Southeast Asia is one of the fastest growing regions globally characterised by thriving consumer demand and an expanding internet ecosystem that provides ample opportunities for growth in many industries, including connected appliances.

Understanding the growth of connected appliances in Southeast Asia

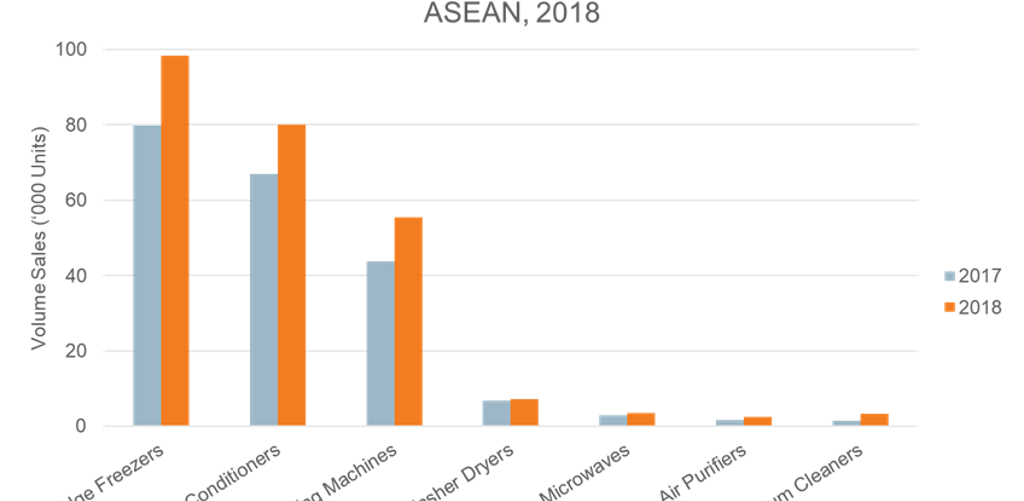

Source: Euromonitor International

Connected appliances growth in Southeast Asia has been robust in recent years, registering a 20% volume increase from 2017-2019. The continuously improving internet infrastructure is one growth driver. Singapore has one of the fastest internet speeds globally as its digital landscape is supported by a resilient ecosystem due to investment by the government, such as the Smart Nation Initiative that explores the growth opportunities of transforming Singapore into a more digitised economy. A reliable internet infrastructure means that connected appliances can operate seamlessly.

Southeast Asia’s high smartphone possession rate is another growth driver. Over 50% of households in the key markets own a smartphone which means more consumers can tether their smart devices. Though non-connected appliances will still be prevalent, smartphones will further deepen the integration of connected appliances especially as consumers rely on the convenience of mobile operating systems.

Growing smartphone ownership and investments in 5G and LTE networks by emerging markets such as Thailand and Indonesia mean that they will soon catch up with their developed counterparts. The growth of connected appliances in Southeast Asia will also be supported by the region’s evolving digital landscape.

