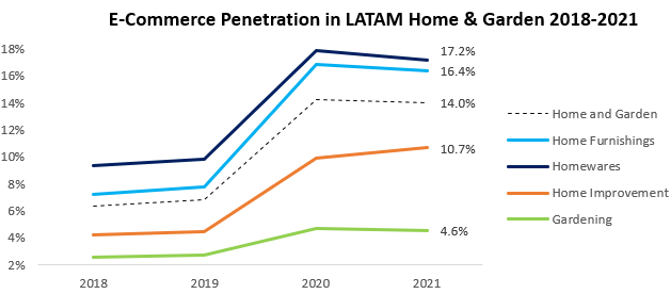

The e-commerce tsunami formed by the pandemic earthquake shook both consumers and companies to a new transaction reality. With 75% growth in e-commerce transactions in 2020, and 6% growth in 2021, home and garden retailers in Latin America continue to experience an increase in pressure connected to the arrival of global powerhouses such as IKEA (Mexico, Chile, Peru), and the regional expansion of Amazon.

Although recent growth already hinted at the need for all players to adapt and excel in the online environment, the rapid developments of the pandemic represented a hard landing for those players that took their time to act, with many struggling to fulfil consumers’ needs and expectations. These expectations, along with the pressure of new entrants that have immediate scale, consumer awareness, and a good reputation for e-commerce sales, are leading competitors to upgrade the online shopping experience offered, investing heavily in improving both the pre-sale and post-sale experiences.

Socialisation paradox manifests in motives for why shoppers choose online

The reopening of physical stores is leading consumers to experience different levels of comfort when interacting with other people. According to Euromonitor International’s 2022 survey on online shopping in Latin America, there was a clear isolation choice by a significant proportion of consumers, who use online channels specifically to avoid interactions with other shoppers (12%) or even with the salespeople (11%) in physical shops. How do you entice consumers into shops again via in-store experiences if the discomfort of human interaction is exactly what they are trying to avoid?

However, the shift in motives did not impact all areas within home and garden equally. Gardening products are usually presented in well-ventilated or outdoor spaces, contributing to the e-commerce penetration spike being noticeably smoother. Gardening registered 9% growth in 2020 and 7% in 2021, all in constant value terms.

During the pandemic, Latin American consumers also started to put into practice their own DIY projects, guiding the home improvement category to 22% growth in constant value terms – but we can see the degree to which that growth was more dependent on the switch to online shopping. Home improvement is closely related to assisted sales, as shoppers need to make sure that their home project is feasible, whilst they need to see the true colours of home paint, and see the patterns of wallpaper or floor covering. Physical interaction with products and sales consultants is therefore important – which makes the rising dependence on the online shopping experience of even greater significance.

There are other categories in which consumers want to have an even more detailed interaction with the product before deciding on their purchase. Homewares, and mainly home furnishings, fall into this psychology, as they have a taste-oriented sales process, that passes through a tactile or at least visual experience before the shopper concludes the deal. The growth of online sales in these categories made the difference (in constant value terms) between decline or maintaining stability, with some small growth being realised (homewares grew 3% and 4% respectively in 2020/2021; home furnishings grew by 1% and 4% in the same years). These categories in particular needed improvements in the online shopping experience as they became far more dependent on e-commerce.

