C-beauty brands, also known as Chinese-born beauty brands, outperformed the market in China over the review period, particularly in skin care and colour cosmetics. Benefiting from strong digital capabilities and marketing strategies, C-beauty is winning younger consumers. However, the challenges facing C-beauty brands are how to build solid competitiveness for sustainable growth. C-beauty brands have been expanding to overseas markets and adjacent categories to seek the next growth curve.

C-beauty brands will need solid competitiveness to extend their lifecycle

C-beauty brands, referring to locally-born Chinese beauty brands, have emerged in China’s beauty and personal care market since 2017. In particular, C-beauty brands have outperformed the market in skin care and colour cosmetics, which international brands once dominated.

With China’s mass market appearing saturated, C-beauty targets premiumisation

C-beauty brands are mainly offered at mass price points (under USD30), with the mass beauty and personal market in China predicted to record a CAGR of less than 1% over the forecast period. The growth space is already limited due to market saturation in the mass segment, so C-beauty brands have started to focus on premiumisation by launching new brands or acquiring foreign premium brands.

Kunming Botanee, owner of the Winona brand, launched its first luxury brand, Aoxmed, in 2022, targeting the anti-ageing and digestive beauty market with an average SKU price of USD200. Yatsen Holdings, with its key brand Perfect Diary, has experienced a slump in sales since 2021. The company has been actively acquiring foreign premium brands since 2020 to expand its premium portfolio. Its acquisitions of premium brands Galénic and Dr Wu have added to the company's global presence in the premium market. New independent premium brands are also entering the market to capture opportunities by combining Chinese heritage and its premium concepts, such as GuanShi, and HerBeast.

C-scent continues to emerge as strong trend

Premium fragrances will become the next area to see more new Chinese beauty brands emerging. Compared with other developed markets in Asia, the potential offered by China's fragrances is still huge, supported by the soft drivers of growing consumer awareness and product varieties. As fragrances become integrated into consumers’ daily beauty routines, per capita usage will rise. Newer Chinese brands, such as DOCUMENTS and ToSummer, have also added to the diversity of the market. They combine their brand stories with traditional Chinese heritage, with the concept of "China scent" resonating well with young middle-class consumers who crave a richer expression of sophisticated lifestyles.

These C-scent brands have already gained attention from global beauty players. In September 2022, L'Oréal China bought a minority stake in DOCUMENTS. In May 2023, Shiseido and ToSummer collaborated to create a new fragrance named “Convallaria”, and a signature diffuser stone, inspired by Shiseido’s Future Solution Night Cream.

C-beauty brands actively explore global expansion beyond China

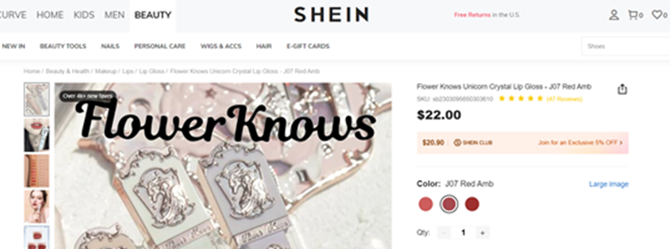

With fierce competition in China's domestic market, C-beauty brands are in desperate need of new opportunities overseas. Particularly in colour cosmetics, brands such as Florasis, Perfect Diary, and Colorkey, have entered Southeast Asia and Japan. In February 2023, C-beauty brand Florasis opened an offline pop-up store in Tokyo within Japanese beauty specialist @COSME Tokyo’s flagship store. This is the first overseas pop-up store for the brand. Beyond the Asian market, C-beauty products entering foreign markets through popular Chinese retailers, such as SHEIN, TikTok and AliExpress, offer strong growth potential.

Flower Knows introduces products to global consumers through SHEIN.

Source: SHEIN

Read our report Uncovering C-Beauty: Growth Strategies and Market Outlook for in-depth analysis on C-beauty brands and China’s beauty and personal care market.