In a constantly changing market, it is always important to track what is happening in mergers and acquisitions (M&A). What and how are the major players doing? What are the potential opportunities in the market? However, it is time consuming to conduct research every time you are studying a new market or industry, and this is where market research is of the utmost importance.

In this blog post, we look at some of the latest trends impacting M&A activity in the Asia Pacific region and how macroeconomic factors could impact certain markets in the future.

How did the market perform?

A quarter of the year has passed and the market is behaving as we forecasted. The total volume of M&A activity has dropped in 2018, which is likely to continue in 2019 with a slight drop in total deal size.

Where is APAC market heading?

Looking into the Chinese market, some of the top deals in China we saw last year were Cosco acquiring Orient Overseas International, and Alibaba and Ant Financial acquiring a remaining stake at Ele.me. It will be interesting to see how will Ele.me leverages Alibaba’s infrastructure and gains more market shares with their new retail and fresh food initiatives (e.g. 叮咚買菜), especially after Meituan’s listing in Hong Kong. These new acquisitions will continue to play an important role in disrupting different industries and markets.

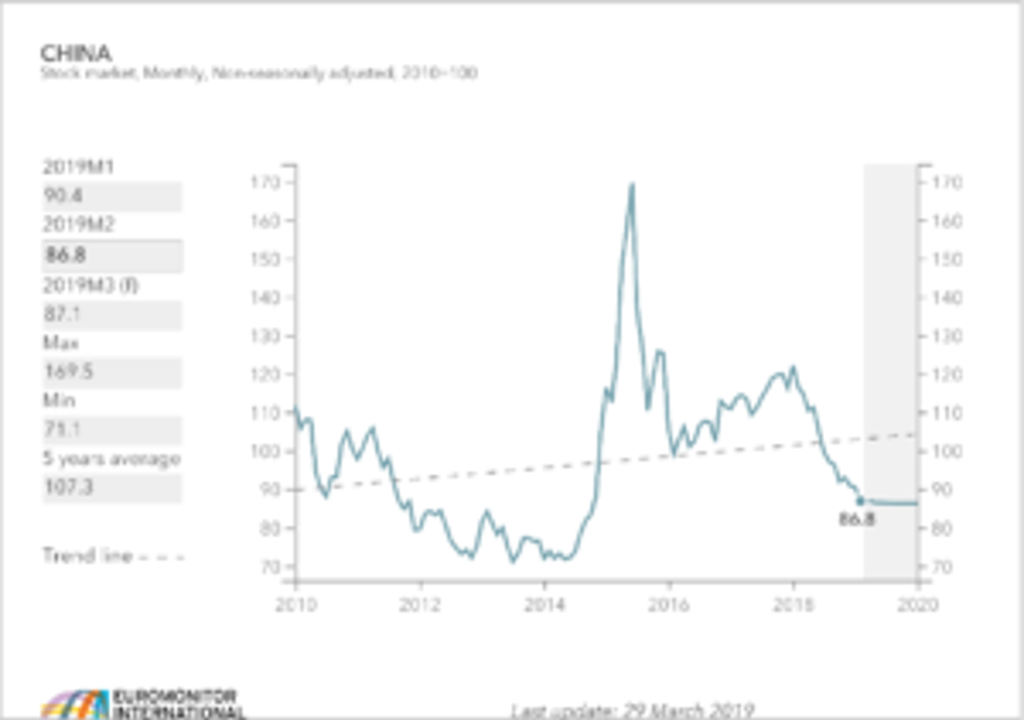

From a macroeconomic perspective, an ongoing trade war, together with the turbulence in global financial markets and a decline in global private sector sentiment, is increasing the risk of a global downturn. Chinese investors’ however, would still be looking for potential markets to invest their capital.

We believe Europe would continue to be a popular destination for offshore M&A, while Latin America and Africa are also drawing investors’ attention. From what we can see from our forecast model, the above regions would be least likely to be impacted by China macro scenarios, thus diverting risk for potential investors.

At the same time, China is facing criticism from Europe for their limited access to the Chinese market, while Chinese investors are enjoying free access to the Europe market. It is worth tracking the upcoming policy changes in both regions to see what impact that could have on future M&A and investments.

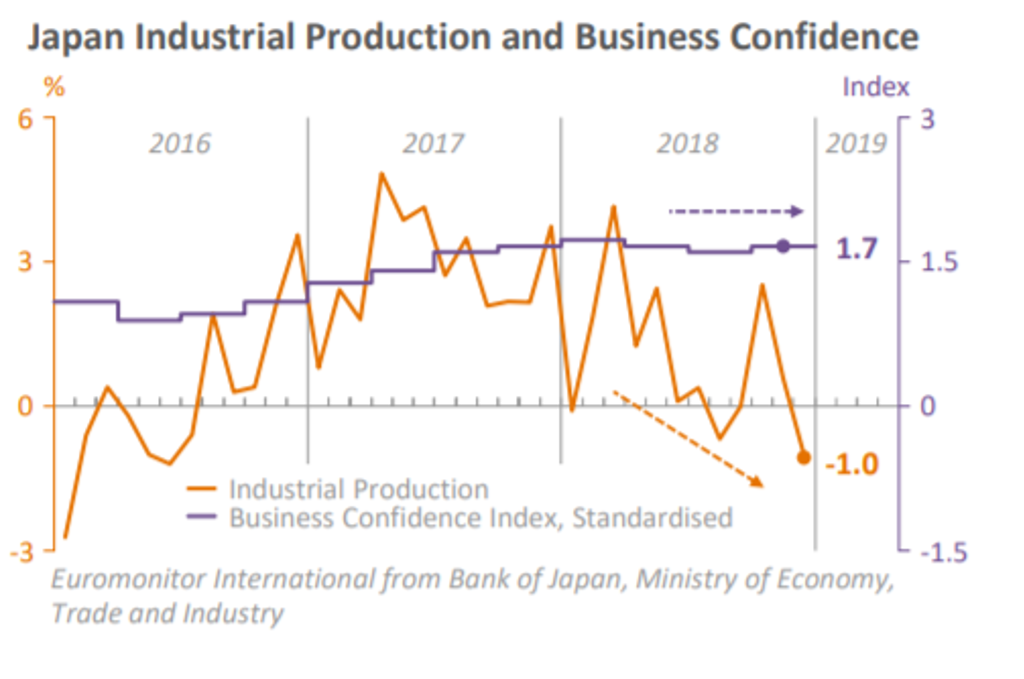

Japan is another country that is active in the M&A market. However, trade tensions have hurt domestic outlook, as businesses shun raising wages and this might delay investment on the back of worries about corporate profits.

What are the hot industries?

Technology companies will continue to be the focus for M&A activity, as demonstrated by Ant financial investing in Openrice and Pet-tech start-ups raising more and more capital. In addition to this, eco-friendly and health and wellness related concepts are also keeping the market busy.

But that doesn’t mean we should forget about the traditional industries, with Anta acquiring Amer Sports before the end of 2018. Telecommunication, property / construction, banking, logistics, power and utilities industries are also not keeping quiet in the M&A space and travel and services market are also moving, with Cathay Pacific acquiring HK express and Klook raising their Series D+ funding.

All in all, respective markets would be more consolidated as conglomerates and unicorns will keep pushing to gain market shares. We shall also be seeing more unicorns debuting on the public markets this year.

Learn more about how market research can support the M&A playbook, and for information about our M&A screening, click here.