtual experiences while cementing new points of sale within social networks and live streaming.

The shift to digital should also be seen as a longer-term opportunity to create online platforms and communities for product discovery, advice and sharing at a time of heightened uncertainty, insecurity and anxiety.

Chinese market is essential to recovery

Although import activity will be disrupted until at least the end of 2020, the Chinese market is already offering strong opportunities, not only for multinationals but also for local brands. China’s large population, continued economic growth and potential are key to industry performance. The rebound in the Chinese economy is related to the country coming out of lockdown before most others, the expected rebound of consumption in 2021-2022 and continuing robust long-term growth.

In addition, the dynamic and diverse e-commerce capabilities of retailers in China have ensured that sales of most beauty and personal care products have remained relatively stable, whilst the pandemic has further accelerated digitalisation in China. The country leads in terms of live streamed shopping, with the leading online platforms, including Alibaba’s Taobao Live, reporting extraordinary growth.

Opportunities for international brands to invest in live streaming in China could become a key driving force over the forecast period. With a strong presence at the epicentre of the rebounding beauty market, China is decisive for companies operating in the beauty and personal care.

Beauty and personal care has shown it is relatively more resilient than other non-essential consumer goods industries, despite the impact of COVID-19. Investment in digital channels, in the Chinese market and in skin health, could potentially offer long-term opportunities for players competing in this industry. However, it is important to keep in mind that any further downgrades to global economic forecasts could potentially delay the pace of recovery, therefore beauty players must consider how to navigate the new normal in a frequently changing environment.