Consumer needs dictate connected deeds

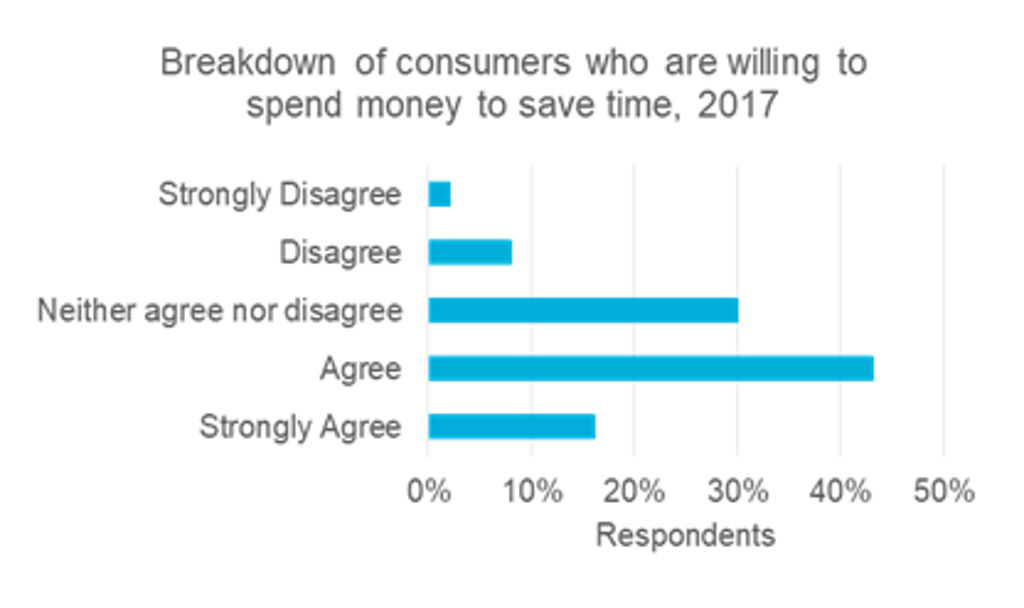

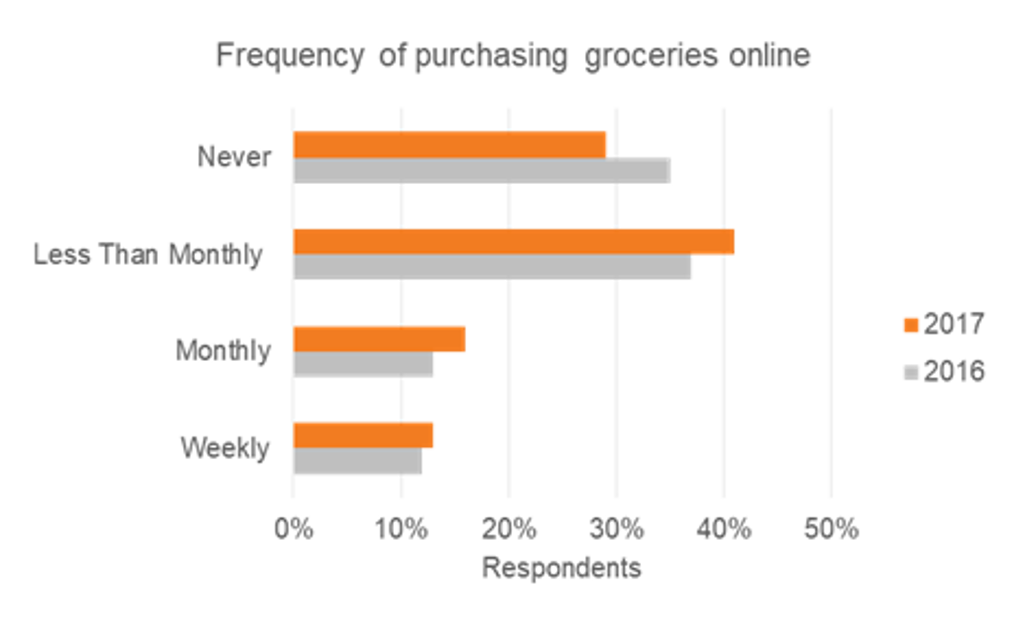

Source: Euromonitor International’s Lifestyles Survey results are drawn from online consumers ranging in age from 15 to 65+. The results here only include respondents from the ASEAN region.

Arguably, the biggest factor shaping demand for connected appliances is the purchasing behaviour of Southeast Asian consumers, according to Euromonitor International’s Lifestyle Survey. Consumers seek shopping options that offer convenience and hyperconnectivity. These are the same features inherent to connected appliances and complements consumers’ shopping motivations. 25% of Southeast Asian respondents reported that they shop for household essentials at least weekly, while more respondents are frequently purchasing groceries online in 2017 as compared to 2016.

Furthermore, convenience is a key push factor as over 50% of respondents are willing to spend money to save time and pursue more meaningful pursuits. Indonesia, the Goliath of Southeast Asia, leads the market in connected appliances.

A dynamic economy driven by millennials, Indonesia has a growing segment of consumers who are image-conscious, tech-savvy and like to try new things. Thailand, the second largest consumer market, shares similar characteristics. Southeast Asian consumers are willing to purchase connected appliances despite the relatively higher cost, provided the features complement their needs. The respondents’ answers are key to understanding the categories that lead the sales of connected appliances in volume terms: fridge freezers and air conditioners.

Pitfalls that disconnect Southeast Asia’s smart appliances landscape

Southeast Asia is diverse in terms of culture, language and economic output. Singapore’s real GDP growth surpasses mature economies such as the US, while Myanmar is shedding its former isolationist past to establish nascent ties to its neighbours. Southeast Asia’s diversity and asymmetric levels of development are challenges that impede the market adoption of connected appliances.

The premium price of connected appliances means that low income households, the majority consumer segment in the developing markets, cannot afford them. Even the possession rates of non-connected appliances remain below 50% in markets such as the Philippines.

Another hurdle is the lack of localisation, the voice-activated function of connected appliances is usually limited to English. There is a need to calibrate the appliances with different languages to reflect the region’s variety of dialects.

Lastly, the emerging markets are affected by inconsistent internet infrastructure due to limited governmental support. To push for greater integration of connected appliances into the Southeast Asian landscape, a one-size-fits-all method will not work.

Connected appliances has potential in Southeast Asia. The dynamic region is primed to be the next economic powerhouse on the global state. Consumer demand for more connected solutions and the improving internet ecosystem are bulwarks that sustain the category’s growth, in addition to rising smartphone possession. However, players must invest in strategies tailored to each market to transform Southeast Asia into a hub for connected appliances.

For more information download our Connected Appliances in ASEAN: Challenges & Opportunities report and connect with me on LinkedIn.

Related Analysis: