In March 2021, Euromonitor ran a webinar From Sustainability to Purpose: The New Way of Doing Business which discussed new consumer values and the shift from sustainability to purpose, with three sustainability professionals at the forefront of this transition. This article explores some of the lessons learnt during the event including the myth that sustainability can’t be affordable and the fact that business commitments alone are not enough but that science-based targets are needed.

From Sustainability to Purpose: Lessons Learnt

Sustainability must be affordable

Following one of the worst recessions on record, the affordability of sustainable products was one of the key topics covered during the event. There is a mindset that sustainability cannot be affordable, but Christa Gyori, CEO and co-founder of Leaders on Purpose, believes that there is no need to premiumise sustainability.

Hege Sæbjørnsen, IKEA’s Global Affairs and Partnership adviser for COP26, agreed and added that although some consumers might be willing to pay more for sustainable products, corporate efforts to become more sustainable do not need to be based on consumers’ willingness to pay more for sustainable products. In fact, the company sees sustainability as the new low-cost business model.

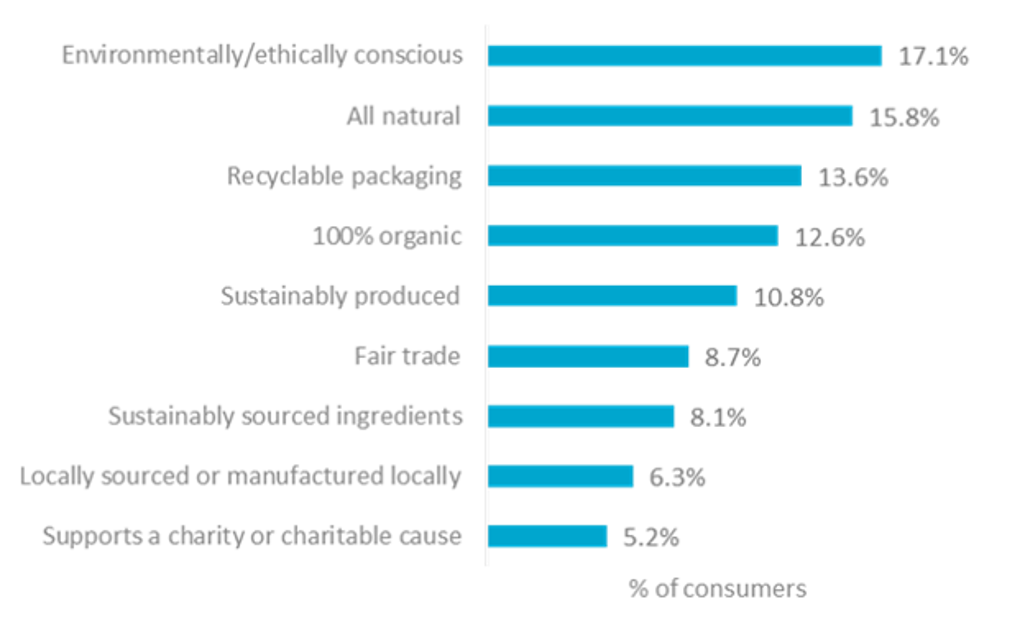

Willingness to pay more for household products with sustainable claims 2021

Source: Voice of the Consumer: Lifestyles survey, 2021

For Christa, there is no doubt that every company can find ways to make sustainable choices easy for consumers, but as Hege noted, economies of scale help. Having the scale that IKEA has helps to drive down costs in relation to making sustainable products affordable.

Fair decarbonisation

Taking care of the planet remains top of mind for consumers in 2021, with a third of them being worried about climate change and 35% are cutting their carbon emissions to have a positive impact on the planet (Euromonitor Voice of the Consumers: Lifestyles survey, 2021).

According to Mike Barry, former Director of Sustainable Business at M&S, addressing the climate crisis is more urgent than ever. He noted that that the economic situation shouldn’t be an excuse for inaction, because the climate crisis does not stop just because the economy is in a recession.

Governments are demanding action and there are many positive commitments from businesses in terms of net-zero decarbonisation. Mike said that these commitments look good on paper, but they need to be followed by action and one of the first steps, according to Hege, is to set up emission reduction science-based targets, aligning strategy with the goals of the Paris Agreement.

