Wellness and sustainability have been at the top of consumers’ agenda for the last decade with more people focusing on cleaner living and cruelty-free lifestyles. Veganism, rejecting alcohol and tobacco, making greener choices, and becoming more vocal on social media, especially in relation to important environmental and social issues, have all increased.

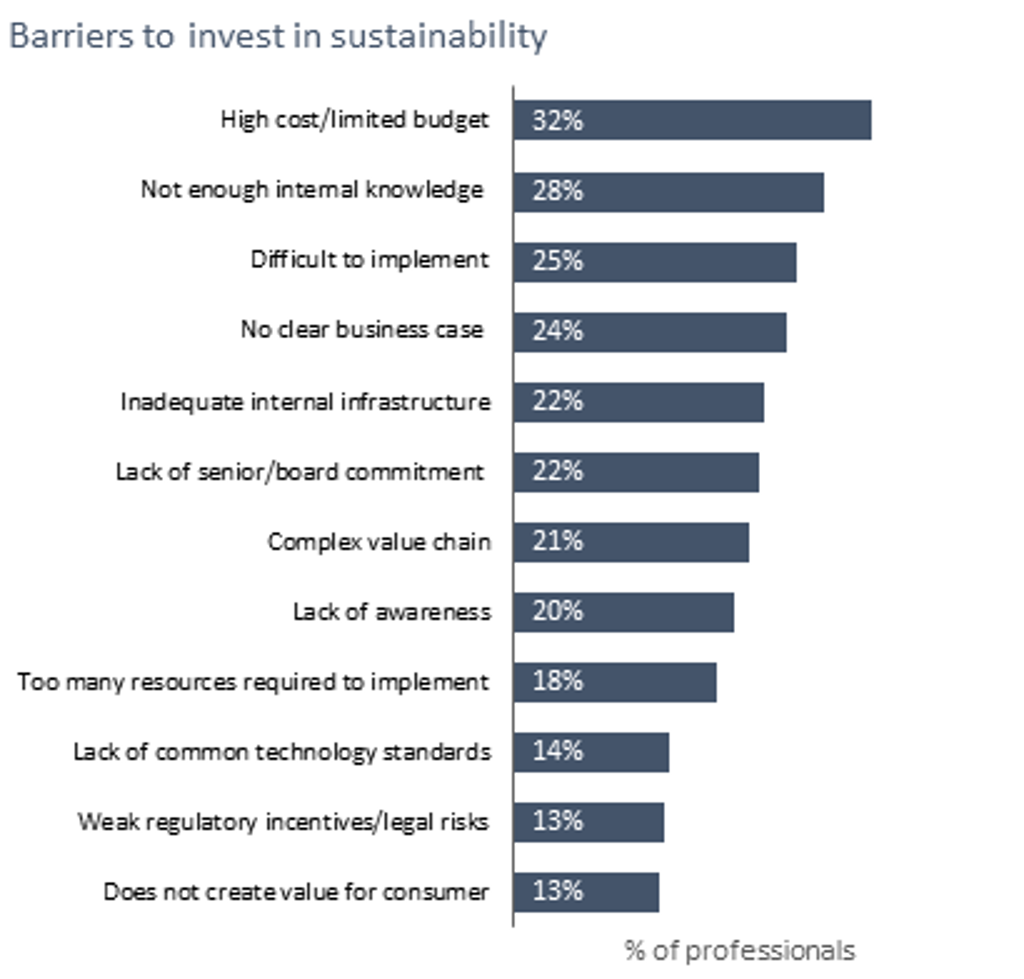

Although calling companies out and boycotting brands that do not agree with an individual’s sustainable values has become the norm and commitment of companies keeps increasing, businesses face numerous barriers to invest into sustainability with high costs and limited budgets being at the top of the list. They are therefore looking for ways to share some of these costs with their consumers.

Euromonitor International’s tools such as Voice of the Industry: Sustainability Survey and Sustainable Living Claims Tracker provide multi-dimensional and cross-country comparable frameworks and insights, allowing businesses to identify ESG trends and priorities, assess consumer sentiments and demand for sustainable offerings, and rebalance portfolios with the right sustainable product claims in the right markets at the right time.

Source: Euromonitor International Voice of the Industry: Sustainability Survey (fielded in February 2022 n=792)

Sustainable consumer sentiments vs behaviours in the food industry

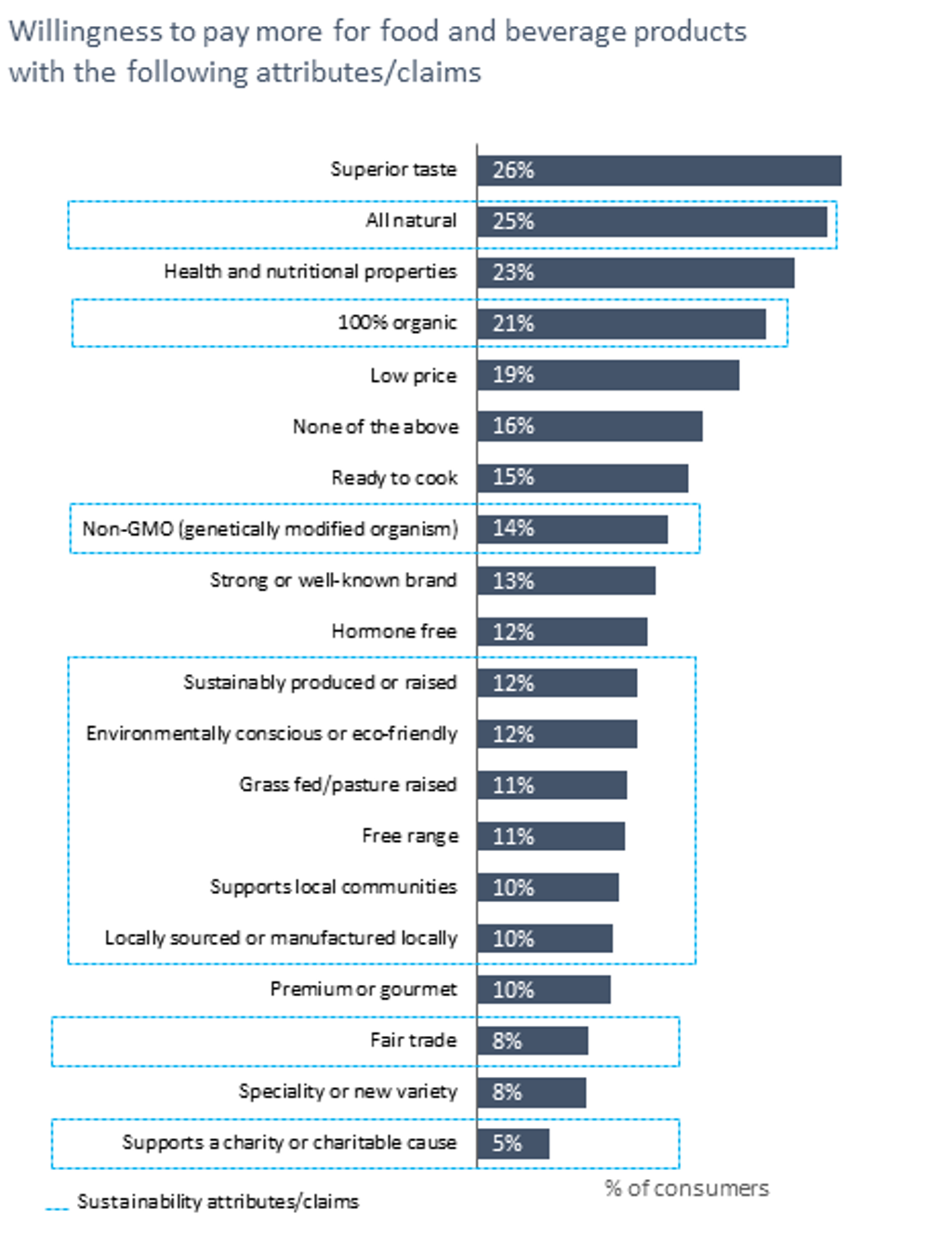

About half of all consumers are still hesitant to pay more for sustainable food products (Voice of the Industry: Sustainability Survey, 2022), however, according to the data from Euromonitor International’s Sustainable Living Claims Tracker, the number of products with sustainability claims in packaged food has been gradually increasing over the last three years. This comes despite a 15% price difference between such products and products without sustainable attributes. Low price still plays a significant role when choosing food and beverage products, although it is obvious that some consumers are starting to increasingly veer their spending towards products that have a positive impact on people and the planet featuring claims such as “All Natural” or “100% Organic”.

Source: Euromonitor International Voice of the Consumer: Lifestyles Survey (fielded in Jan-Feb 2022, n= 39,832)

Rebalancing product assortment with the right claims to engage and attract consumers has become extremely important for those food and drinks companies that want to remain competitive and successful in an increasingly sustainability-conscious world. As a result, they need data, compelling analysis and meaningful stories in order to:

- Identify which consumer trends are driving the demand for products with sustainability claims;

- Explore consumer sentiment and purchasing behaviour of products with sustainability claims (to rebalance portfolios with the right products, claims and price positioning);

- Size the market for sustainable products across different countries, industries and categories.

Combining consumer insights from the Voice of the Consumer: Lifestyles Survey, and competitor insights from the Voice of the Industry Sustainability Survey with SKU-level data on pricing and consumer ratings from the Sustainable Living Claims Tracker, Euromonitor International helps companies to understand which sustainability claims consumers like more and/or are willing to pay more for – and where the sustainable business opportunities are in terms of return of investments.

