According to Euromonitor’s latest research on alcoholic drinks, the UK is showing a clear trend towards domestic products with a distinctive, modern heritage and premium cachet. Anna Ward explores this burgeoning trend, and asks how sustainable it is, given the cost of living crisis and rising inflation.

Natural attachment to familiar names and places is never more evident than in times of crisis. “Local” drinks resonate on both practical and psychological levels, as illustrated by patterns in the historic performance of cachaça in Brazil or baijiu in China.

Other factors are also at play in the rise of domestic offers. The near global relevance of the craft movement has been achieved through geographic variations in ingredients, stories, and recipes, in efforts to target demand for invention and alternative choices. Community associations and ties to recognisable locations strengthen connections with consumers.

Emerging domestic drinks categories – such as Scottish rum, Welsh and English whisky, and wine from Kent and Sussex – are rapidly gaining popularity in the UK. However, challenges are stacking up for small producers. Price is a growing cause for concern. The extreme rises in input costs affecting the whole industry will have a particularly severe impact on companies equipped with limited resources for adaptation. In the UK specifically, definitional disparities, border complications, and staff shortages following Brexit present persistent obstacles.

Escaping the constrains of tradition

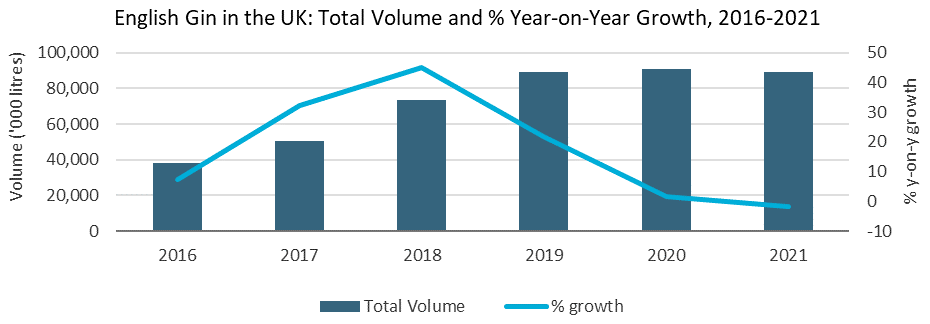

Gin remains ubiquitous among craft spirit offers, benefiting from clear opportunities for origin stories and an absence of aging requirements, but category diversification is underway as UK gin performance deteriorates. English and Scottish rum brands, for example, are attracting attention.

The rise of world whiskies is well-documented. Younger consumers in particular are now less concerned with established geographic or production rules. Freedom from the strict regulations governing traditional whisk(e)y production allows flexibility in innovation, but can also hinder the reputation-building process, with the risk of poor-quality offers dragging down still fragile perceptions.

English and Welsh whisky are gradually becoming recognised, respected segments in their own right. Producers in England applied for protected geographical indication status in the UK in early 2022, aiming to ensure quality, consistency, and transparency to encourage faith in the English whisky label.

English wine remains dynamic and is moving beyond its initial emphasis on sparkling styles. The relative lack of wine tradition in the UK compared to say, France or Italy, means that consumption rituals are not as closely embedded. Globally, wine has struggled to generate as much of a buzz as many other categories in recent years, and boosting appeal among younger legal drinking age groups is a strategic priority. Without the pressure of extensive cultural associations, UK consumers are especially open to modern formats, positioning, and branding.

Premium focus to remain…for now

In the short-to mid-term, international trade complications may encourage some small players to shift their emphasis further towards their domestic UK market, although international acknowledgment is, of course, a major objective for emerging categories. Reflecting patterns seen at the global level, broad product coverage and collaborative efforts are becoming ever more important.

Whether or not premiumisation can be sustained in the current inflationary environment is a key question for the industry, given the severity of the expected strain on disposable incomes. The examples discussed here currently concentrate on high-end offers – single malts in English and Welsh whisky, and pricing for English sparkling wine that tends to fall closer to Champagne than Prosecco.

This is understandable given the usually artisanal nature of production, combined with the need to establish a strong standing from the outset. At the moment, the only logical approach is to underline the existing premium positioning and seek to realise the ongoing potential for ‘affordable’ indulgence. Yet, considering these categories holistically, longer term significance will hinge on coverage of a wider price spectrum. While fashionable craft offers may have led the way, the gin renaissance of the last decade would never have achieved the same mainstream relevance through super-premium variants alone.

Read more: Latest 2022 data, analyses and market trends for alcoholic drinks in 100 research countries are now available here.