Mike introduced the concept of “just transition”, which he defines as the equivalent to net-zero carbon for human lives and communities. Hege encouraged all sectors and business to think in holistic, super-progressive and transformational ways to achieve the social, just transition, that Mike talks about.

Consumer-centric purpose

According to Euromonitor’s Voice of the Industry: Sustainability survey (2020), brand reputation is the main reason for companies to invest in sustainability. However, only a quarter of businesses use consumer surveys to prioritise their sustainability initiatives.

Christa believes that to become more sustainable, organisations need to listen to their customers. According to Hege, this needs to be done at a granular level, understanding consumers’ needs and demands in different markets. For a company like IKEA, it is essential to understand how people live at home and what their dreams or aspirations are. It is important to do local research, looking at consumer segmentation, market conditions and local legislation. Hege was categoric when she said there are no real shortcuts around that, and this is the only way to be relevant in the locations a company is present.

Digitalisation, a tool for purpose

According to Euromonitor’s Voice of the Industry: Digital Survey (2020), Coronavirus (COVID-19) has accelerated the digital transformation by 1-2 years among half of the surveyed companies, while for 20% of businesses it has fast-forwarded it by at least three years. In Hege’s words, technology has accelerated IKEA’S innovation process, helping the company to think smarter and leaner, while also finding new ways to reach consumers and communicate with them.

For Christa, the quick and widespread adoption of digital technologies has helped businesses to collaborate better. She also mentioned that digital technologies are improving decision making. Measuring and tracking business impacts (both positive and negative) help make better decisions. You can't improve what you can’t measure.

However, digitalisation also comes with challenges, and for IKEA one of these is the higher return rates from e-commerce. Hege told us that to manage the return flow in a sustainable way, the company has had to innovate and find new homes for those products, making sure returned products were repackaged and resold.

The future is circular

Traditional supply chains are designed to be global and lineal, from origin to consumption. However, things are changing, with companies increasingly investing in circular business models that keep products in use.

According to Hege, circular models are both commercial and sustainable. She made the point that if consumers are already purchasing second-hand products on platforms like eBay or Gumtree, companies that don’t adapt to meet that demand are at risk of losing them to someone else. Hege, added that circular models are a very strong driver for business innovation. Extending the relationship with the client beyond the initial purchase helps to understand their evolving needs.

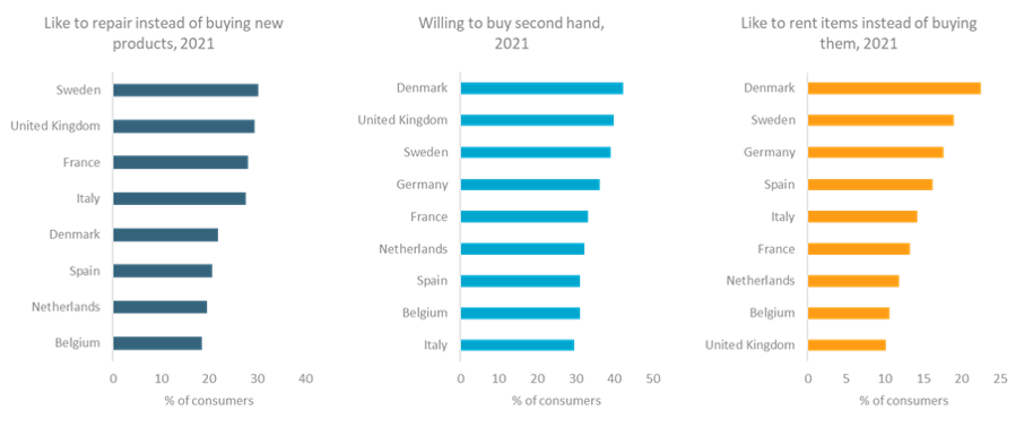

Assessing consumer preferences about circular business models is the first step in the innovation process. With British consumers being among the most willing to repair and buy second-hand (Euromonitor’s Voice of the Consumer: Lifestyles survey, 2021), the UK offers opportunities for repairing and second-hand models. This is a market where IKEA is currently selling both second-hand furniture through its buy-back scheme and spare parts via its customer service to those consumers that want to extend the life of their products.

Circular Consumption in Europe

Source: Voice of the Consumer: Lifestyles survey, 2021

For more information, watch the on-demand webinar and download the slides.