Euromonitor International has identified five key consumer insights from the results of its Voice of the Consumer: Lifestyles Survey. The survey was fielded to over 40,000 respondents in 40 countries worldwide in early 2021.

Global consumers are more focused on value, emotional wellbeing and hybrid lifestyles across the physical and digital worlds. Companies that can respond and align to these needs will be better placed to succeed and grow. With lessons learnt from the pandemic and the global recession, it is vital to prevent future shocks and disruption to your business.

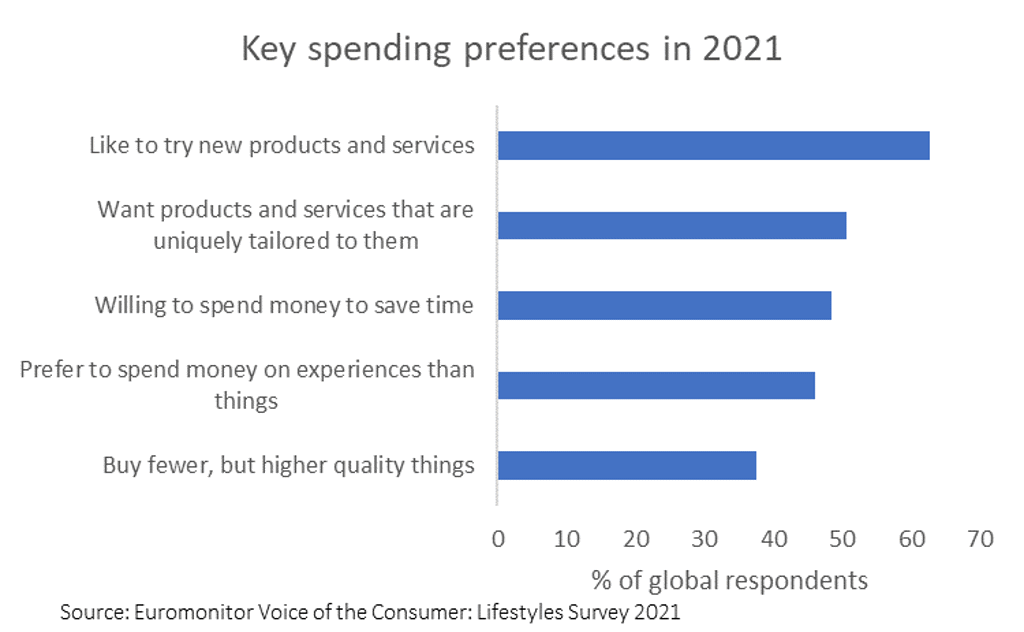

Consumers spending cautiously

Job losses, reduced income and economic uncertainty following the pandemic are resulting in more cautious consumer spending where value for money and personal values are key decision factors.

Seeking out the private label and low-cost products is universal among all generations and reflects all income groups, not just those struggling financially. As consumers are buying more mindfully and are more conscious of their choices, re-using, renting and repairing, along with buying smarter, have become essential considerations. 29% of global consumers surveyed reported that they intend to increase their visits to discount stores.

While consumers are looking at ways to reduce their spending and buying more, lower-priced items, their focus is on value for money and getting more from their investments. This is accelerating the shift to buying fewer items, but buying better.

Businesses can appeal to consumers with goods that have a lasting impact; good quality, multifunctional products and those that can be repurposed mean consumers achieve longevity from their purchases.

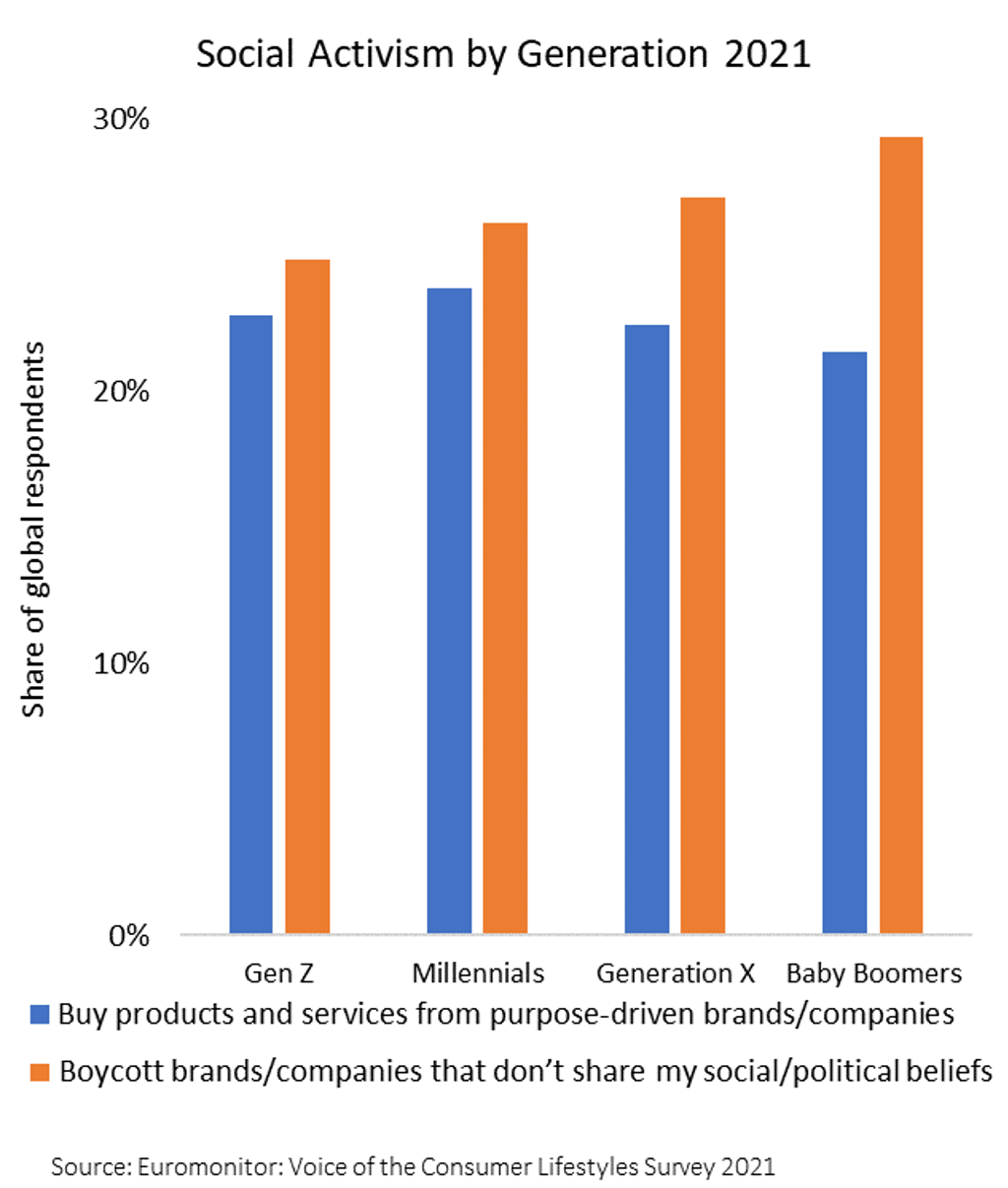

Social activism is gaining momentum

There has been a surge in social activism as Coronavirus (COVID-19) has shaken consumers, fuelling the desire to be - and do - better, not just for themselves, but for others as well. As the pandemic has moved into its second year, there has been a shift in priorities to protecting the planet, but also exposing and acting against social injustices, with 32% of global consumers surveyed reporting only buying from brands or companies that support their social and political beliefs.

Consumers are clearly making noise and taking a stand on social and political issues. They do not want to associate themselves with goods that have been produced without due consideration for the people making them, or that fail to create greater good for society. Companies or brands should choose their ethos and actions carefully so that they closely align them with their product or brand, avoid being viewed as performative and aim to be seen as truly caring and authentic so that consumers can relate their actions with their purchases.

