The post-pandemic consumer landscape has been transformed by major behavioural shifts on the part of consumers, in terms of how they live, work, play and shop. Key shifts in consumer behaviour – including the adoption of digitalised, home-centric lifestyles, increased concern about social and environmental responsibility, and a greater focus on value – have given rise to new consumer needs and priorities and necessitated the need for companies to rethink their strategies in order to stay relevant in the long term.

Everything goes digital

As consumers increasingly adopt digital lifestyles, businesses across industries are accelerating digitalisation. Digitalisation, however, is more than just e-commerce, as it also encompasses innovative technologies to improve products and services:

- In apparel and footwear, many retailers have beefed up their e-commerce operations and are seeking to improve consumers’ online shopping experience with seamless payment systems and virtual try-ons.

- In food and nutrition, as consumers move from the grocery store to the screen, businesses have reinvented impulse food purchasing. Quick commerce – i.e., a shorter, faster route to the customer – raises consumer expectations; as has happened with meal delivery. European businesses Getir and Gorillas entered the US in 2021 with grocery shopping “in minutes”.

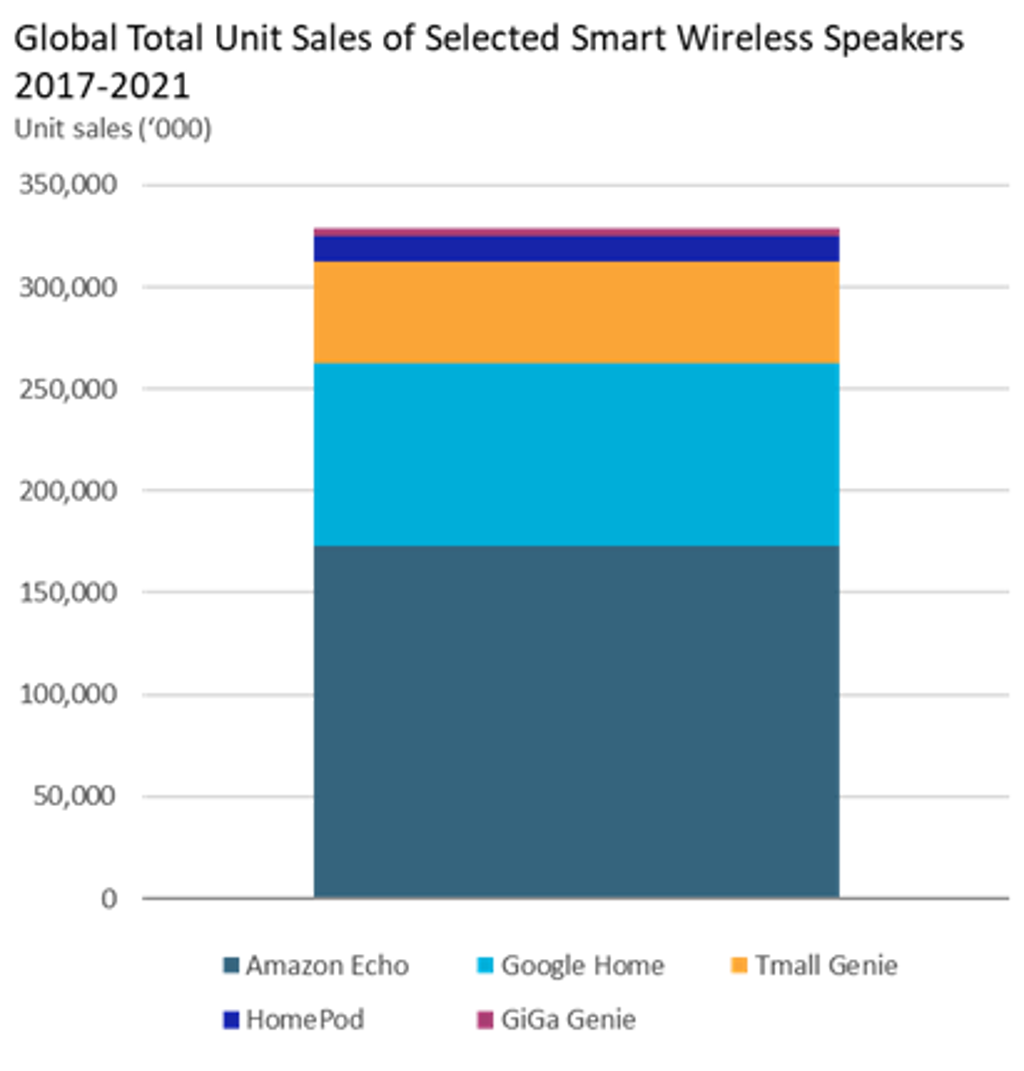

- Meanwhile, the home care industry is developing a whole suite of technologies, such as robotic automation, advances in smart home ecosystems, and broader smart infrastructure. Digitalisation in the home is further accelerated by changing consumer attitudes towards greater acceptance of voice recognition and cameras in the home.

Home is a sanctuary and a hub for many activities

While consumers are seeking to release their pent-up demand for out-of-home experiences, more home-centric lifestyles are here to stay. Therefore, businesses need to adapt and develop products and services for home occasions:

- For manufacturers in the drinks industry, next-generation in-home devices – drink dispensers, coffee machines, cooking devices, infusers, and others – could prove an important component of long-term post-COVID-19 strategies, offering an ongoing connection with consumers who have developed a host of new habits following more than a year at home.

- In the food industry, the migration of many meals to the home over the mid to long term will result in greater demand for packaged food and snacks. In addition, demand will rise for experiences, such as restaurant-quality meals or more indulgent treats at home, even as away-from-home meals will regain momentum as foodservice and impulse channels reopen.

- The home care industry has been particularly well-positioned to take advantage of the changing nature of the home. More time at home necessitates more frequent cleaning, as well as growing interest in new services and technology to help compensate for time spent on household chores. A transition towards task automation had already been on the rise pre-pandemic, and an acceleration of this development is expected in many markets over the forecast period.

Consumers focus on value

In an era of weak income gains and high inflation, consumers need to stretch their limited resources more than ever before. In this new consumer landscape, a greater focus is being placed on value:

- In the alcoholic drinks industry, premiumisation is losing its appeal due to falling incomes and rising unemployment. Although the reopening of society, shopping and hospitality is bringing about more opportunities for on-trade consumption, this usually comes at a higher price point, thus deterring consumers from purchasing premium drinks. As such, the industry will shift its focus away from premiumisation, towards more nuanced and diversified strategies.

- The home care industry is facing the challenge of middle-class households trading down and economising in the face of higher utility costs for both energy and water. This could mean a setback in terms of R&D and innovation in the industry, as consumers shift to basic, low-cost cleaning products such as a simple bar of soap and a bucket of water, or handwashing.

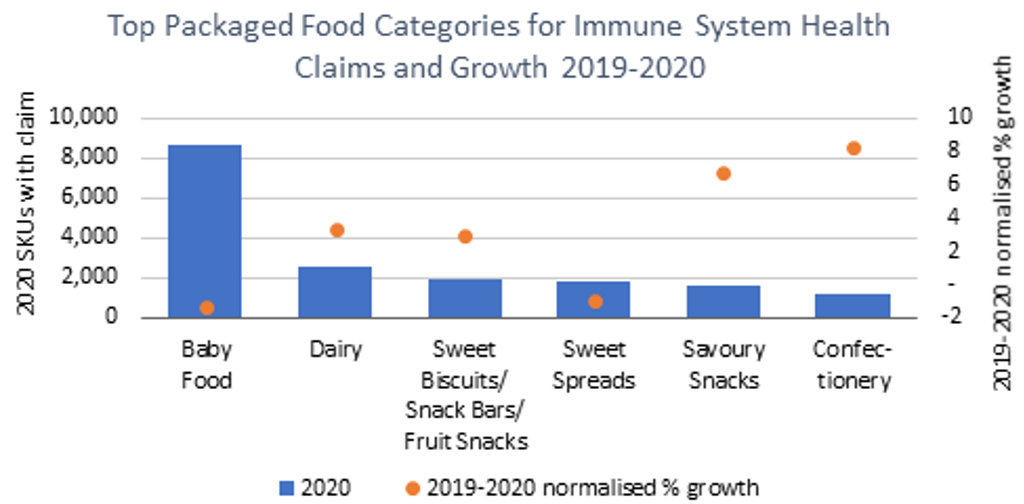

- Besides affordability, consumers also want other values, such as convenience, health and wellness. In the food and nutrition industry, for example, products with health claims – particularly claims relating to immune health, mood and focus management – are on the rise thanks to consumers’ greater awareness of how foods can naturally help strengthen health and prevent illnesses.

Source: Euromonitor International

Social and environmental responsibility

Consumers are now more aware of environmental issues and are increasingly prioritising brands that hold sustainability as a purpose, hence brand reputation is a key driving force behind sustainability efforts:

- Apparel and footwear companies, for example, are more and more outspoken about their efforts and commitments to curb fashion’s environmental impact from various angles, including sustainable sourcing, supply chain transparency, and reducing waste through greater circularity, which relies on resale, rentals and regenerative fashion.

- The food industry is increasing investment in developing and producing alternatives to meat- and dairy-based foods, as they are seen as more sustainable. These include plant-based products and lab-cultured meat. The industry is also transitioning to more sustainable agricultural and manufacturing practices, including the adoption of a more local approach to supply and demand.

- Putting social and environmental responsibility at the heart of the business can make companies more competitive. It contributes to making businesses more sustainable in their operations, while also aligning with consumer values.

Purchase our strategy briefing New Consumer Landscape: Rethinking Consumer Industries for further insights.