Breaking the physical boundary in the pre-sale phase

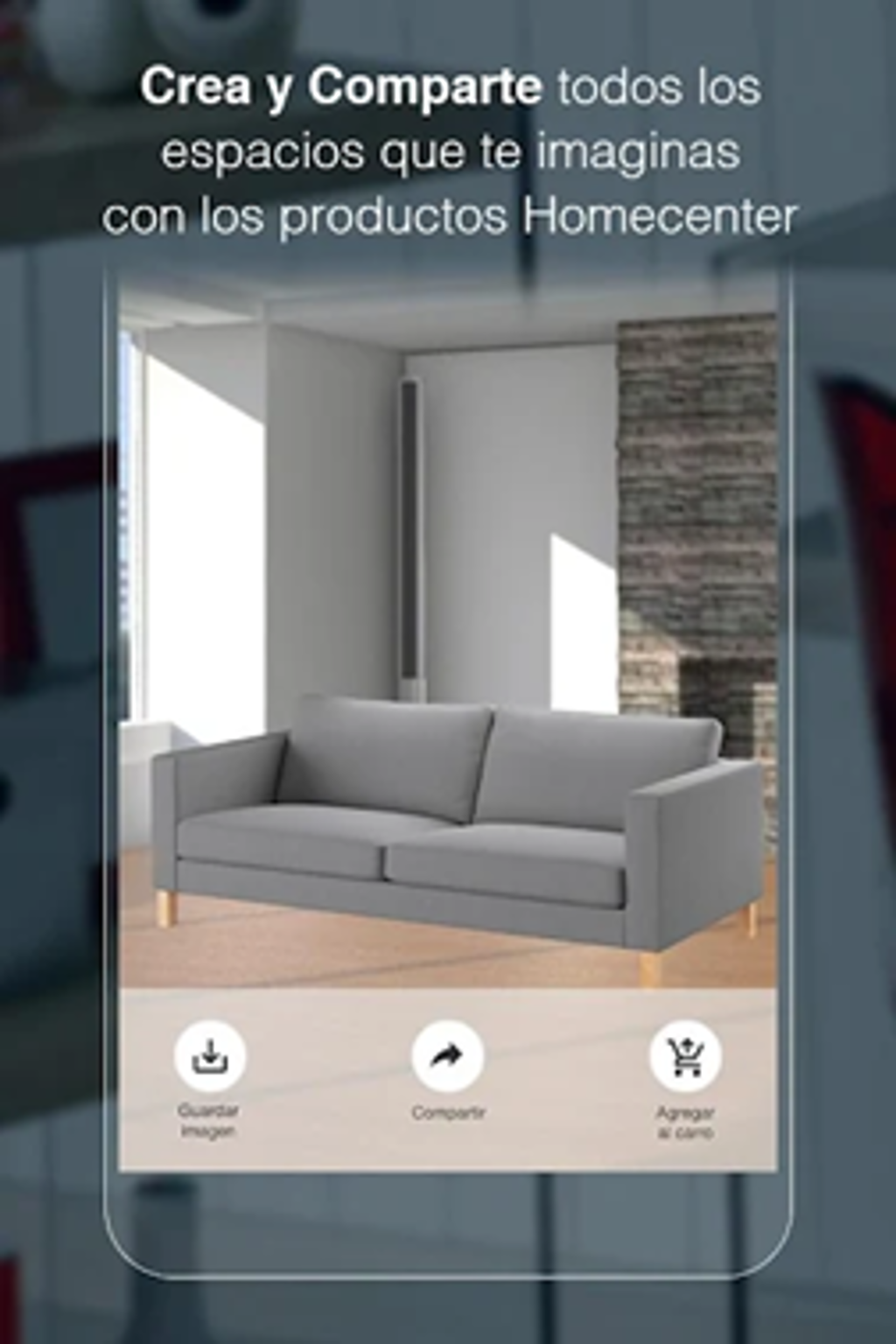

Regional market leader Sodimac launched its “online assisted sales” and “online decoration assessment” services in Chile, which give customers the opportunity to receive tips on products, home design and decoration from experts through a video call. Sodimac also invested regionally in 3D visualisation and augmented reality features, providing its customers with tools that enable them to conduct a virtual product trial at home, so they can be sure it is according to their personal taste and the space available in their household.

Source: Google Play – App Sodimac Homecenter Colombia

The locations and sizes of stores represent other challenges. With less space, companies are not able to show their full portfolios, leading to less brand variety on shelves. The solution is that companies are providing physical space for consumers to test and feel their products, and decorative set-ups, rather than showing many SKUs, and fostering the completion of the sales process through the online environment, where a larger portfolio is available. These experiential centres, also called guide shops, are key for cultivating consumers’ final purchasing decision for products that require more consideration, and are a central part of Sodimac Homecenter’s strategy.

Streamlined logistics and technology: the recipe for a successful fulfilment process

MadeiraMadeira, one of Brazil’s newest “unicorns”, was initially a purely online store, but has just opened its 110th bricks-and-mortar store. The company acquired the logistics start-up iTrack to monitor and manage deliveries and pick-ups, allowing the customer to track the process. It also created the logistics company Bulky Log, as investment in distribution centres is proving to be key for operating in big countries (such as Brazil), that cannot centralise their logistics in a single city without compromising speed of service.

Source: fretebras.com.br

While MadeiraMadeira continued its expansion by opening a fulfilment centre in the Northeast region, Mobly, another Brazilian player, made a similar movement, opening its fourth distribution centre (the first in the Northeast), aiming to decrease freight costs to consumers, handling around 30% of its business in the region. Mobly also has its own dedicated logistics division, called Mobly Log.

After facing a series of difficulties with delivery times during the pandemic in Chile and Argentina, Sodimac also focused on improving its fulfilment process. It invested in a new distribution centre in the Santiago Metropolitan region, and is also creating an additional distribution centre dedicated to cyber sales events.

Latin American retailers are pushing their online operations hard to keep afloat in the race for experience, but are facing increasing competition. New entrants such as IKEA and Amazon, leaders in direct-to-consumer sales, are adding pressure to this formula, and as brands improve their services, the pace and degree of change will only increase.

Companies following the path to excellence in online sales need to get a deep understanding of consumer behaviour when shopping in different categories. Efforts made must close the gap between the digital environment and the physical purchase drivers in each category, providing a satisfying and fulfilling shopping experience throughout all steps of the customer journey.

For further insight, read our report, World Market for Home Improvement and Gardening