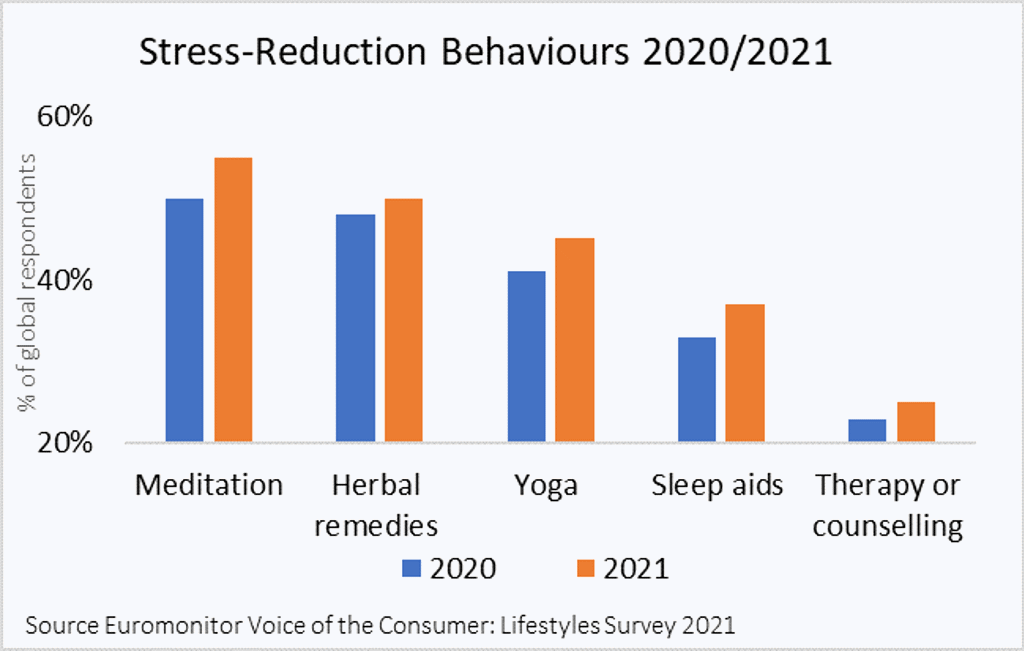

Emotional wellbeing front of mind

Mental resilience has been under pressure, leading consumers to better understand their emotional needs. Consumers are seeking ways to simplify their lives and to stop worrying. Stress-reduction activities, such as meditation, herbal remedies and yoga, as well as physical exercise, have all been front of mind as consumers ramp up their efforts to better care for themselves.

Increased pressure on consumers’ mental wellness is driving demand for more products and services that support mental wellbeing and emotional balance. With 35% of global consumers surveyed expecting to increase their spending on health and wellness over the coming months, identifying how products and services can help to support those that are feeling more vulnerable is vital as consumers connect emotional wellbeing to their overall health, brands will need to redefine their products and services to focus on the value to emotional wellbeing they offer.

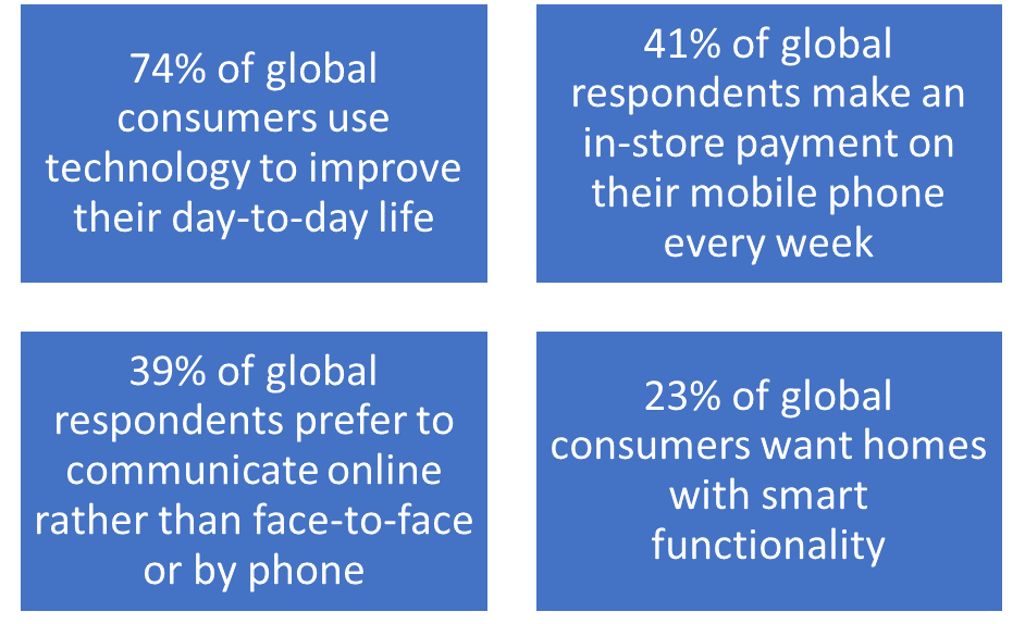

Online living becoming more established

The shift to online living has been rapidly accelerated by COVID-19 and many new virtual habits have become the norm. Consumers have been adapting to a hybrid life of physical and virtual worlds where they can seamlessly live, work, shop and play both in-person and online.

Younger consumers already had a high degree of digital adoption pre-COVID-19, but the pandemic has accelerated their move to virtual living. Streaming services, food delivery and virtual entertainment events are routinely normal. However, the shift to online living has resulted in a large proportion of all generations of global consumers making a move into the online space.

Globally, companies and brands need to produce websites and apps that allow consumers to browse easily online, remotely or in-store, as well as provide online consulting and virtual services that connect with consumers on every level to remain in the picture.

Home-centric lifestyles evolve

Globally consumers have become more creative with their time. Old routines have been disrupted as many people find themselves with greater flexibility in their lives, less bound by timings of exercise classes or when they can get to the shops for example, as they shift to streaming services and online shopping.

Demand for in-home experiences, such as virtual tours, immersive adventures, concerts, masterclasses and video gaming have all skyrocketed. Consumers now have access to much more, at times and prices that suit them. Home-centred routines and a different mindset around special occasions or going out look like they are here to stay.