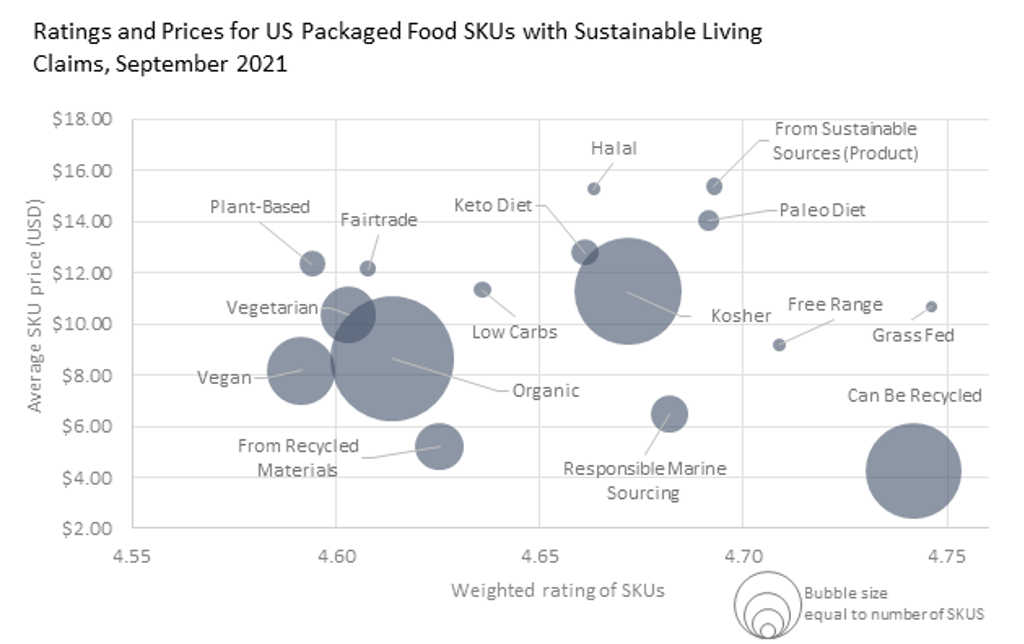

Are expensive products preferred?

In the US, the relationship between shopper satisfaction and product prices in the packaged food industry seems to vary. Looking across 17 specific individual sustainable living claims within the US packaged food industry, we can see that there is no direct correlation between price and shopper satisfaction with these products. The three claims with higher shopper satisfaction “Can Be Recycled”, “Grass Fed” and “Free Range” are not the most expensive.

Consumers may give high ratings to both – premium priced products with sustainable claims like “Paleo Diet” or products “From Sustainable Sources”, and low priced products with environmental claims like “Can Be Recycled”.

In contrast, most of the claims with lower availability (smaller bubbles in the chart) such as “From Sustainable Sources”, “Plant-Based”, “Fair Trade” or “Halal”, have a high price, which suggests product availability has an impact on price, and sustainability claims become more affordable as more products reach the market.

Sources: Euromonitor International’s Sustainable Living Claims Tracker

Note: Data from Euromonitor International’s Via which tracks 1,500+ online retailers in 40 countries.

Data-driven stories and pressure-tested answers to support your strategy

- Maximise the opportunity by understanding consumer trends: A higher than average price of SKUs with sustainability claims related to diet such as “Kosher”, “Paleo Diet, “Halal” or “Plant-Based” can be linked to consumers’ willingness to lead both sustainable and healthy lifestyles. Almost a third of consumers eat less meat to have a positive impact on the planet (Voice of the Consumer: Lifestyles Survey, 2022) and over half of industry professionals expect the plant-based eating trend to be extremely or very influential in food sales over the next five years (Voice of the Industry: Packaged Food Survey, 2021).

- Improve communication strategies: Low consumer preference for food products with packaging made from recycled materials compared to recyclable packaging suggests there is a clear need for consumer education and clearer communication of product benefits to consumers. To foster positive perceptions, it is essential to build communication strategies that clearly articulate products’ benefits to consumers and do not just focus on features.

- Maximize return of investment: There is a big opportunity in the market for products with “Sustainable Sourcing” claims. They have the highest price along with high consumer ratings, and low product availability as indicated by the small size of the bubble.

- Pricing strategy: Price plays a complex role in consumers’ product evaluation process and impacts their purchasing decisions. Price is not seen only as a cost but also works as an indication of quality. Large size of the bubble for products with “Organic” attributes demonstrates the maturity of the claim. However, relatively low rating and low / medium price may indicate poor differentiation among brands and need to enhance product design, communication, and/or pricing strategies.

By using global and regional expert networks in combination with our tried and tested methodologies, Euromonitor International helps the clients to identify, compare and prioritise the most important sustainability topics across countries, understand consumer sentiment and behaviour around purchasing products with sustainability claims and benchmark product portfolios against other companies to inform pricing and positioning strategies.

Learn more

- Euromonitor International’s Sustainable Living Claims Tracker monitors millions of SKUs sold online, including product claims and other attributes related to sustainability, across 40 countries, 1,500 online retailers and 11 consumer goods industries to help you unlock key strategic and tactical insights with its standardised online product coverage.

- Euromonitor International’s Voice of the Industry Sustainability Survey is an annual online survey that tracks the views of over 1,500 industry professionals across FMCG industries on the topic of sustainability over time to allow you understanding competitors' strategies and industry sustainability trends.