In Canada, growth of adult-use cannabis is being driven by consumers new to cannabis and those converting from the illicit market. Additionally, ease of access and growing availability through recreational dispensaries are attracting more consumers from the medical market. A similar trend can be observed in the US, in states where recreational adult-use is legal. Ease of access and format innovation will continue to pull new consumers from the medical and illicit markets.

Adult-use captures consumers from medical-use, the illicit market and new consumers

There were a reported 3.8 million adult-use cannabis consumers in Canada in 2021, and value sales are expected to grow by 19% in 2022, as the consumer base expands and spending per capita rises with the development of value-added formats. Flower is the most popular format in adult-use cannabis. However, growth is expected to slow as demand stabilises and flower loses share to alternative formats, like vapour products, where the range of flavours, convenience, and discreet nature appeal to consumers.

New consumers are coming from the illicit market or are altogether new entrants. Additionally, following the legalisation of adult-use cannabis in late 2018, Canada’s mature medical cannabis market has seen value sales transferred to the adult-use market. While many medical cannabis patients continue to use the existing medical infrastructure to manage or treat certain symptoms, disorders, and conditions, for others it’s easier to access adult-use cannabis to treat minor ailments. Formats most used in the medical market – flower and vapour products – are also the most popular in adult-use. Consumers who may be eligible for medical cannabis that opt for adult-use will have access to the same formats.

Product diversification shows a clear path for growth in adult-use cannabis

The increase in uptake of adult-use cannabis – whether from previous medical-users, new, first-time recreational users or those coming over from the illicit market – is spurring demand for format diversification, wider availability, and new consumption occasions. These trends are clearly evident in the US, as legislation expands.

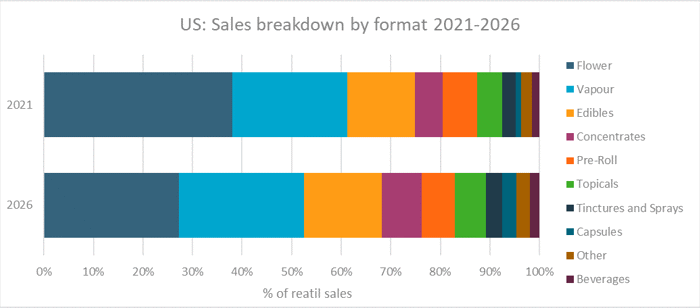

Flower is currently the most popular format in adult-use cannabis in the US and globally, thanks to the familiarity of experienced consumers and a wide variety of product attributes such as cannabinoid content, strength, and strains. However, flower will see its share decline in the coming years, as consumers explore new formats that offer convenience and serve other consumption occasions, such as edibles and concentrates. Growth for flower products will remain high (13% CAGR over 2021-2026) but categories such as vapour products, edibles and concentrates will grow on average by a 26% CAGR over the same period.

Growth in vapour products is partially attributable to new consumers who want to try different flavours and strains or cannabinoid mixes. Concentrates are seeing fast growth due to versatility and given the strength of many products in terms of cannabinoid content, appealing to experienced consumers. Conversely, edibles offer consumers an unparalleled variety in product range. While gummies remain the most popular type of edibles, new products are expanding consumption occasions for adult-use cannabis.

The increasing variety in adult-use cannabis formats will help cannabis move away from its taboo niche into mainstream consumption with branding and product availability playing key factors in growth, and driven further by growing demand for holistic wellness, where cannabis has clear functional and relaxative benefits.

For more information on the state of the cannabis market in North America and to access full market data and our forecast for future developments, read our dedicated country reports, Cannabis in the US and Cannabis in Canada.