As sustainability grows in relevance and consumers lean towards more sustainable lifestyles, consumer segmentation according to shared environmentally friendly traits and preferences is becoming instrumental for companies seeking to develop and market sustainable products in the right markets at the right time. Euromonitor International has identified 12 types of Sustainable Consumers, based on their values and attitudes. We provide an overview of the top three of them in the following article.

Meat Avoiders

Almost two in five consumers around the world avoid eating meat. Religious traditions, beliefs regarding animal welfare, and environmental and health concerns drive this global trend. Millennials with higher education and that are financially secure are the most prominent Meat Avoiders.

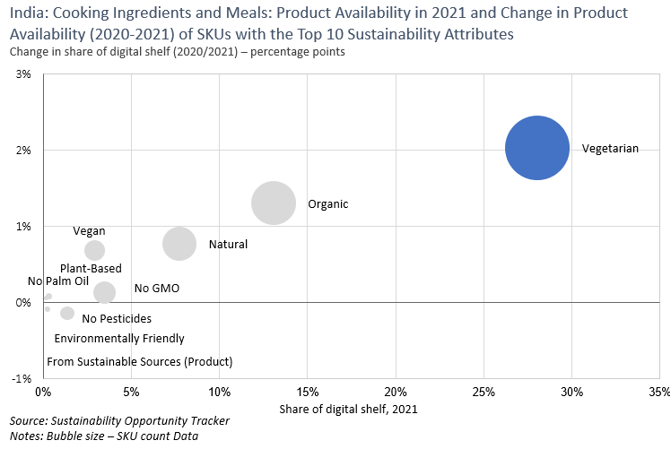

Regarding products, Meat Avoiders are very selective, especially within packaged food categories like staple foods, and cooking ingredients and meals. These well-informed consumers are ready to pay extra for more mature and trustworthy sustainability claims, such as vegan, vegetarian, organic or locally sourced. for example, in India, which is the leading country in terms of the proportion of Meat Avoiders, the sustainability attribute vegetarian accounts for nearly one third of cooking ingredients and meals’ digital share of SKUs.

Zero Wasters

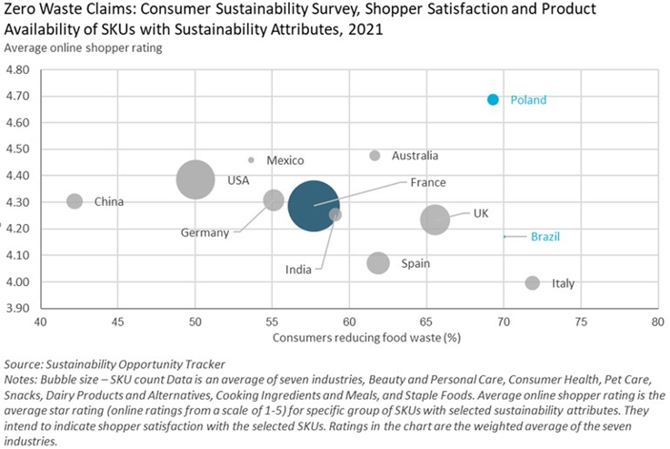

Zero Wasters account for 37% of the global population. They are most prevalent among older generations, such as Baby Boomers and Generation X, who combine conscious consumption with frugal spending and saving practices. Zero wasters are primarily concentrated in Latin America, generating numerous opportunities for companies willing to play in this space. Brazil has the second highest concentration of Zero Wasters globally, and offers vast unmet demand for zero-waste products, offering opportunities for brands aiming to gain a presence in this area.

Climate Activists

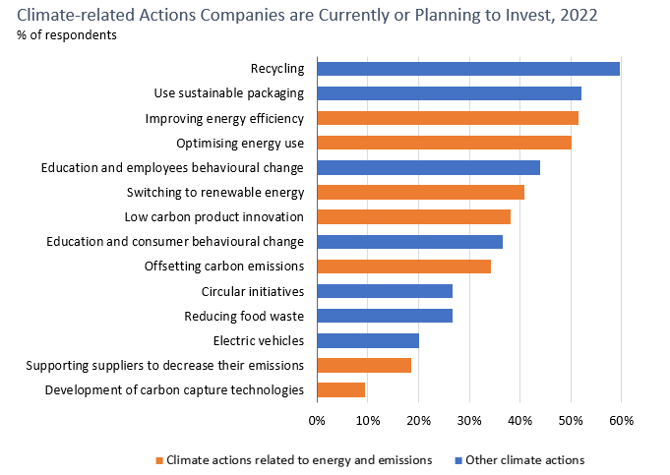

Climate Activists are consumers who are worried about climate change and aim to reduce energy consumption or use more energy-efficient products, and/or reduce carbon emissions by driving less or taking public transportation. As the impact of climate change is one of the hottest topics for consumers, more companies are including optimising energy use and tackling carbon emissions in their investment priorities. According to Euromonitor International’s Voice of the Industry: Sustainability Survey 2022, 57% of global companies plan to use low-carbon/carbon neutral claims in new product launches.

Climate Activists are increasingly searching for ways to reduce their negative impact on the planet, prioritising sustainable mobility over offsetting their carbon emissions. These consumers moderate their plastic, energy and water use, and are keen to recycle and reuse. Moreover, with resources under pressure, Climate Activists tend to sympathise with companies that feel the same way and contribute to reducing the negative impact. For example, US multinational company Procter & Gamble (P&G) is highly active in encouraging people to switch to cold water washing with its leading Ariel and Tide brands.

Recommendations

- Communicate your sustainability strategy to consumers loud and clear. Be authentic and transparent. Consumers expect brands to disclose information related to sustainability, both internally and externally, and are increasingly joining forces with other organisations to address social and environmental problems.

- While value for money is important, consumers also value sustainability. Value perception is changing to become multi-layered, with purpose and sustainability increasingly included as the drivers for discretionary spending. Nevertheless, as consumers are choosier, a brand strategy must be authentic to earn that buck.

- Affordable sustainability is the key in a recessionary environment where saving money is top of mind for many consumers. Cost-effective options, concentrating on quality, durability and energy efficiency, avoiding unnecessary waste and promoting the linkage between health and sustainability are strategic stances to take on.

Read more on how to build a sustainability strategy in the White Paper – Building a Sustainable Strategy: A Guide for Business Leaders.